Answered step by step

Verified Expert Solution

Question

1 Approved Answer

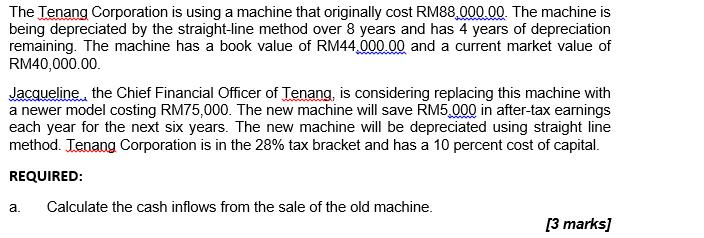

The Tenang Corporation is using a machine that originally cost RM88,000.00. The machine is being depreciated by the straight-line method over 8 years and

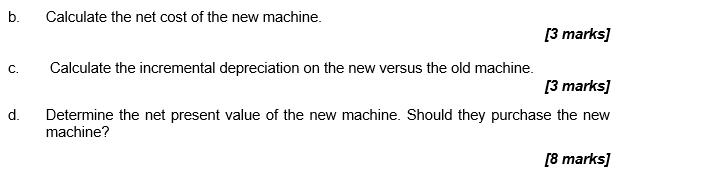

The Tenang Corporation is using a machine that originally cost RM88,000.00. The machine is being depreciated by the straight-line method over 8 years and has 4 years of depreciation remaining. The machine has a book value of RM44.000.00 and a current market value of RM40,000.00. Jacqueline the Chief Financial Officer of Tenang, is considering replacing this machine with a newer model costing RM75,000. The new machine will save RM5,000 in after-tax earnings each year for the next six years. The new machine will be depreciated using straight line method. Jenang Corporation is in the 28% tax bracket and has a 10 percent cost of capital. REQUIRED: a. Calculate the cash inflows from the sale of the old machine. [3 marks] b. Calculate the net cost of the new machine. C. Calculate the incremental depreciation on the new versus the old machine. [3 marks] [3 marks] d. Determine the net present value of the new machine. Should they purchase the new machine? [8 marks]

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cash inflows from the sale of the old machine we need to find the selling price Book Value of the old machine RM4400000 Market Valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started