Answered step by step

Verified Expert Solution

Question

1 Approved Answer

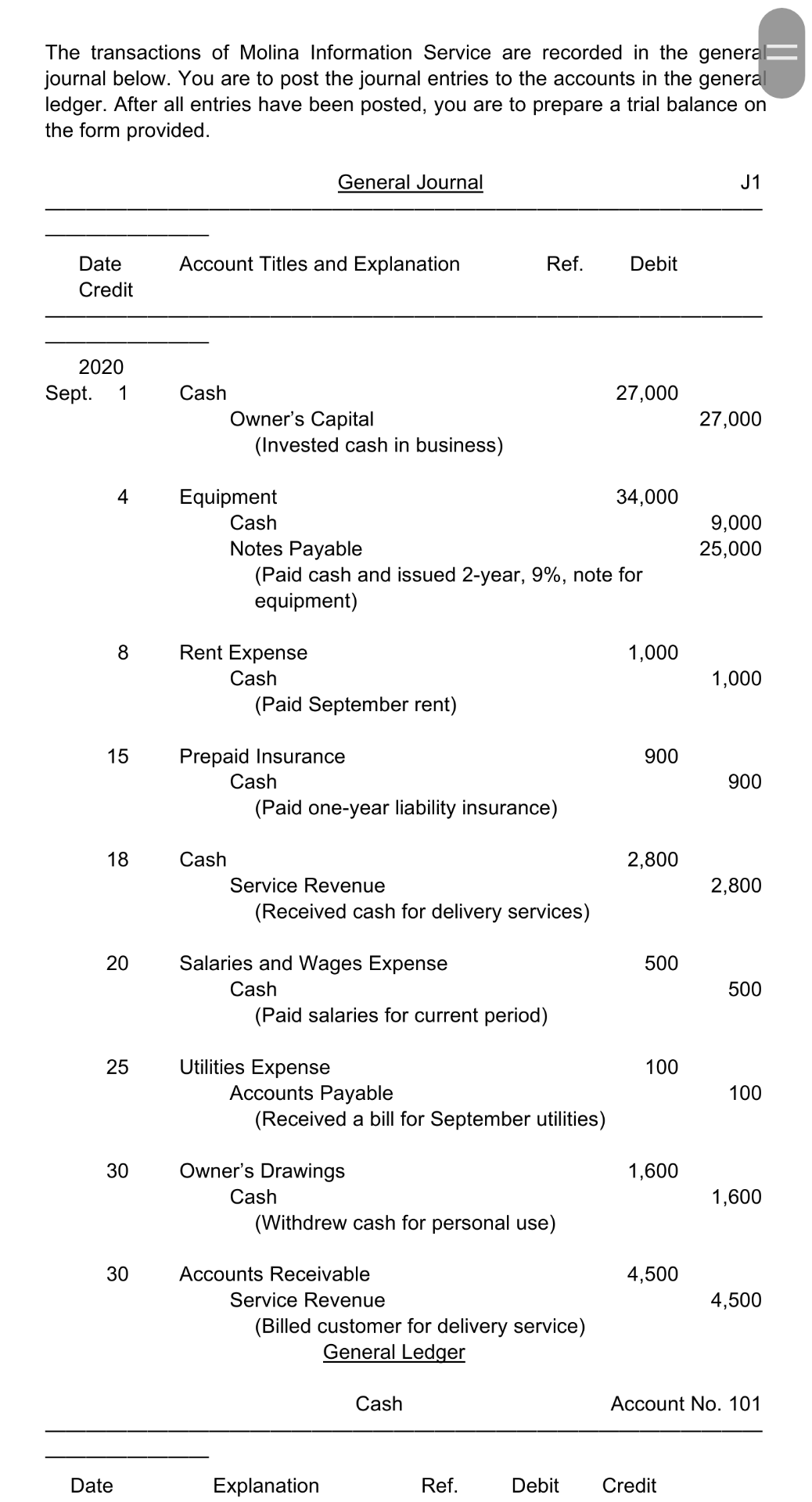

The transactions of Molina Information Service are recorded in the general journal below. You are to post the journal entries to the accounts in the

