Answered step by step

Verified Expert Solution

Question

1 Approved Answer

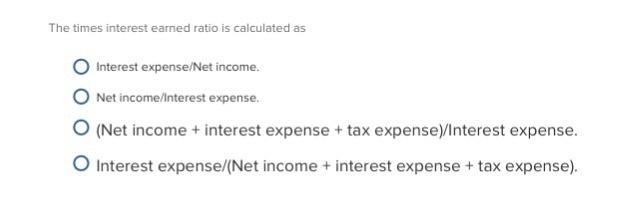

The times interest earned ratio is calculated as Interest expense/Net income. Net income/Interest expense. O (Net income + interest expense + tax expense)/Interest expense.

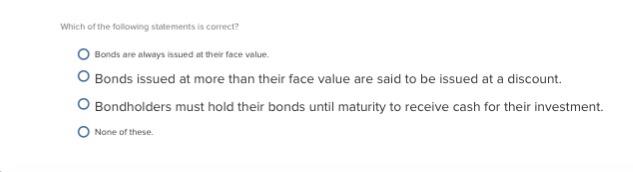

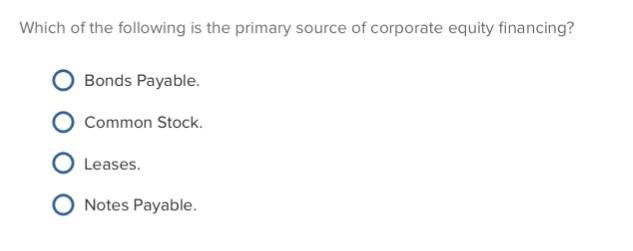

The times interest earned ratio is calculated as Interest expense/Net income. Net income/Interest expense. O (Net income + interest expense + tax expense)/Interest expense. O Interest expense/(Net income + interest expense + tax expense). Which of the following statements is correct? O Bonds are always issued at their face value. O Bonds issued at more than their face value are said to be issued at a discount. O Bondholders must hold their bonds until maturity to receive cash for their investment. None of these. Which of the following is the primary source of corporate equity financing? Bonds Payable. Common Stock. Leases. O Notes Payable.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Times Interest Earned Ratio Earning Before Interest and Taxes Interest Expense EBIT Net Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started