Answered step by step

Verified Expert Solution

Question

1 Approved Answer

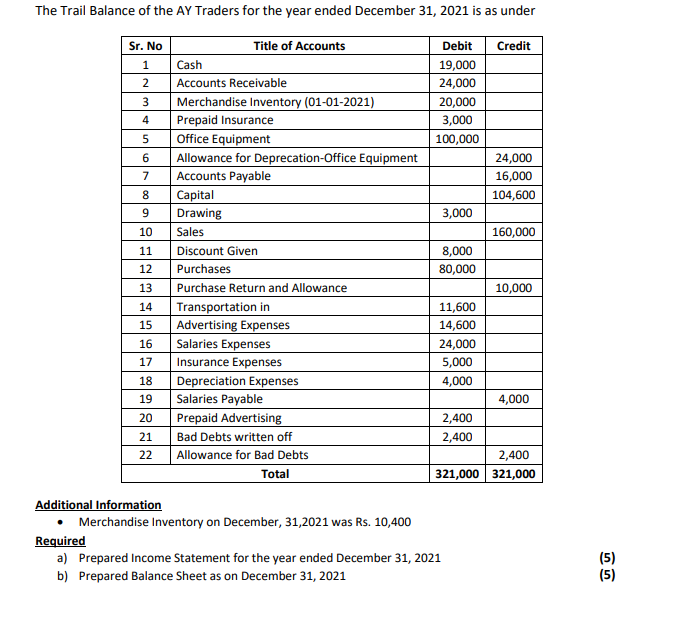

The Trail Balance of the AY Traders for the year ended December 31, 2021 is as under Sr. No Title of Accounts Debit Credit

The Trail Balance of the AY Traders for the year ended December 31, 2021 is as under Sr. No Title of Accounts Debit Credit 1 Cash 19,000 2 Accounts Receivable 24,000 3 Merchandise Inventory (01-01-2021) 20,000 4 Prepaid Insurance 3,000 5 Office Equipment 100,000 6 Allowance for Deprecation-Office Equipment 24,000 7 Accounts Payable 16,000 8 Capital 104,600 9 Drawing 3,000 10 Sales 160,000 11 Discount Given 8,000 12 Purchases 80,000 13 Purchase Return and Allowance 10,000 14 Transportation in 11,600 15 Advertising Expenses 14,600 16 Salaries Expenses 24,000 17 Insurance Expenses 5,000 18 Depreciation Expenses 4,000 19 Salaries Payable 4,000 20 Prepaid Advertising 2,400 21 Bad Debts written off 2,400 22 Allowance for Bad Debts 2,400 Total 321,000 321,000 Additional Information Merchandise Inventory on December, 31,2021 was Rs. 10,400 Required a) Prepared Income Statement for the year ended December 31, 2021 b) Prepared Balance Sheet as on December 31, 2021 55 (5) (5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Income Statement of AY Traders for the year ended December 31 2021 Particulars Amount Rs Particula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started