Question: The transactions below needs to journalize, TB, general ledge, unadjusted and adjusted balance, balance sheet and income statement. PS. the transaction dates might not make

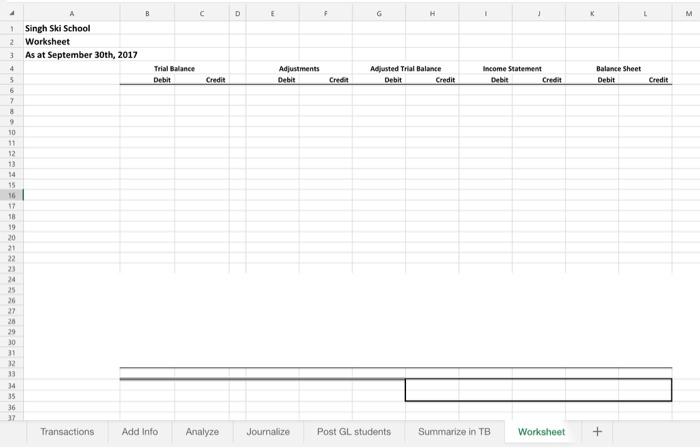

The transactions below needs to journalize, TB, general ledge, unadjusted and adjusted balance, balance sheet and income statement.

PS. the transaction dates might not make sense i know but unfortunately this is how our professor gave us and i have tried to make it better. I really do need help with this assignment as soon as possible. Thank you and i appreciate it!

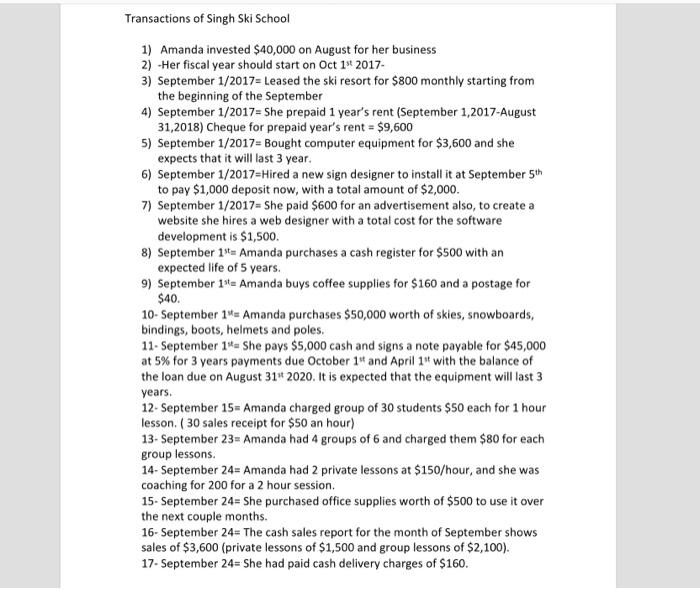

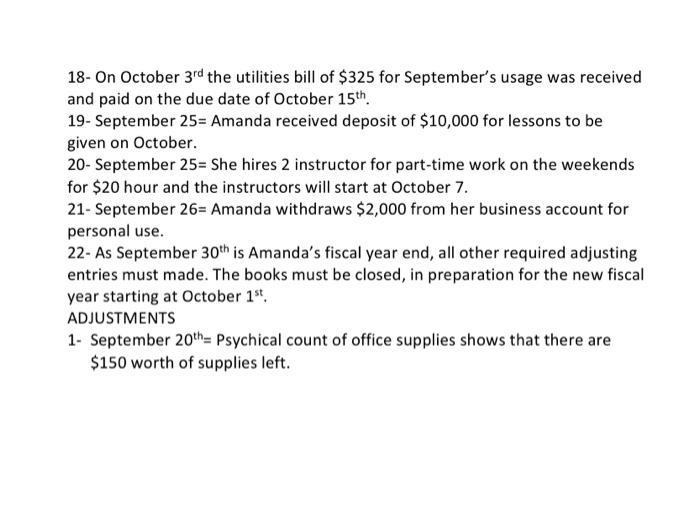

Transactions of Singh Ski School 1) Amanda invested $40,000 on August for her business 2) Her fiscal year should start on Oct 1st 2017- 3) September 1/2017= Leased the ski resort for $800 monthly starting from the beginning of the September 4) September 1/2017= She prepaid 1 year's rent (September 1,2017-August 31,2018) Cheque for prepaid year's rent = $9,600 5) September 1/2017= Bought computer equipment for $3,600 and she expects that it will last 3 year. 6) September 1/2017-Hired a new sign designer to install it at September 5th to pay $1,000 deposit now, with a total amount of $2,000. 7) September 1/2017- She paid $600 for an advertisement also, to create a website she hires a web designer with a total cost for the software development is $1,500. 8) September 1st Amanda purchases a cash register for $500 with an expected life of 5 years. 9) September 1st Amanda buys coffee supplies for $160 and a postage for $40. 10- September 1= Amanda purchases $50,000 worth of skies, snowboards, bindings, boots, helmets and poles. 11- September 1 She pays $5,000 cash and signs a note payable for $45,000 at 5% for 3 years payments due October 1st and April 1" with the balance of the loan due on August 31 2020. It is expected that the equipment will last 3 years. 12- September 15 Amanda charged group of 30 students $50 each for 1 hour lesson. (30 sales receipt for $50 an hour) 13- September 23= Amanda had 4 groups of 6 and charged them $80 for each group lessons. 14- September 24= Amanda had 2 private lessons at $150/hour, and she was coaching for 200 for a 2 hour session. 15- September 24- She purchased office supplies worth of $500 to use it over the next couple months. 16-September 24- The cash sales report for the month of September shows sales of $3,600 (private lessons of $1,500 and group lessons of $2,100). 17- September 24- She had paid cash delivery charges of $160.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts