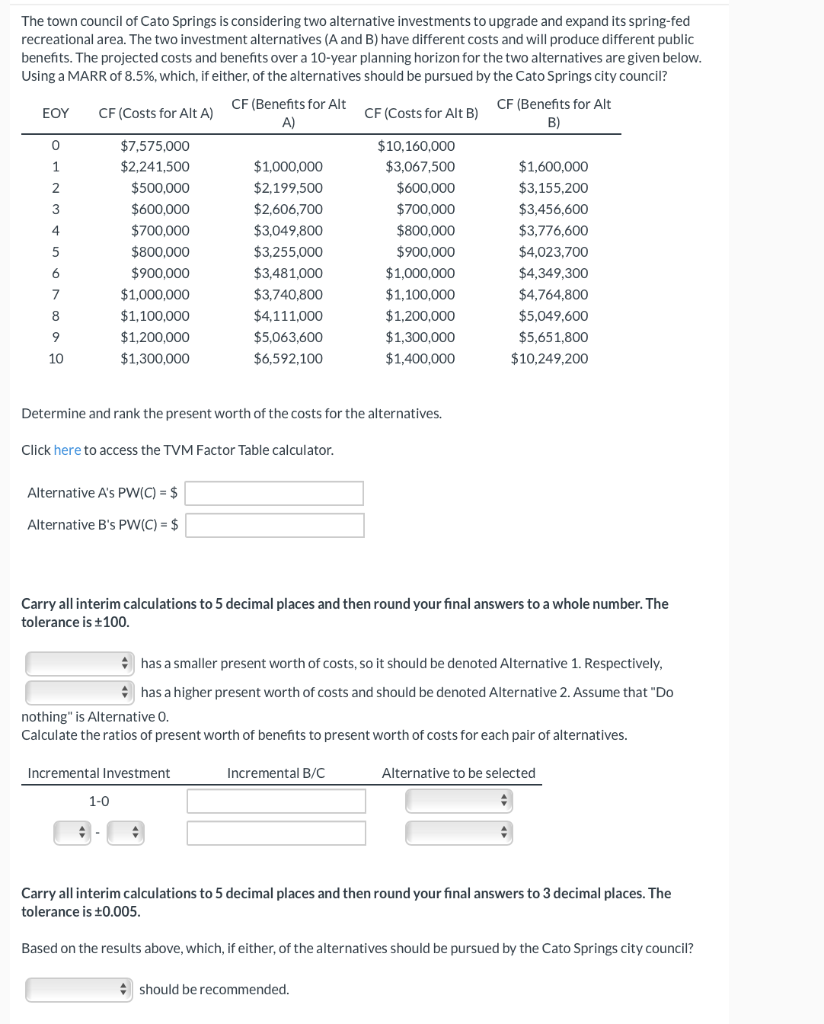

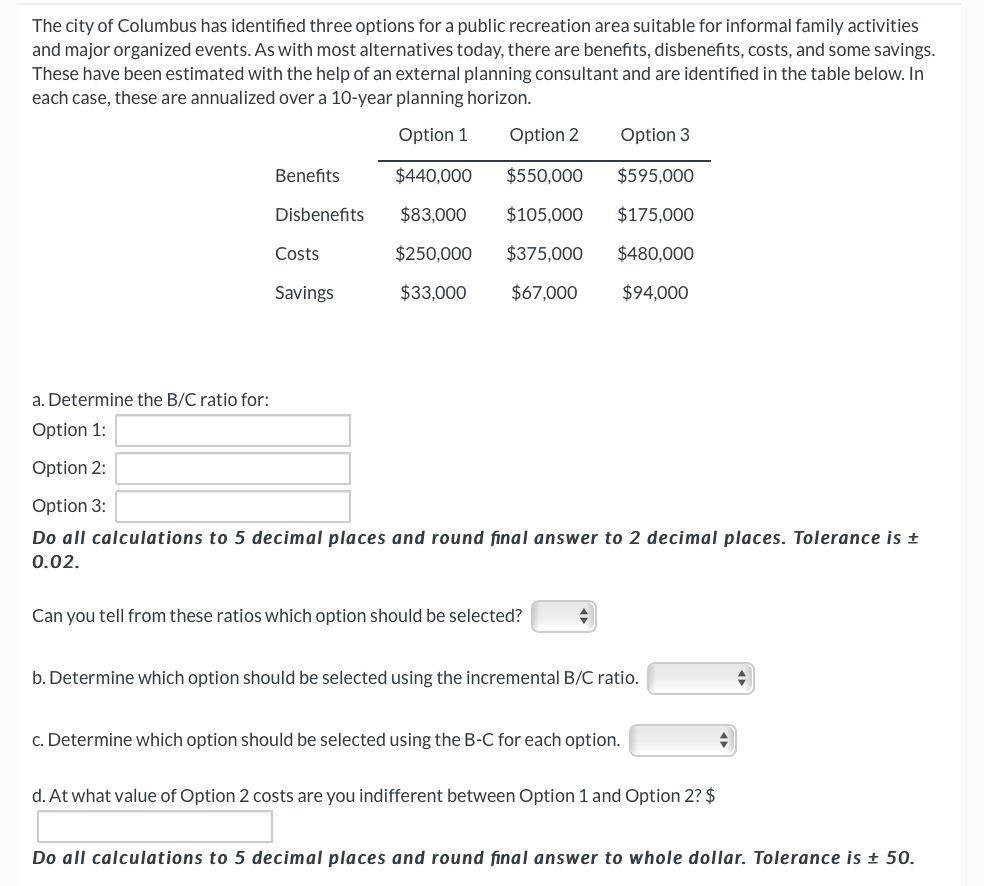

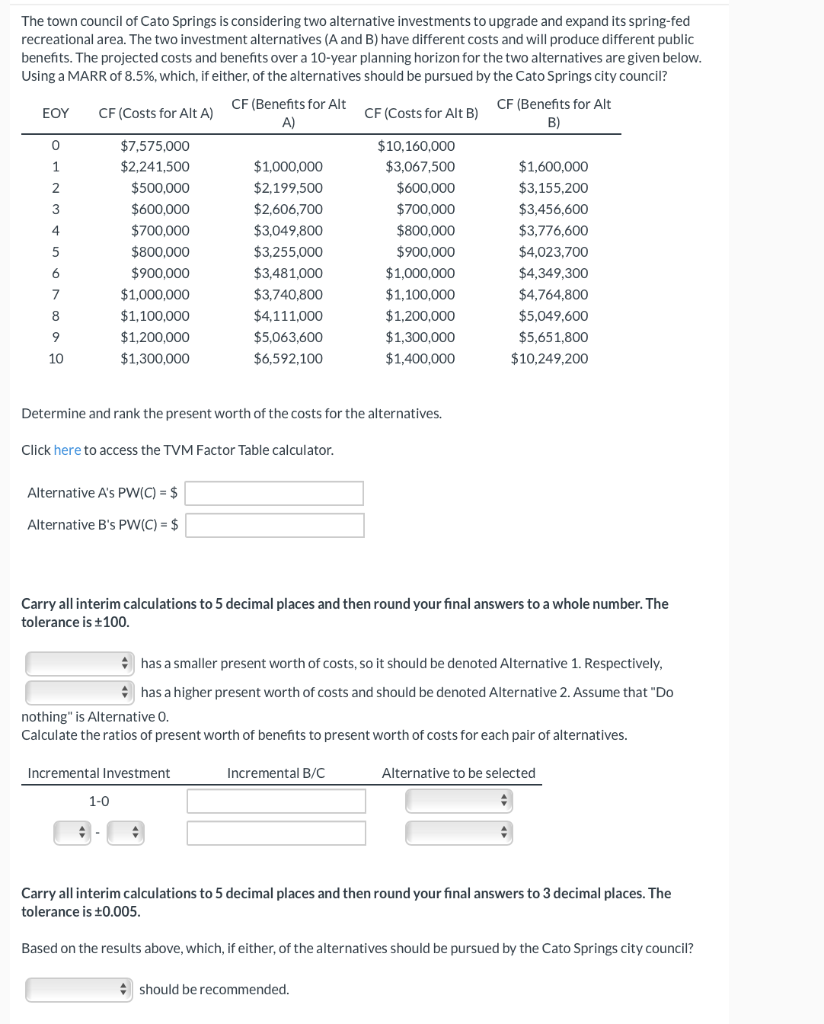

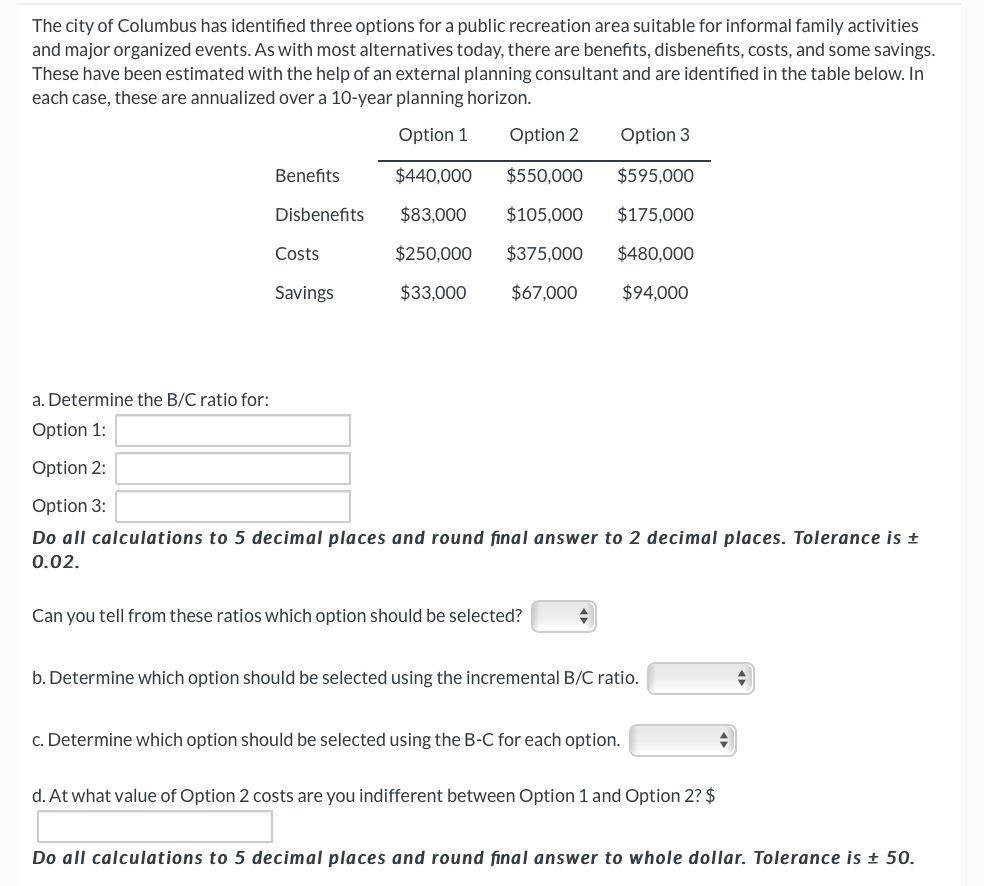

The town council of Cato Springs is considering two alternative investments to upgrade and expand its spring-fed recreational area. The two investment alternatives (A and B) have different costs and will produce different public benefits. The projected costs and benefits over a 10-year planning horizon for the two alternatives are given below. Using a MARR of 8.5%, which, if either of the alternatives should be pursued by the Cato Springs city council? EOY CF (Costs for Alt A) CF (Benefits for Alt A) CF (Costs for Alt B) CF (Benefits for Alt B) 0 1 2 3 4 5 $7,575,000 $2,241,500 $500,000 $600,000 $700,000 $800,000 $900,000 $1,000,000 $1,100,000 $1,200,000 $1,300,000 $1,000,000 $2,199,500 $2,606,700 $3,049,800 $3,255,000 $3,481,000 $3,740,800 $4,111,000 $5,063,600 $6,592,100 $10.160,000 $3,067,500 $600,000 $700,000 $800,000 $900,000 $1,000,000 $1,100,000 $1.200.000 $1,300,000 $1,400,000 $1,600,000 $3,155,200 $3,456,600 $3,776,600 $4,023,700 $4,349,300 $4,764,800 $5,049,600 $5,651,800 $10,249,200 6 7 8 9 10 Determine and rank the present worth of the costs for the alternatives. Click here to access the TVM Factor Table calculator. Alternative A's PW(C) = $ Alternative B's PW(C) = $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +100. has a smaller present worth of costs, so it should be denoted Alternative 1. Respectively, has a higher present worth of costs and should be denoted