Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Tiger Securities LLC is an active player in global financial markets. Its proprietary trading division holds a large local bond and stock portfolio,

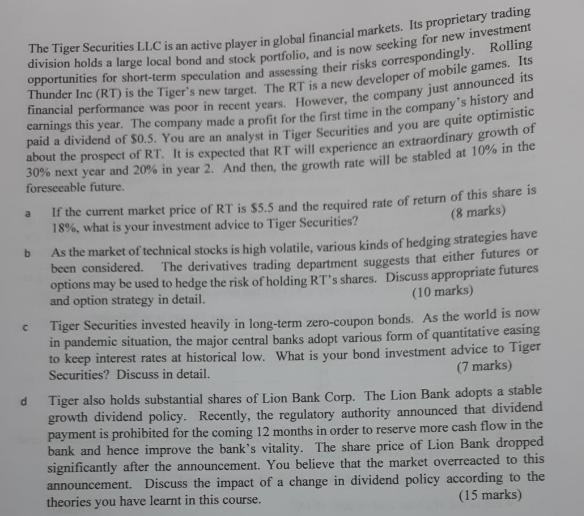

The Tiger Securities LLC is an active player in global financial markets. Its proprietary trading division holds a large local bond and stock portfolio, and is now seeking for new investment opportunities for short-term speculation and assessing their risks correspondingly. Rolling Thunder Inc (RT) is the Tiger's new target. The RT is a new developer of mobile games. Its financial performance was poor in recent years. However, the company just announced its earnings this year. The company made a profit for the first time in the company's history and paid a dividend of $0.5. You are an analyst in Tiger Securities and you are quite optimistic about the prospect of RT. It is expected that RT will experience an extraordinary growth of 30% next year and 20% in year 2. And then, the growth rate will be stabled at 10% in the foreseeable future. a b C d If the current market price of RT is $5.5 and the required rate of return of this share is 18%, what is your investment advice to Tiger Securities? (8 marks) As the market of technical stocks is high volatile, various kinds of hedging strategies have been considered. The derivatives trading department suggests that either futures or options may be used to hedge the risk of holding RT's shares. Discuss appropriate futures and option strategy in detail. (10 marks) Tiger Securities invested heavily in long-term zero-coupon bonds. As the world is now in pandemic situation, the major central banks adopt various form of quantitative easing to keep interest rates at historical low. What is your bond investment advice to Tiger (7 marks) Securities? Discuss in detail. Tiger also holds substantial shares of Lion Bank Corp. The Lion Bank adopts a stable growth dividend policy. Recently, the regulatory authority announced that dividend payment is prohibited for the coming 12 months in order to reserve more cash flow in the bank and hence improve the bank's vitality. The share price of Lion Bank dropped significantly after the announcement. You believe that the market overreacted to this announcement. Discuss the impact of a change in dividend policy according to the (15 marks) theories you have learnt in this course. The Tiger Securities LLC is an active player in global financial markets. Its proprietary trading division holds a large local bond and stock portfolio, and is now seeking for new investment opportunities for short-term speculation and assessing their risks correspondingly. Rolling Thunder Inc (RT) is the Tiger's new target. The RT is a new developer of mobile games. Its financial performance was poor in recent years. However, the company just announced its earnings this year. The company made a profit for the first time in the company's history and paid a dividend of $0.5. You are an analyst in Tiger Securities and you are quite optimistic about the prospect of RT. It is expected that RT will experience an extraordinary growth of 30% next year and 20% in year 2. And then, the growth rate will be stabled at 10% in the foreseeable future. a b C d If the current market price of RT is $5.5 and the required rate of return of this share is 18%, what is your investment advice to Tiger Securities? (8 marks) As the market of technical stocks is high volatile, various kinds of hedging strategies have been considered. The derivatives trading department suggests that either futures or options may be used to hedge the risk of holding RT's shares. Discuss appropriate futures and option strategy in detail. (10 marks) Tiger Securities invested heavily in long-term zero-coupon bonds. As the world is now in pandemic situation, the major central banks adopt various form of quantitative easing to keep interest rates at historical low. What is your bond investment advice to Tiger (7 marks) Securities? Discuss in detail. Tiger also holds substantial shares of Lion Bank Corp. The Lion Bank adopts a stable growth dividend policy. Recently, the regulatory authority announced that dividend payment is prohibited for the coming 12 months in order to reserve more cash flow in the bank and hence improve the bank's vitality. The share price of Lion Bank dropped significantly after the announcement. You believe that the market overreacted to this announcement. Discuss the impact of a change in dividend policy according to the (15 marks) theories you have learnt in this course.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a As the analyst from Tiger Securities I would recommend investing in Rolling Thunder Inc RT given the positive future growth prospects Using the Gordon Growth Model we can calculate the intrinsic val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started