Question

The textbook includes a sample budget format for college students and there are a variety of templates available online. This assignment includes one basic template

The textbook includes a sample budget format for college students and there are a variety of templates available online. This assignment includes one basic template which reflects the information noted in this week's power point on creating a budget. The class has until April 10th to complete this assignment. This gives the class plenty of time to review the information in this module.

For this assignment, students will complete and analyze a hypothetical budget. Students must download the assignment, type in the required information, save, and submit the file.

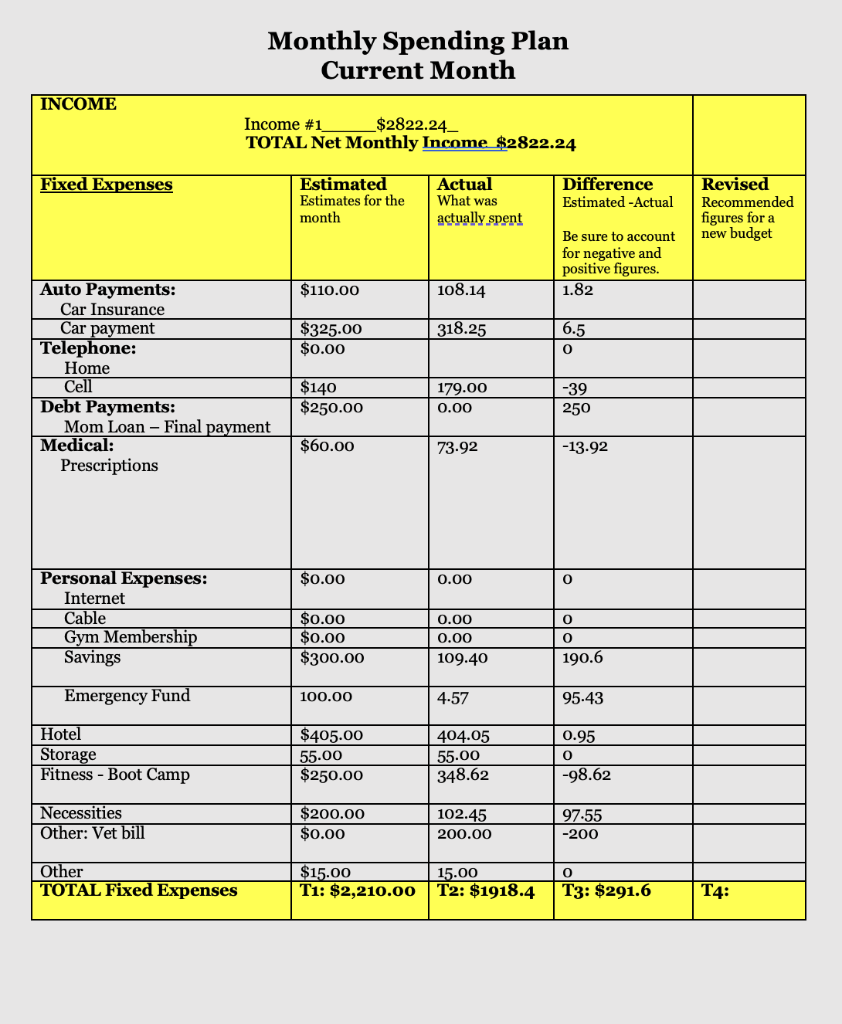

Students are to assume that the person has followed the first step of creating a budget, which is to note their income for the month and complete an estimate of all expenses for the month. Additionally, the person/family has also tracked their expenses for one month. The attached file has three items already completed: net income for the month, Estimated Column, and Actual Column.

