Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2019. The accounting department of Thompson has started the fixed-asset and depreciation

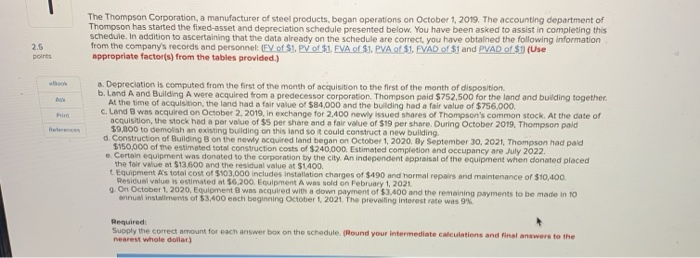

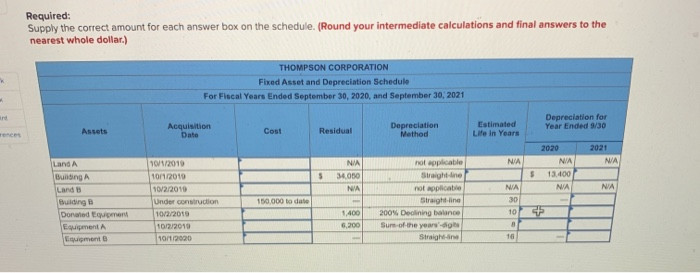

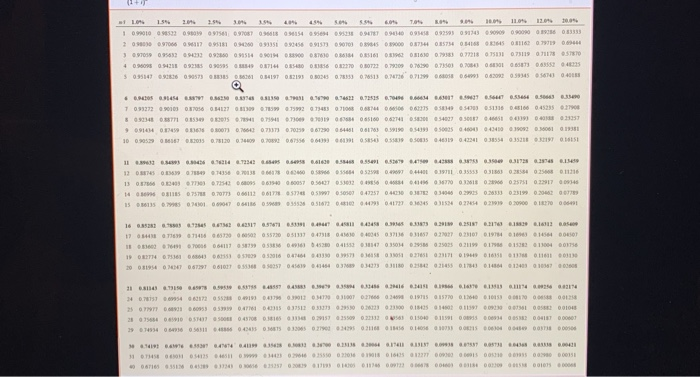

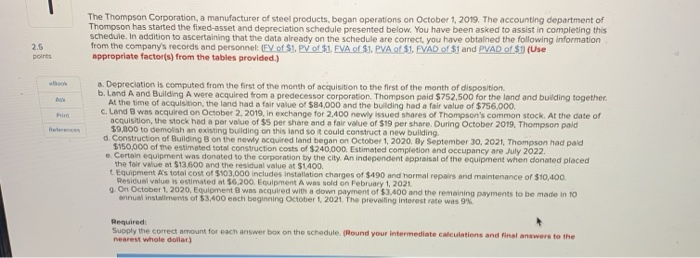

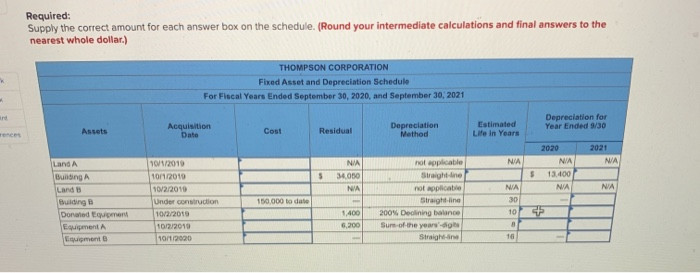

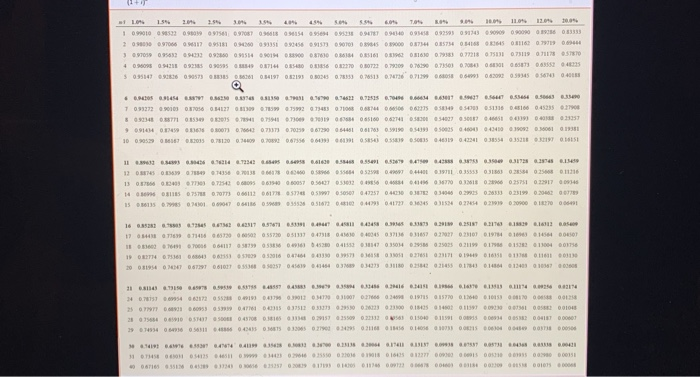

The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2019. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this Schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information from the company's records and personnel (Ey of SI. PV of $1. FVA of S1. PVA of $1. FVAD of $1 and PVAD of $ (Use appropriate factor(s) from the tables provided.) 2.5 points a. Depreciation is computed from the first of the month of acquisition to the first of the month of disposition b. Land A and Building A were acquired from a predecessor corporation Thompson paid $752,500 for the land and building together At the time of acquisition, the land had a fair value of $84,000 and the building had a fair value of $756,000. c. Land was acquired on October 2, 2019, in exchange for 2.400 newly issued shares of Thompson's common stock. At the date of acquisition, the stock had a par value of $5 per share and a fair value of $19 per share. During October 2019, Thompson pald $9,000 to demolish an existing building on this land so it could construct a new building. d. Construction of Building on the newly acquired land began on October 1, 2020 By September 30, 2021, Thompson had paid $150,000 of the estimated total construction costs of $240,000. Estimated completion and occupancy are July 2022. e. Certain equipment was donated to the corporation by the city. An independent appraisal of the equipment when donated placed the fair value at $13.600 and the residual value at $1400 t Equipment As total cost of $103,000 includes installation charges of $490 and normal repairs and maintenance of $10,400 Residual value is estimated at 56,200. Equipment A was sold on February 1, 2021 o on October 1, 2020, Equipment was acquired with a down payment of $3,400 and the remaining payments to be made in 10 annual installments of $3,400 each beginning October 1, 2021. The prevailing interest rate was 9 Required Supply the correct amount for each answer box on the schedule. (Round your intermediate calculations and final answers to the nearest whole dollar) Required: Supply the correct amount for each answer box on the schedule. (Round your intermediate calculations and final answers to the nearest whole dollar.) THOMPSON CORPORATION Fixed Asset and Depreciation