Answered step by step

Verified Expert Solution

Question

1 Approved Answer

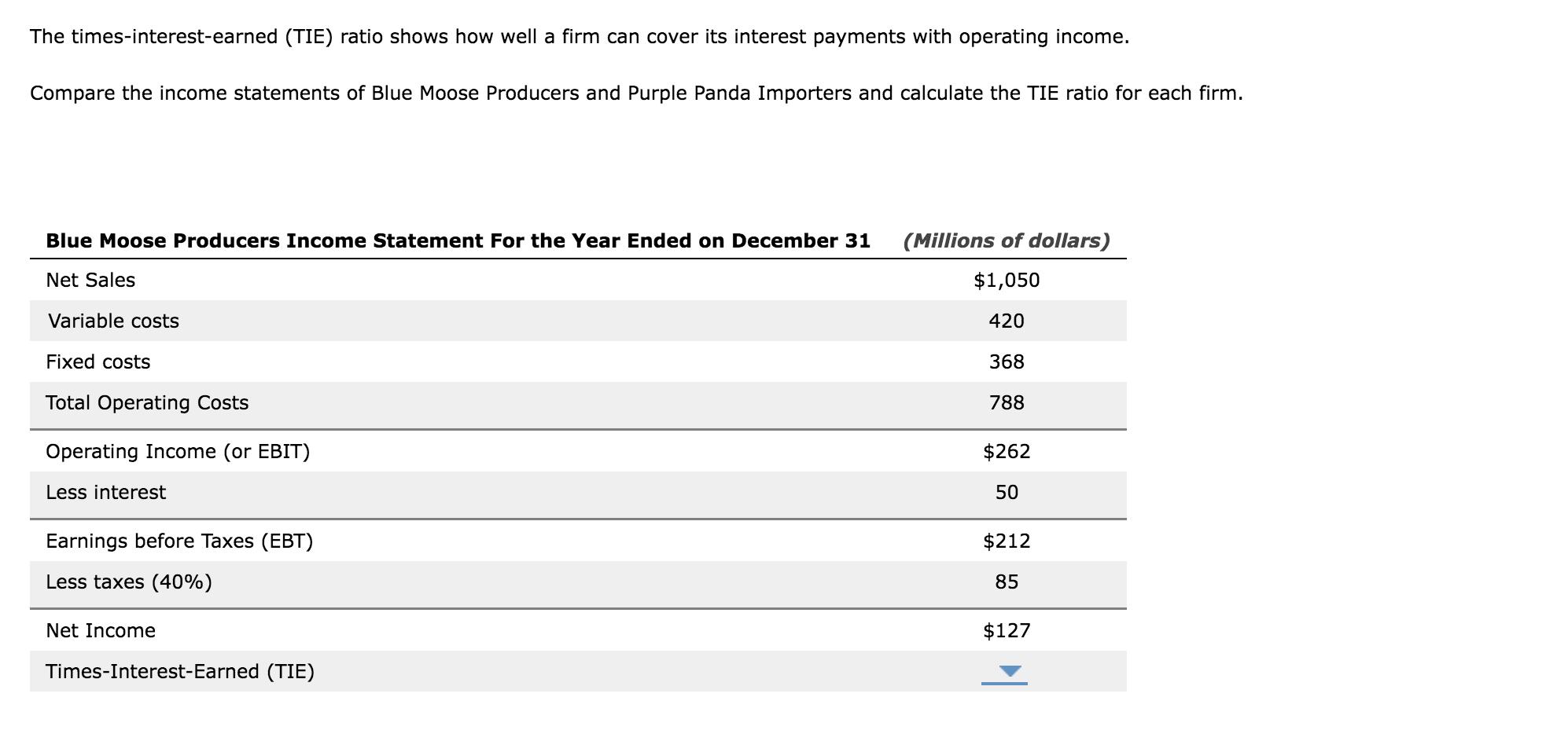

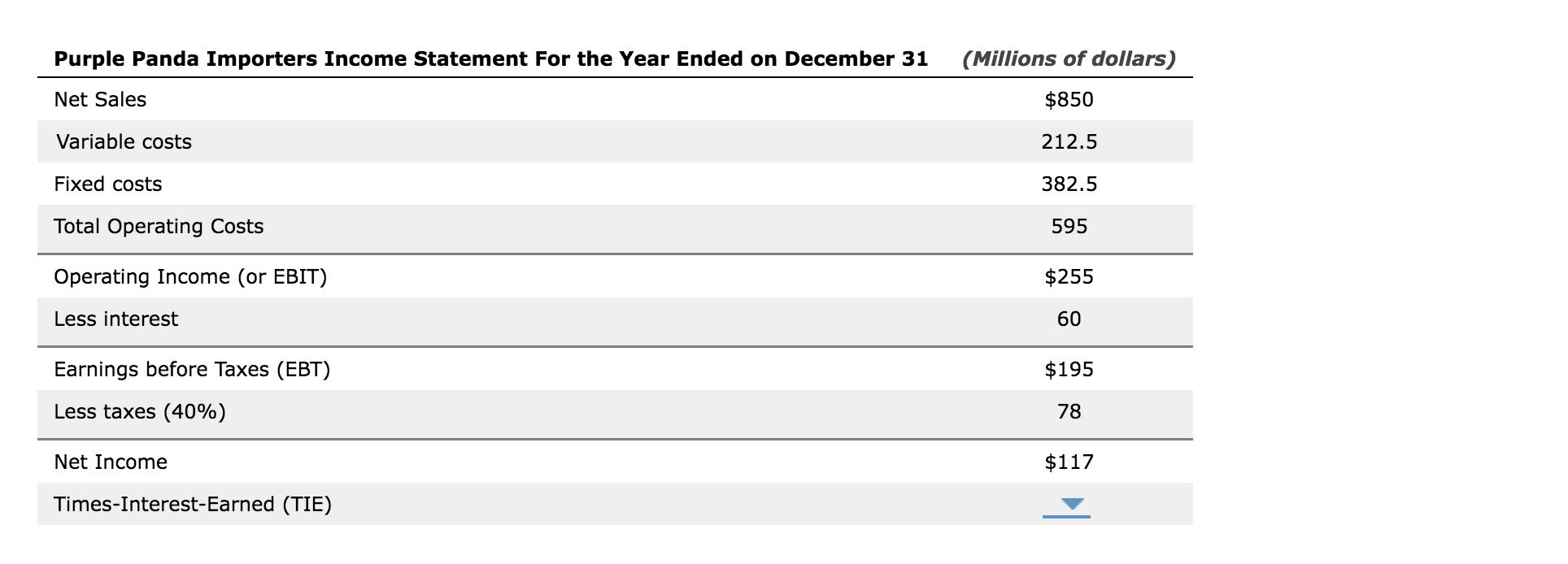

The times-interest-earned (TIE) ratio shows how well a firm can cover its interest payments with operating income. Compare the income statements of Blue Moose

The times-interest-earned (TIE) ratio shows how well a firm can cover its interest payments with operating income. Compare the income statements of Blue Moose Producers and Purple Panda Importers and calculate the TIE ratio for each firm. Blue Moose Producers Income Statement For the Year Ended on December 31 (Millions of dollars) Net Sales Variable costs Fixed costs Total Operating Costs Operating Income (or EBIT) Less interest Earnings before Taxes (EBT) Less taxes (40%) Net Income Times-Interest-Earned (TIE) $1,050 420 368 788 $262 50 $212 85 $127 Purple Panda Importers Income Statement For the Year Ended on December 31 (Millions of dollars) Net Sales Variable costs $850 212.5 382.5 Fixed costs Total Operating Costs Operating Income (or EBIT) Less interest Earnings before Taxes (EBT) Less taxes (40%) Net Income Times-Interest-Earned (TIE) 595 $255 60 $195 78 $117

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started