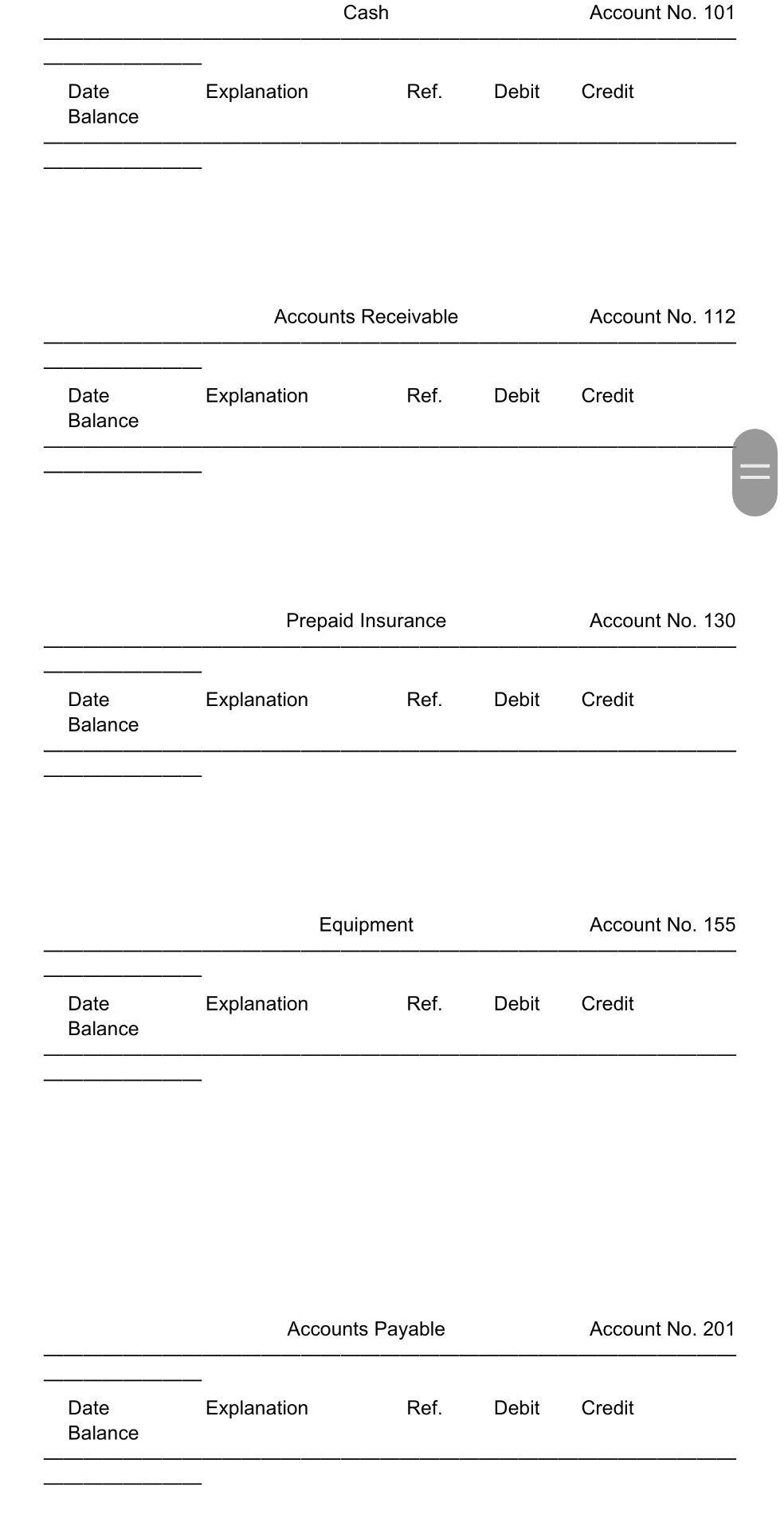

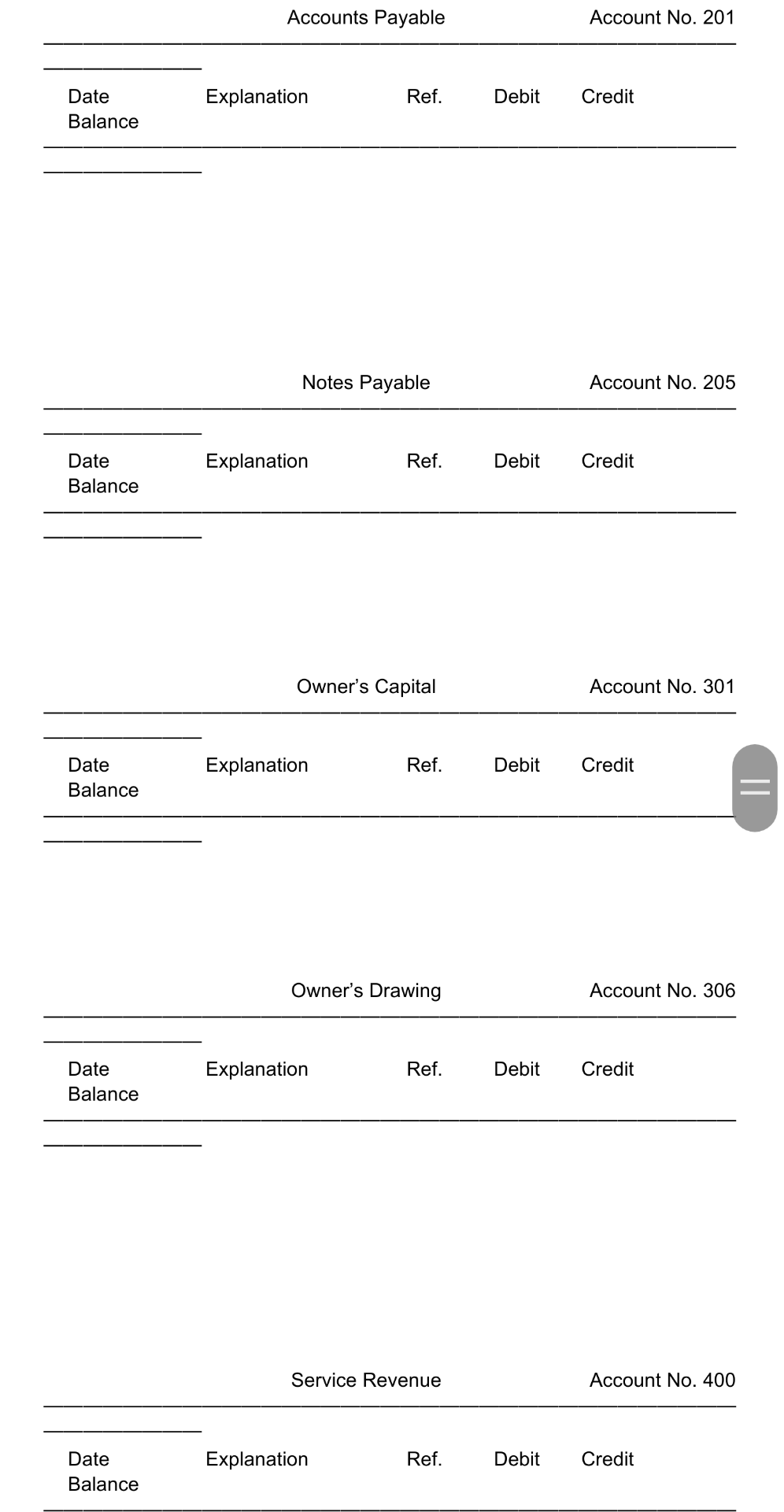

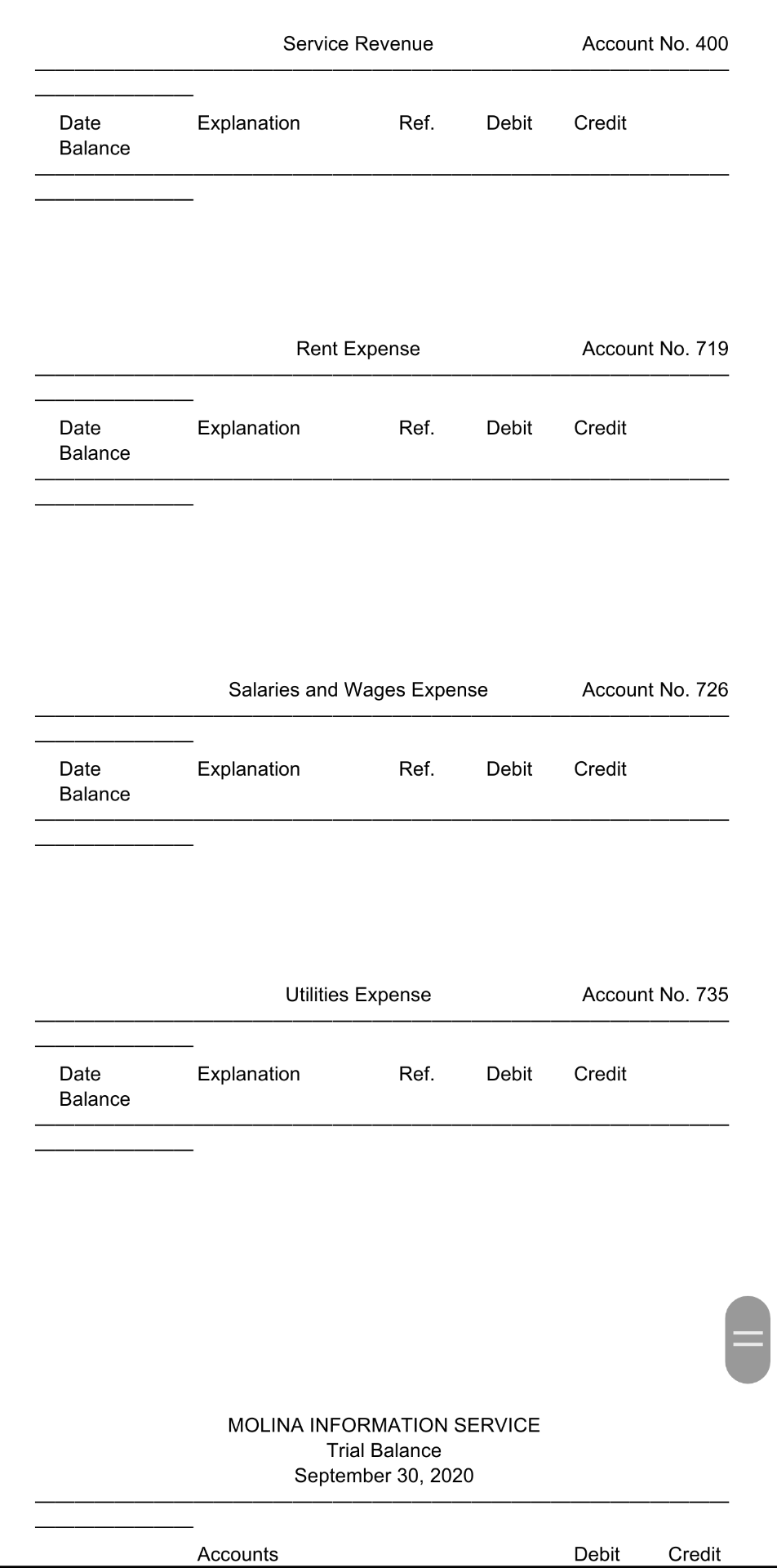

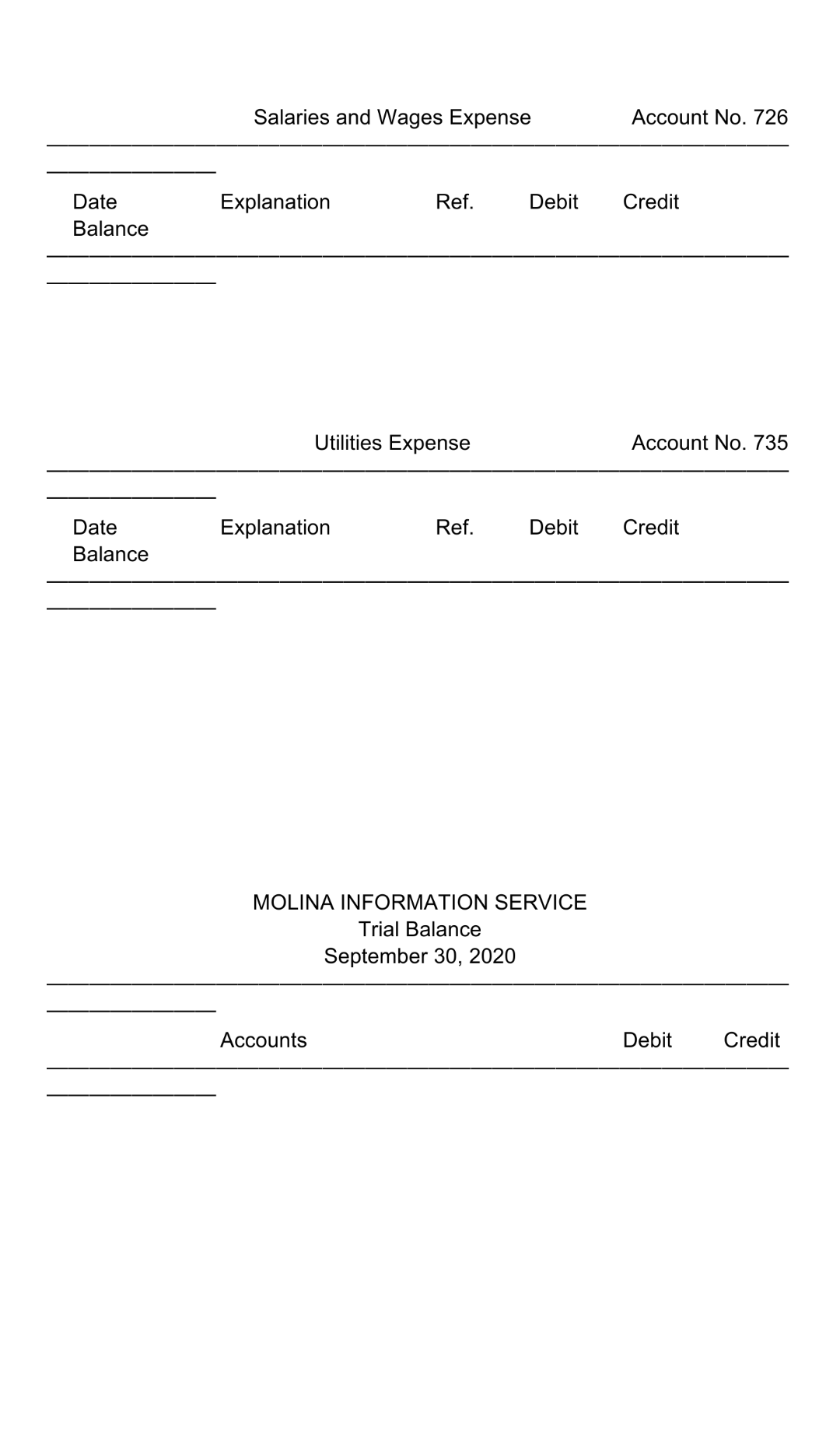

The transactions of Molina Information Service are recorded in the general journal below. You are to post the journal entries to the accounts in the general ledger. After all entries have been posted, you are to prepare a trial balance on the form provided. General Journal J1 Account Titles and Explanation Ref. Debit Date Credit 2020 Sept. 1 27,000 Cash Owner's Capital (Invested cash in business) 27,000 4 Equipment 34,000 Cash Notes Payable (Paid cash and issued 2-year, 9%, note for equipment) 9,000 