Schedule For Fiscal Years Ended September 30, 2020, and September 30, 2021 Acquisition Date Assets Depreciation for Year Ended 9/30 Cost Depreciation Method Residual Estimated Life In Years 2021 NIA NA 2020 NIA 13.400 NA NIA 34.050 NA 5 $ NA NA Land A Bunting ILand B Building Donald Equipe Equipment Equipment 10/1/2010 101/2010 10/2/2010 Under construction 10/2/2019 10/2/2019 10/1/2020 150,000 to date not applicable Straight line not applicable Straight line 200% Declining balance Sum of the years Straighine 1,400 6.200 30 10 8 16 SE US 1.55 1 TO 30 11 1 09901069572098039 097561 0.97087 0.18 0.0154 095094 09523 0.94787 09046 09458 0.92595 0914.9090909009019086 083333 2000097066 0201 095181 020 993358093456 09157 0.90701 89045 0.375 085734 0.14168 16 01162 0.797 0.0** 3097059 095683 090333 090 01514 1 060 06154035161 1962 0160 0.795 08 11 073119 0111870 40.96095 0.94213 092 050 049 0714 500 0.3856 OXYTO OB0722 0.73209 0.76250 0.750 0.70840 00 0.6587 0.6355204235 $ 0.35147032636 0.90573 0.6761 0.54197 0.82195 0.025 0.78333 0.76513 0.12736 0.71299 0.58058 01 04.2002 0.583455693040188 . .300.35454.7 0.68 0.0.0.0.0.74622 0.72515 6.7049.64.60 . . .54 0.04 0.33 7 09772 090103 07056 01107092 0714 0.70 0.61 006 800 000 000 043235 790 8090348 087 01533010101010 0109 04516006711354023 0.00 0.00 0.00 0.0023357 091444 0459 023636 00 0.76643 073373 0.7033967290054451 0.01763 0.58190 0.5403 002 40000480 019002 0.0001 0.13381 10 0.20 0.2035 0.78170 0.409 0.70832 0.67356 06009 0.58505589 sous 48319 042241 0.3854 235213 0.32197 0.15 1. . . . . . . .166.38468 0.50 6.53079 2.43 0.33 031728.28 0.13450 12 0.4 0.3%8397 0.74356 0.70138 01 03 0586655664052598 0.4 0.40 0.7.0.35553 0.31803 0.28584 0.25648 011116 13 0.766 0340372542 0661000057 0.50 0.53032 656 0.41 070 38 026 025751 0.22917 60946 14 01 075738 0.70773 000112 0.61757 0.57 0.509 647257 04:30 0.34045 0.22 0.28333 0.23199 0.20462 0778 15 06135 000 00047 016 00556 051072 060 04293 04 04 03 07154 019 020900 D1TOON 16 0.3226333 6.73845 BIS 17 0.37716.30.411.23 2.37 0.21 0.25187 188 18 Bas 1500 160 064111 87 66 4520 0415524035008025 07119 DI 15382 013004 6 19 DRYT4075361 06641100001010 0101010 0005 01105010510737 0101011 111011011000 20 03194 0 MM 067291 06102755385057 05619 444 0 413 JUIS 022 02:45 0.17 0.14864140010387.000 34 05 069954 12 0 0 0 0 0 0 0 0 0 0 2008 019715015770 B110158 000 25 OF 016053 05 0.13 032 033113022530 020733 0300 018425 01001159701010 23075084 00 00 043705 0.3810 33 0.2157 62509 0.3232 0.15040 011010 00034 0352 0.04187 0.00007 2974534 033 0031 046 043000 1305 90049011601456 0110 0100110010 067160551 01 01101010 011306 0000678 0 18 00101010

