Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The transfer of shares from Mr Lee to Mr Siva will be liable to tax under the Real Property Gains Tax Act. Explain to Mr

The transfer of shares from Mr Lee to Mr Siva will be liable to tax under the Real Property Gains Tax Act. Explain to Mr Lee the reason that he will be taxed under the Act.

Assuming that Mr Lee is liable to RPGT on the transfer of shares, compute the RPGT and show all workings.

Based on your answer in advise Mr Lee and Mr Siva on their legal obligations pertaining to the transfer of shares.

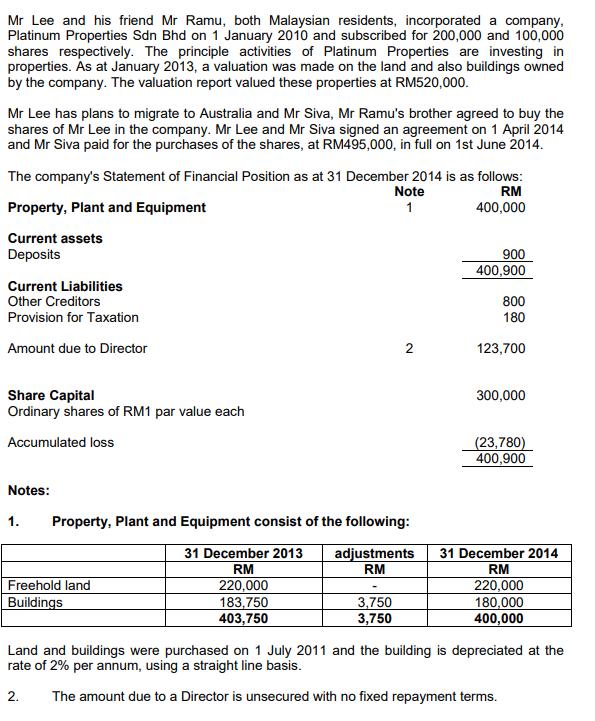

Mr Lee and his friend Mr Ramu, both Malaysian residents, incorporated a company, Platinum Properties Sdn Bhd on 1 January 2010 and subscribed for 200,000 and 100,000 shares respectively. The principle activities of Platinum Properties are investing in properties. As at January 2013, a valuation was made on the land and also buildings owned by the company. The valuation report valued these properties at RM520,000. Mr Lee has plans to migrate to Australia and Mr Siva, Mr Ramu's brother agreed to buy the shares of Mr Lee in the company. Mr Lee and Mr Siva signed an agreement on 1 April 2014 and Mr Siva paid for the purchases of the shares, at RM495,000, in full on 1st June 2014. The company's Statement of Financial Position as at 31 December 2014 is as follows: RM 400,000 Property, Plant and Equipment Current assets Deposits Current Liabilities Other Creditors Provision for Taxation Amount due to Director Share Capital Ordinary shares of RM1 par value each Accumulated loss Notes: 1. Freehold land Buildings Property, Plant and Equipment consist of the following: 31 December 2013 adjustments RM RM 220,000 183,750 403,750 Note 1 3,750 3,750 2 900 400,900 800 180 123,700 300,000 (23,780) 400,900 31 December 2014 RM 220,000 180,000 400,000 Land and buildings were purchased on 1 July 2011 and the building is depreciated at the rate of 2% per annum, using a straight line basis. 2. The amount due to a Director is unsecured with no fixed repayment terms.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Mr Lee will be taxed under the Real Property Gains Tax RPGT Act because the transfer of shares in Platinum Properties Sdn Bhd is considered a disposal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started