Question

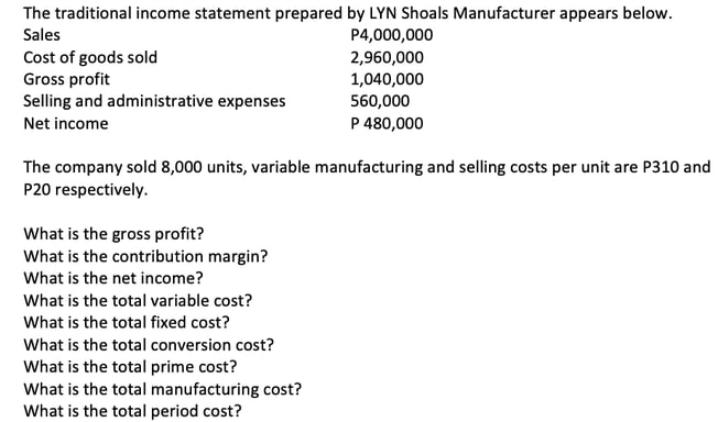

The traditional income statement prepared by LYN Shoals Manufacturer appears below. Sales P4,000,000 2,960,000 1,040,000 560,000 P 480,000 Cost of goods sold Gross profit

The traditional income statement prepared by LYN Shoals Manufacturer appears below. Sales P4,000,000 2,960,000 1,040,000 560,000 P 480,000 Cost of goods sold Gross profit Selling and administrative expenses Net income The company sold 8,000 units, variable manufacturing and selling costs per unit are P310 and P20 respectively. What is the gross profit? What is the contribution margin? What is the net income? What is the total variable cost? What is the total fixed cost? What is the total conversion cost? What is the total prime cost? What is the total manufacturing cost? What is the total period cost?

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Sales 8000 units x P500 per unit P4000000 Variable manufacturing cost per unit P310 Variabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray Garrison, Theresa Libby, Alan Webb

9th canadian edition

1259269477, 978-1259269479, 978-1259024900

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App