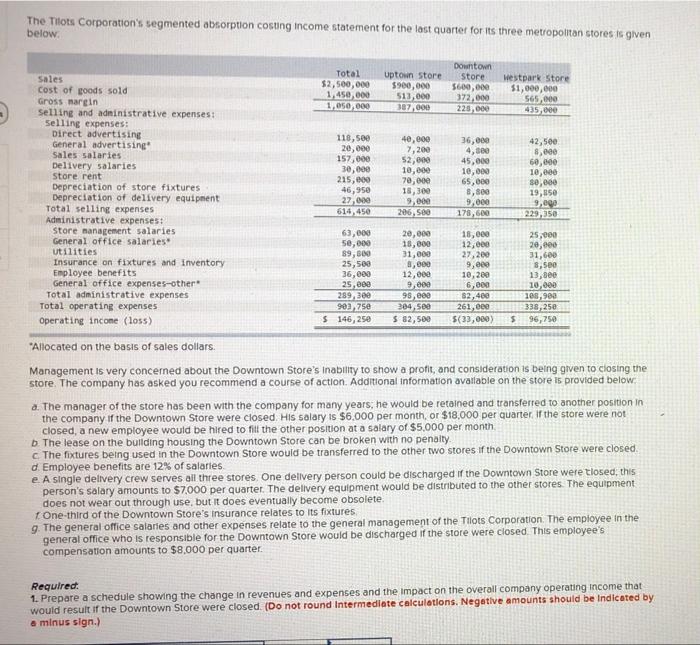

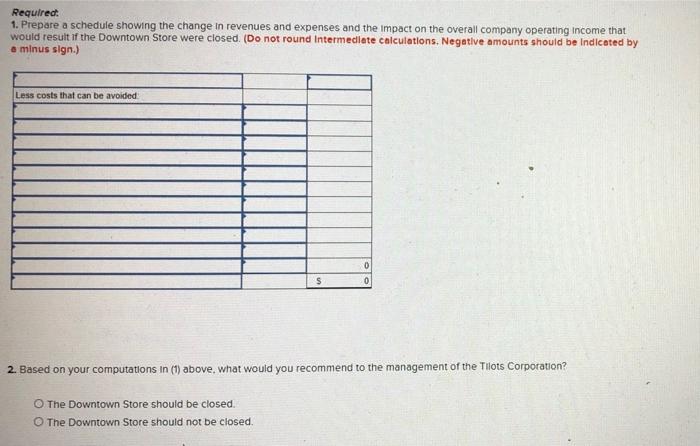

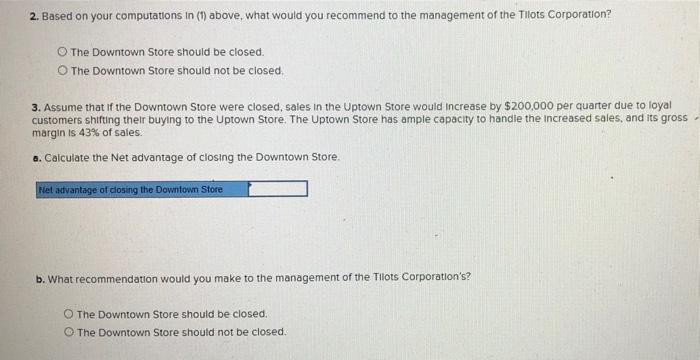

The Tilots Corporation's segmented absorption cosung income statement for the last quarter for its three metropolitan stores is given below: "Allocated on the basis of sales dollars. Management is very concerned about the Downtown Store's inablity to show a profit, and consideration is being given to closing the store. The company has asked you recommend a course of action. Additional information avatlable on the store is provided below: a. The manager of the store has been with the company for many years, he would be retained and transferred to another position in the company if the Downtown Store were closed. His salary is $6,000 per month, or $18,000 per quarter. If the store were not closed, a new employee would be hired to fill the other position at a salary of $5,000 per month b. The lease on the bullding housing the Downtown Store can be broken with no penaity. c. The fixtures being used in the Downtown Store would be transferred to the other two stores if the Downtown Store were closed. d. Employee benefits are 12% of salaries. e. A single delivery crew serves all three stores. One delivery person could be discharged if the Downtown Store were tlosed; this person's salary amounts to $7,000 per quarter. The dellvery equipment would be distributed to the other stores. The equipment does not wear out through use, but it does eventually become obsolete t. One-third of the Downtown Store's insurance relates to its fixtures g. The general office salaries and other expenses relate to the general management of the Tilots corporation. The empioyee in the general office who is responsible for the Downtown Store would be discharged if the store were closed. This employee's compensation amounts to $8,000 per quarter 1. Prepare a schedule showing the change in revenues and expenses and the impact on the overall company operating income that Required: would result if the Downtown Store were closed. (Do not round Intermedlate calculations. Negative amounts should be Indicated by a minus sign.) Requlred: 1. Prepare a schedule showing the change in revenues and expenses and the impact on the overall company operating income that would result if the Downtown Store were closed. (Do not round Intermedlate calculations. Negative amounts should be Indiceted by e minus sign.) 2. Based on your computations in (1) above, what would you recommend to the management of the Tilots Corporation? The Downtown Store should be closed The Downtown Store should not be closed. 2. Based on your computations in (1) above, what would you recommend to the management of the Tllots Corporation? The Downtown Store should be closed. The Downtown Store should not be closed. 3. Assume that If the Downtown Store were closed, sales in the Uptown Store would increase by $200,000 per quarter due to loyal customers shifting their buying to the Uptown Store. The Uptown Store has ample capacity to handle the increased sales, and its gross margin is 43% of sales. a. Calculate the Net advantage of closing the Downtown Store. b. What recommendation would you make to the management of the Tilots Corporation's? The Downtown Store should be closed. The Downtown Store should not be closed