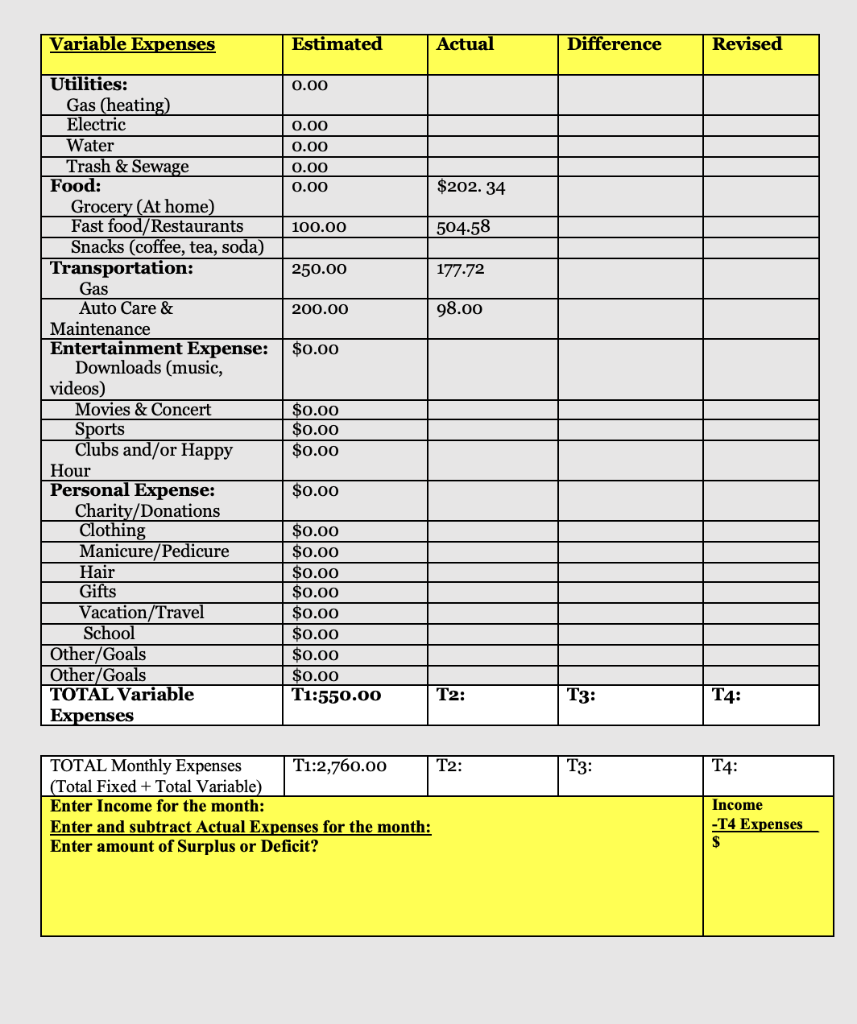

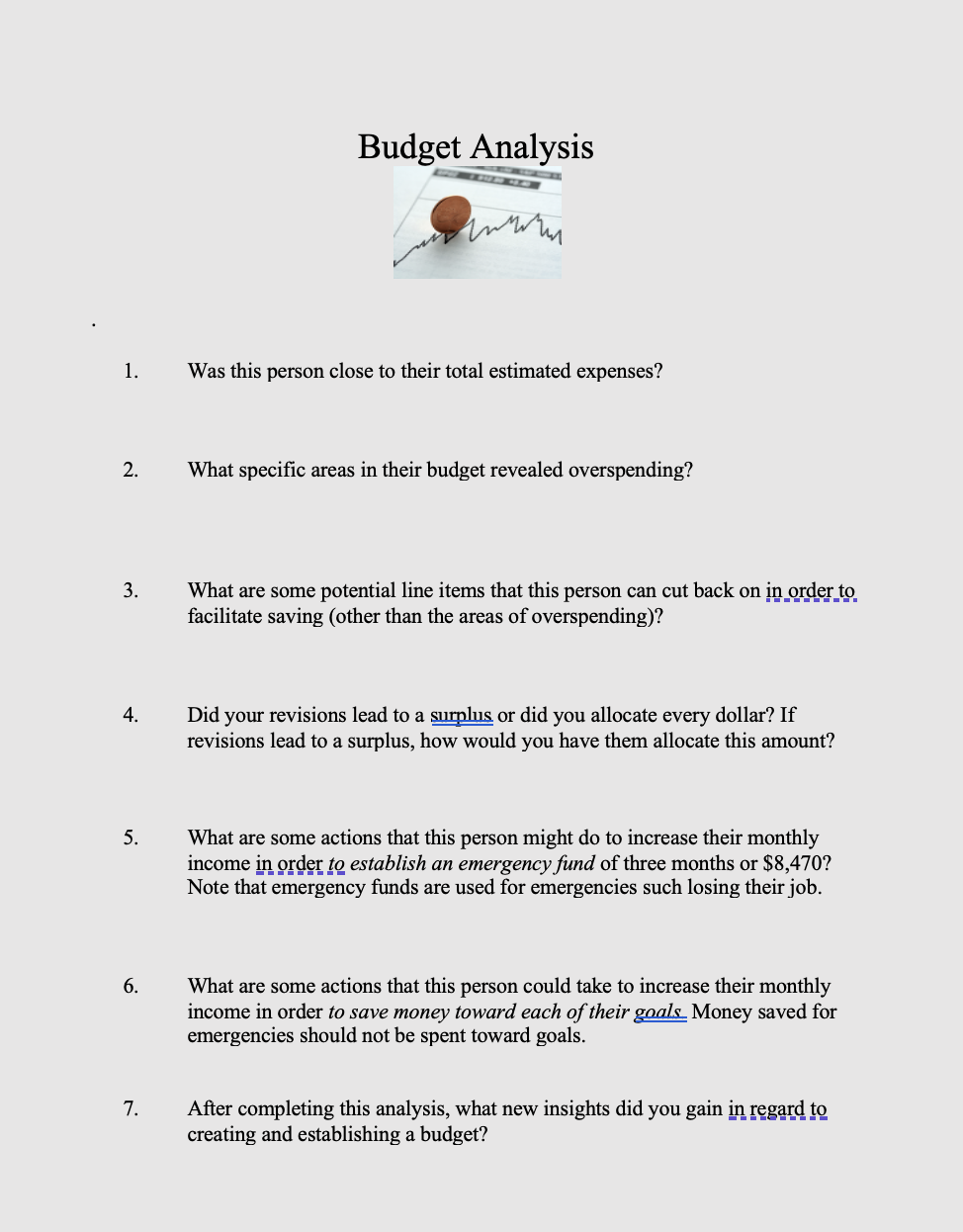

To complete the rest of the assignment, begin by adding up what they actually spent for each item in the Actual Column in the Monthly Spending Plan. Be sure to add up their Fixed Expenses, Variable Expenses, and Total Expenses.

After this, complete the next column over, the Difference Column. This column will show the variance between what they thought they would spend and what they actually spent. Some figures may be negative; be mindful of adding negatives and positive numbers. Add up the totals for each of the items to see how much they went over or under this month.

After completing the Difference Column, complete the Revised Column. This column shows the changes that you think they should plan to make for the next month, if any. If there is a surplus, then this is the amount left for them to save. This amount can be allocated toward specific goals, creating an emergency fund, or to draw from during the months when income is low.

As you are working on the revised column, note that their pet is feeling better and they will not have to return to see the veterinarian. They will not be taking a weekend trip this month and will not be staying at any hotels for a while. They are not big on cooking but are willing to spend less on eating out and bring food from home.

As you work on helping them make changes, be realistic about what you think they can do differently the next month. You may want to find areas to cut back on and allocate the money that would have been spent on those areas toward savings, an emergency fund, or paying down debt. This column needs to include actual dollar amounts NOT actions. The figures in this column become their new budget for the following month. They will try implementing these new figures and to see if it is a good fit for them.

On another note, it generally takes about three months to get create budget that is realistic and that works. This means that all of the steps would have to be repeated all over again.