Alternative 2. Assume that "Do nothing" is Alternative 0. Calculate the ratios of present worth of benefits to present worth of costs for each pair of alternatives. Incremental Investment Incremental B/C Alternative to be selected 1-0 Carry all interim calculations to 5 decimal places and then round your final answers to 3 decimal places. The tolerance is +0.005. Based on the results above, which, if either of the alternatives should be pursued by the Cato Springs city council? 4 should be recommended. The city of Columbus has identified three options for a public recreation area suitable for informal family activities and major organized events. As with most alternatives today, there are benefits, disbenefits, costs, and some savings. These have been estimated with the help of an external planning consultant and are identified in the table below. In each case, these are annualized over a 10-year planning horizon. Option Option 2 Option 3 Benefits $440,000 $550,000 $595,000 Disbenefits $83,000 $105,000 $175,000 Costs $250,000 $375,000 $480,000 Savings $33,000 $67,000 $94,000 a. Determine the B/C ratio for: Option 1: Option 2: Option 3: Do all calculations to 5 decimal places and round final answer to 2 decimal places. Tolerance is t 0.02. Can you tell from these ratios which option should be selected? b. Determine which option should be selected using the incremental B/C ratio. c. Determine which option should be selected using the B-C for each option. d. At what value of Option 2 costs are you indifferent between Option 1 and Option 2?