The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2019. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this Schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information from the company's records and personnel (Ey of SI. PV of $1. FVA of S1. PVA of $1. FVAD of $1 and PVAD of $ (Use appropriate factor(s) from the tables provided.) 2.5 points a. Depreciation is computed from the first of the month of acquisition to the first of the month of disposition b. Land A and Building A were acquired from a predecessor corporation Thompson paid $752,500 for the land and building together At the time of acquisition, the land had a fair value of $84,000 and the building had a fair value of $756,000. c. Land was acquired on October 2, 2019, in exchange for 2.400 newly issued shares of Thompson's common stock. At the date of acquisition, the stock had a par value of $5 per share and a fair value of $19 per share. During October 2019, Thompson pald $9,000 to demolish an existing building on this land so it could construct a new building. d. Construction of Building on the newly acquired land began on October 1, 2020 By September 30, 2021, Thompson had paid $150,000 of the estimated total construction costs of $240,000. Estimated completion and occupancy are July 2022. e. Certain equipment was donated to the corporation by the city. An independent appraisal of the equipment when donated placed the fair value at $13.600 and the residual value at $1400 t Equipment As total cost of $103,000 includes installation charges of $490 and normal repairs and maintenance of $10,400 Residual value is estimated at 56,200. Equipment A was sold on February 1, 2021 o on October 1, 2020, Equipment was acquired with a down payment of $3,400 and the remaining payments to be made in 10 annual installments of $3,400 each beginning October 1, 2021. The prevailing interest rate was 9 Required Supply the correct amount for each answer box on the schedule. (Round your intermediate calculations and final answers to the nearest whole dollar) Required: Supply the correct amount for each answer box on the schedule. (Round your intermediate calculations and final answers to the nearest whole dollar.) THOMPSON CORPORATION Fixed Asset and Depreciation Schedule For Fiscal Years Ended September 30, 2020, and September 30, 2021 Acquisition Date Assets Depreciation for Year Ended 9/30 Cost Depreciation Method Residual Estimated Life In Years 2021 NIA NA 2020 NIA 13.400 NA NIA 34.050 NA 5 $ NA NA Land A Bunting ILand B Building Donald Equipe Equipment Equipment 10/1/2010 101/2010 10/2/2010 Under construction 10/2/2019 10/2/2019 10/1/2020 150,000 to date not applicable Straight line not applicable Straight line 200% Declining balance Sum of the years Straighine 1,400 6.200 30 10 8 16 SE US 1.55 1 TO 30 11 1 09901069572098039 097561 0.97087 0.18 0.0154 095094 09523 0.94787 09046 09458 0.92595 0914.9090909009019086 083333 2000097066 0201 095181 020 993358093456 09157 0.90701 89045 0.375 085734 0.14168 16 01162 0.797 0.0** 3097059 095683 090333 090 01514 1 060 06154035161 1962 0160 0.795 08 11 073119 0111870 40.96095 0.94213 092 050 049 0714 500 0.3856 OXYTO OB0722 0.73209 0.76250 0.750 0.70840 00 0.6587 0.6355204235 $ 0.35147032636 0.90573 0.6761 0.54197 0.82195 0.025 0.78333 0.76513 0.12736 0.71299 0.58058 01 04.2002 0.583455693040188 . .300.35454.7 0.68 0.0.0.0.0.74622 0.72515 6.7049.64.60 . . .54 0.04 0.33 7 09772 090103 07056 01107092 0714 0.70 0.61 006 800 000 000 043235 790 8090348 087 01533010101010 0109 04516006711354023 0.00 0.00 0.00 0.0023357 091444 0459 023636 00 0.76643 073373 0.7033967290054451 0.01763 0.58190 0.5403 002 40000480 019002 0.0001 0.13381 10 0.20 0.2035 0.78170 0.409 0.70832 0.67356 06009 0.58505589 sous 48319 042241 0.3854 235213 0.32197 0.15 1. . . . . . . .166.38468 0.50 6.53079 2.43 0.33 031728.28 0.13450 12 0.4 0.3%8397 0.74356 0.70138 01 03 0586655664052598 0.4 0.40 0.7.0.35553 0.31803 0.28584 0.25648 011116 13 0.766 0340372542 0661000057 0.50 0.53032 656 0.41 070 38 026 025751 0.22917 60946 14 01 075738 0.70773 000112 0.61757 0.57 0.509 647257 04:30 0.34045 0.22 0.28333 0.23199 0.20462 0778 15 06135 000 00047 016 00556 051072 060 04293 04 04 03 07154 019 020900 D1TOON 16 0.3226333 6.73845 BIS 17 0.37716.30.411.23 2.37 0.21 0.25187 188 18 Bas 1500 160 064111 87 66 4520 0415524035008025 07119 DI 15382 013004 6 19 DRYT4075361 06641100001010 0101010 0005 01105010510737 0101011 111011011000 20 03194 0 MM 067291 06102755385057 05619 444 0 413 JUIS 022 02:45 0.17 0.14864140010387.000 34 05 069954 12 0 0 0 0 0 0 0 0 0 0 2008 019715015770 B110158 000 25 OF 016053 05 0.13 032 033113022530 020733 0300 018425 01001159701010 23075084 00 00 043705 0.3810 33 0.2157 62509 0.3232 0.15040 011010 00034 0352 0.04187 0.00007 2974534 033 0031 046 043000 1305 90049011601456 0110 0100110010 067160551 01 01101010 011306 0000678 0 18 00101010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started