Question

The treasurer of a major U.S. firm has $22 million to invest for three months. The interest rate in the United States is .22

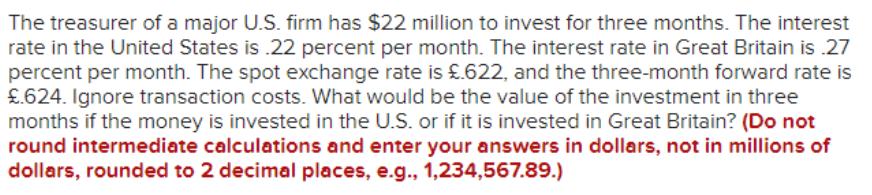

The treasurer of a major U.S. firm has $22 million to invest for three months. The interest rate in the United States is .22 percent per month. The interest rate in Great Britain is .27 percent per month. The spot exchange rate is .622, and the three-month forward rate is .624. Ignore transaction costs. What would be the value of the investment in three months if the money is invested in the U.S. or if it is invested in Great Britain? (Do not round intermediate calculations and enter your answers in dollars, not in millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

US Investment vs UK Investment Scenario 1 US Investment 1 Interest Earned Monthly interest rate 22 p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

9th edition

978-0077459451, 77459458, 978-1259027628, 1259027627, 978-0073382395

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App