$ Do all calculations to 5 decimal places and round final answer to whole dollar. Tolerance is + 50. The town council of Cato Springs is considering two alternative investments to upgrade and expand its spring-fed recreational area. The two investment alternatives (A and B) have different costs and will produce different public benefits. The projected costs and benefits over a 10-year planning horizon for the two alternatives are given below. Using a MARR of 8.5%, which, if either of the alternatives should be pursued by the Cato Springs city council? EOY CF (Costs for Alt A) CF (Benefits for Alt A) CF (Costs for Alt B) CF (Benefits for Alt B) 0 1 2 3 4 5 $7,575,000 $2,241,500 $500,000 $600,000 $700,000 $800,000 $900,000 $1,000,000 $1,100,000 $1,200,000 $1,300,000 $1,000,000 $2,199,500 $2,606,700 $3,049,800 $3,255,000 $3,481,000 $3,740,800 $4,111,000 $5,063,600 $6,592,100 $10.160,000 $3,067,500 $600,000 $700,000 $800,000 $900,000 $1,000,000 $1,100,000 $1.200.000 $1,300,000 $1,400,000 $1,600,000 $3,155,200 $3,456,600 $3,776,600 $4,023,700 $4,349,300 $4,764,800 $5,049,600 $5,651,800 $10,249,200 6 7 8 9 10 Determine and rank the present worth of the costs for the alternatives. Click here to access the TVM Factor Table calculator. Alternative A's PW(C) = $ Alternative B's PW(C) = $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +100. has a smaller present worth of costs, so it should be denoted Alternative 1. Respectively, has a higher present worth of costs and should be denoted Alternative 2. Assume that "Do nothing" is Alternative 0. Calculate the ratios of present worth of benefits to present worth of costs for each pair of alternatives. Incremental Investment Incremental B/C Alternative to be selected 1-0 Carry all interim calculations to 5 decimal places and then round your final answers to 3 decimal places. The tolerance is +0.005. Based on the results above, which, if either of the alternatives should be pursued by the Cato Springs city council? 4 should be recommended. The city of Columbus has identified three options for a public recreation area suitable for informal family activities and major organized events. As with most alternatives today, there are benefits, disbenefits, costs, and some savings. These have been estimated with the help of an external planning consultant and are identified in the table below. In each case, these are annualized over a 10-year planning horizon. Option Option 2 Option 3 Benefits $440,000 $550,000 $595,000 Disbenefits $83,000 $105,000 $175,000 Costs $250,000 $375,000 $480,000 Savings $33,000 $67,000 $94,000 a. Determine the B/C ratio for: Option 1: Option 2: Option 3: Do all calculations to 5 decimal places and round final answer to 2 decimal places. Tolerance is t 0.02. Can you tell from these ratios which option should be selected? b. Determine which option should be selected using the incremental B/C ratio. c. Determine which option should be selected using the B-C for each option. d. At what value of Option 2 costs are you indifferent between Option 1 and Option 2?$ Do all calculations to 5 decimal places and round final answer to whole dollar. Tolerance is + 50