Answered step by step

Verified Expert Solution

Question

1 Approved Answer

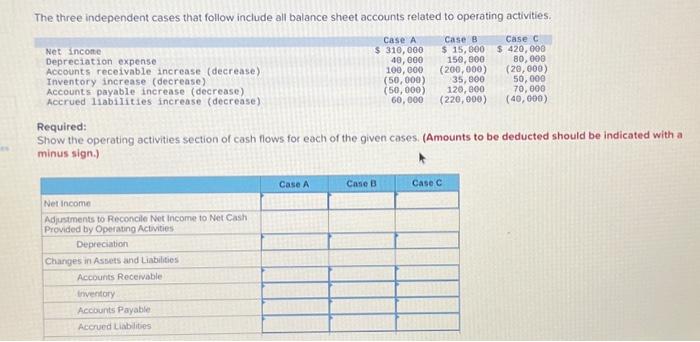

The three independent cases that follow include all balance sheet accounts related to operating activities. Case B $ 15,000 150,000 (200,000) 35,000 120,000 (220,000) Case

The three independent cases that follow include all balance sheet accounts related to operating activities. Case B $ 15,000 150,000 (200,000) 35,000 120,000 (220,000) Case C $ 420,000 80,000 (20, 000) 50,000 70,000 (40,000) Net income Depreciation expense Accounts receivable increase (decrease) Inventory increase (decrease) Accounts payable increase (decrease) Accrued liabilities increase (decrease) Required: Show the operating activities section of cash flows for each of the given cases. (Amounts to be deducted should be indicated with a minus sign.) Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Depreciation Changes in Assets and Liabilities Accounts Receivable Inventory Accounts Payable Accrued Liabilities Case A $ 310,000 40,000 100, 000 (50,000) (50,000) 60,000 Case A Case B Case C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started