25,000 8 1,000 Rent Expense Cash (Paid September rent) 1,000 15 900 Prepaid Insurance Cash (Paid one-year liability insurance) 900 18 2,800 Cash Service Revenue (Received cash for delivery services) 2,800 20 500 Salaries and Wages Expense Cash (Paid salaries for current period) 500 25 100 Utilities Expense Accounts Payable (Received a bill for September utilities) 100 30 1,600 Owner's Drawings Cash (Withdrew cash for personal use) 1,600 30 4,500 4,500 Accounts Receivable Service Revenue (Billed customer for delivery service) General Ledger Cash Account No. 101 Date Explanation Ref. Debit Credit Cash Account No. 101 Explanation Ref. Debit Credit Date Balance Accounts Receivable Account No. 112 Explanation Ref. Debit Date Balance Credit = Prepaid Insurance Account No. 130 Explanation Ref. Debit Date Balance Credit Equipment Account No. 155 Explanation Ref. Debit Date Balance Credit Accounts Payable Account No. 201 Explanation Ref. Debit Date Balance Credit Accounts Payable Account No. 201 Explanation Ref. Debit Credit Date Balance Notes Payable Account No. 205 Explanation Ref. Debit Date Balance Credit Owner's Capital Account No. 301 Explanation Ref. Debit Credit Date Balance Owner's Drawing Account No. 306 Explanation Ref. Debit Credit Date Balance Service Revenue Account No. 400 Explanation Ref. Debit Credit Date Balance Service Revenue Account No. 400 Explanation Ref. Debit Date Balance Credit Rent Expense Account No. 719 Explanation Ref. Debit Credit Date Balance Salaries and Wages Expense Account No. 726 Explanation Ref. Debit Date Balance Credit Utilities Expense Account No. 735 Explanation Ref. Debit Date Balance Credit II MOLINA INFORMATION SERVICE Trial Balance September 30, 2020 Accounts Debit Credit Salaries and Wages Expense Account No. 726 Explanation Ref. Debit Date Balance Credit Utilities Expense Account No. 735 Explanation Ref. Debit Credit Date Balance MOLINA INFORMATION SERVICE Trial Balance September 30, 2020 Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started