Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The trading company XYZ Finance wants to purchase some amount of government bonds. Three types of government bonds are under consideration. They are issued

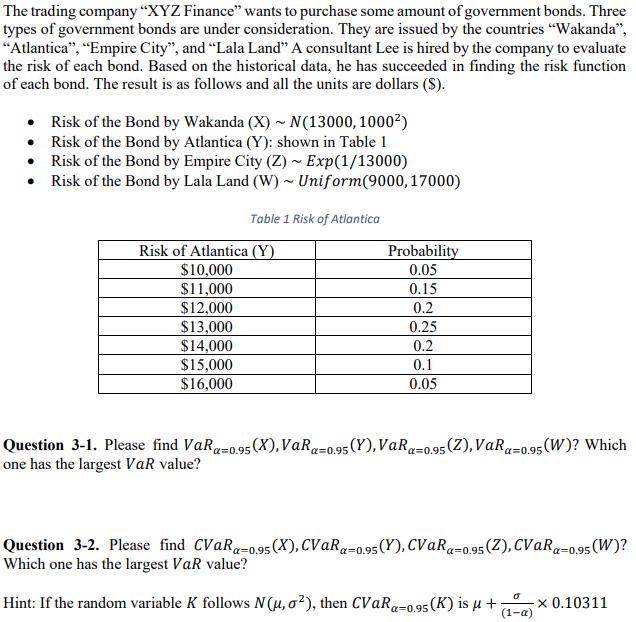

The trading company "XYZ Finance" wants to purchase some amount of government bonds. Three types of government bonds are under consideration. They are issued by the countries "Wakanda", "Atlantica", "Empire City", and "Lala Land" A consultant Lee is hired by the company to evaluate the risk of each bond. Based on the historical data, he has succeeded in finding the risk function of each bond. The result is as follows and all the units are dollars ($). Risk of the Bond by Wakanda (X)~ N(13000, 1000) Risk of the Bond by Atlantica (Y): shown in Table 1 Risk of the Bond by Empire City (Z) ~ Exp(1/13000) Risk of the Bond by Lala Land (W) Uniform(9000, 17000) Table 1 Risk of Atlantica Risk of Atlantica (Y) Probability 0.05 $10,000 $11,000 0.15 $12,000 0.2 $13,000 0.25 $14,000 0.2 0.1 $15,000 $16,000 0.05 Question 3-1. Please find VaRa=0.95 (X), VaRa=0.95 (Y), VaRa=0.95 (Z), VaRa=0.95 (W)? Which one has the largest VaR value? Question 3-2. Please find CVaRa-0.95 (X), CVaRa=0.95 (Y), CVaRa=0.95 (Z), CVaRa-0.95 (W)? Which one has the largest VaR value? Hint: If the random variable K follows N(u, o), then CVaRa-0.95 (K) is + x 0.10311 (1-)

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Question 31 VaRX 13000 VaRY 15000 VaRZ 9000 VaRW 16000 The bond issued by Lala Land has the largest VaR value Question 32 Please find CVaRa095 X CVaRa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started