Answered step by step

Verified Expert Solution

Question

1 Approved Answer

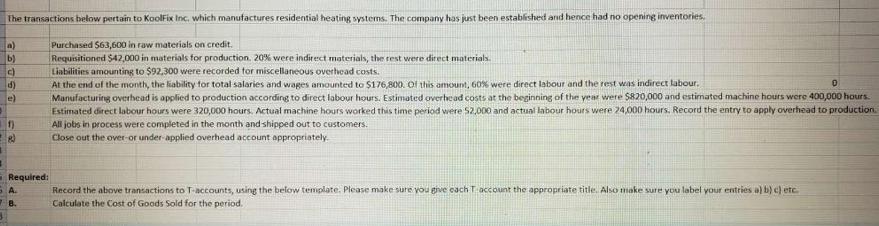

The transactions below pertain to KoolFix Inc. which manufactures residential heating systems. The company has just been established and hence had no opening inventories.

The transactions below pertain to KoolFix Inc. which manufactures residential heating systems. The company has just been established and hence had no opening inventories. Purchased $63,600 in raw materials on credit. Requisitioned $42,000 in materials for production. 20% were indirect materials, the rest were direct materials. Liabilities amounting to $92,300 were recorded for miscellaneous overhead costs. D At the end of the month, the liability for total salaries and wages amounted to $176,800. Of this amount, 60% were direct labour and the rest was indirect labour. Manufacturing overhead is applied to production according to direct labour hours. Estimated overhead costs at the beginning of the year were $820,000 and estimated machine hours were 400,000 hours. Estimated direct labour hours were 320,000 hours. Actual machine hours worked this time period were $2,000 and actual labour hours were 24,000 hours. Record the entry to apply overhead to production. All jobs in process were completed in the month and shipped out to customers. Close out the over-or under-applied overhead account appropriately. 33050 a) b) d) e) 1) (8) Required: 4 w Record the above transactions to T-accounts, using the below template. Please make sure you give each T account the appropriate title. Also make sure you label your entries a) b) c) etc. Calculate the Cost of Goods Sold for the period.

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a Record the transactions 1 Raw Materials Inventory asset 63600 Accounts Payable liability 63600 2 W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started