Answered step by step

Verified Expert Solution

Question

1 Approved Answer

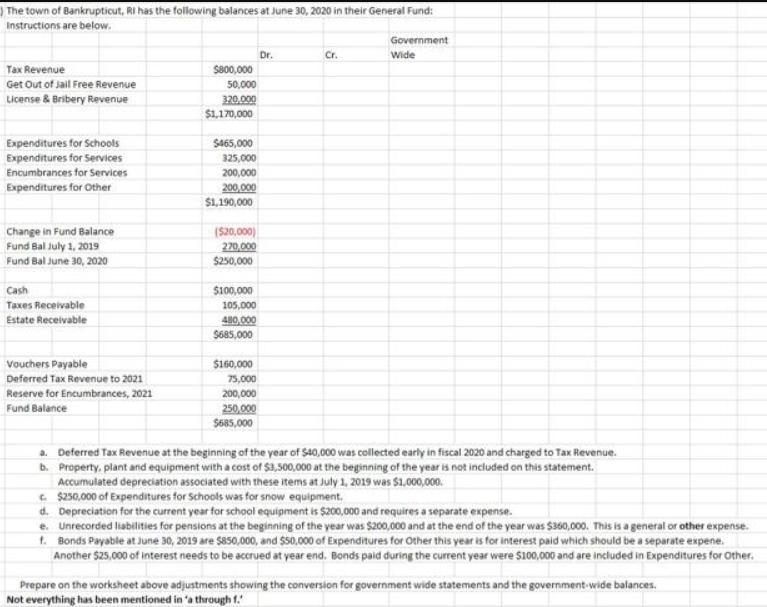

The town of Bankrupticut, RI has the following balances at June 30, 2020 in their General Fund: Instructions are below. Tax Revenue Get Out

The town of Bankrupticut, RI has the following balances at June 30, 2020 in their General Fund: Instructions are below. Tax Revenue Get Out of Jail Free Revenue License & Bribery Revenue Expenditures for Schools Expenditures for Services Encumbrances for Services Expenditures for Other Change in Fund Balance Fund Bal July 1, 2019 Fund Bal June 30, 2020 Cash Taxes Receivable Estate Receivable Vouchers Payable Deferred Tax Revenue to 2021 Reserve for Encumbrances, 2021 Fund Balance $800,000 50,000 320,000 $1,170,000 $465,000 325,000 200,000 200,000 $1,190,000 ($20,000) 270,000 $250,000 $100,000 105,000 480,000 $685,000 $160,000 75,000 200,000 250,000 $685,000 Dr. Cr. Government Wide a. Deferred Tax Revenue at the beginning of the year of $40,000 was collected early in fiscal 2020 and charged to Tax Revenue. b. Property, plant and equipment with a cost of $3,500,000 at the beginning of the year is not included on this statement. Accumulated depreciation associated with these items at July 1, 2019 was $1,000,000. c. $250,000 of Expenditures for Schools was for snow equipment, d. Depreciation for the current year for school equipment is $200,000 and requires a separate expense. e. Unrecorded liabilities for pensions at the beginning of the year was $200,000 and at the end of the year was $360,000. This is a general or other expense. f. Bonds Payable at June 30, 2019 are $850,000, and $50,000 of Expenditures for Other this year is for interest paid which should be a separate expene. Another $25,000 of interest needs to be accrued at year end. Bonds paid during the current year were $100,000 and are included in Expenditures for Other. Prepare on the worksheet above adjustments showing the conversion for government wide statements and the government-wide balances. Not everything has been mentioned in 'a through f.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Ravise Worksheet Tax Revenue 800000 40000 1 Jail Free Revenue Get out of lience Briberly Penerve ixp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started