Answered step by step

Verified Expert Solution

Question

1 Approved Answer

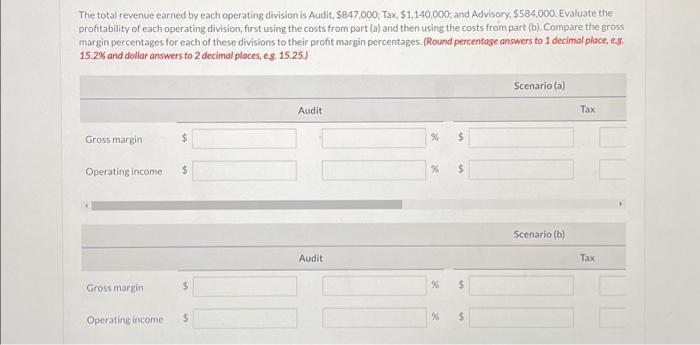

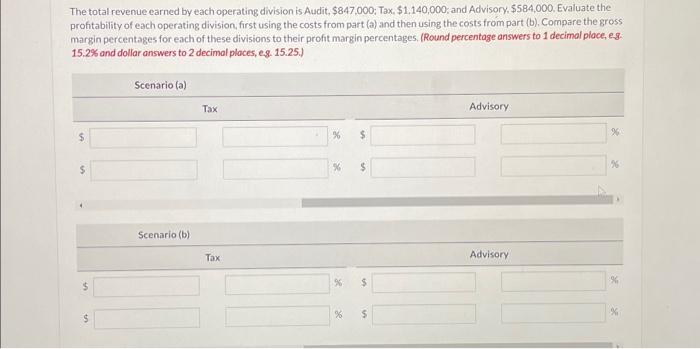

The total revenue earned by each operating division is Audit, $847,000, Tax, $1,140,000; and Advisory, $584,000. Evaluate the profitability of each operating division, first

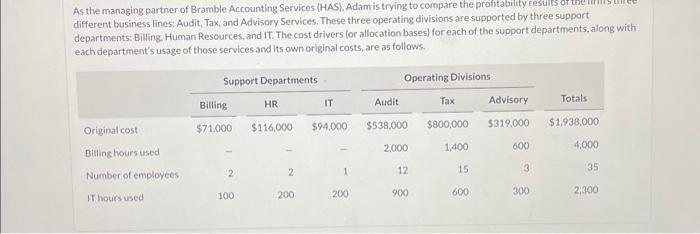

The total revenue earned by each operating division is Audit, $847,000, Tax, $1,140,000; and Advisory, $584,000. Evaluate the profitability of each operating division, first using the costs from part (a) and then using the costs from part (b). Compare the gross margin percentages for each of these divisions to their profit margin percentages. (Round percentage answers to 1 decimal place, e.g. 15.2% and dollar answers to 2 decimal places, eg. 15.25.) Gross margin Operating income $ Gross margin Operating income $ $ Audit Audit % % $ % $ % $ Scenario (a). Scenario (b) Tax Tax E The total revenue earned by each operating division is Audit, $847,000; Tax, $1.140,000; and Advisory, $584,000. Evaluate the profitability of each operating division, first using the costs from part (a) and then using the costs from part (b). Compare the gross margin percentages for each of these divisions to their profit margin percentages. (Round percentage answers to 1 decimal place, e.g. 15.2% and dollar answers to 2 decimal places, e.g. 15.25.) $ $ $ $ Scenario (a) Scenario (b) Tax Tax % % % $ $ $ $ Advisory Advisory % % % % As the managing partner of Bramble Accounting Services (HAS), Adam is trying to compare the profitability results of the S different business lines: Audit, Tax, and Advisory Services. These three operating divisions are supported by three support departments: Billing, Human Resources, and IT. The cost drivers (or allocation bases) for each of the support departments, along with each department's usage of those services and its own original costs, are as follows. Support Departments Original cost Billing hours used Number of employees IT hours used Billing $71.000 2 100 HR $116,000 2 200 IT $94,000 1 200 Audit Operating Divisions $538,000 2,000 12 900 Tax $800,000 1,400 15 600 Advisory $319,000 600 3 300 Totals $1,938,000 4,000 35 2,300

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the profitability of each operating division we need to calculate the gross margin and operating income for each division We can do this b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started