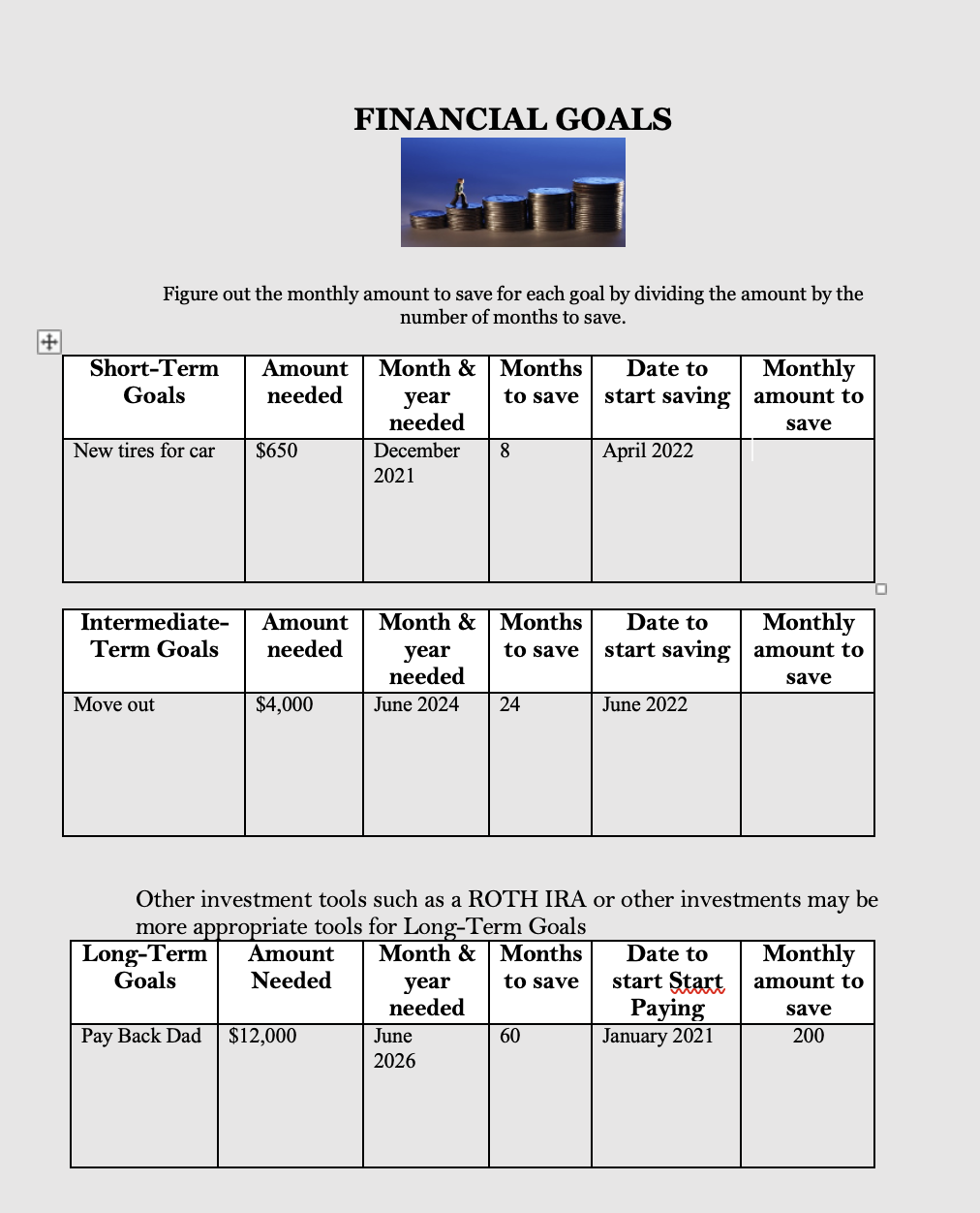

Complete the the Financial Goals sheet and the Budget Analysis sheet. The sheet with the goals explains how to do the math for each goal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started