Question

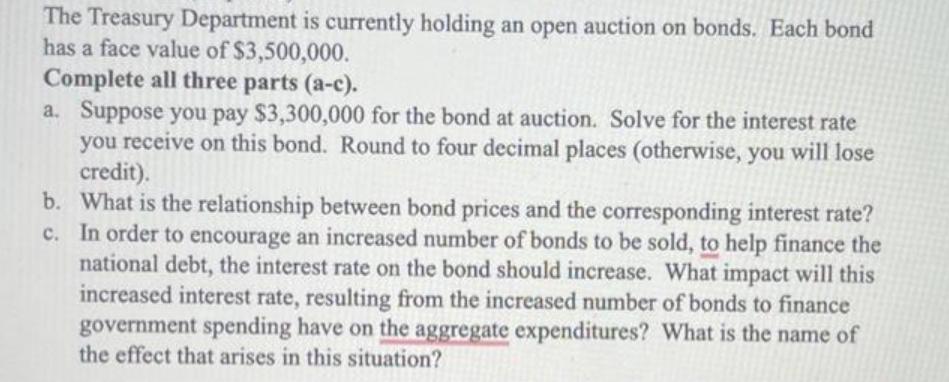

The Treasury Department is currently holding an open auction on bonds. Each bond has a face value of $3,500,000. Complete all three parts (a-c).

The Treasury Department is currently holding an open auction on bonds. Each bond has a face value of $3,500,000. Complete all three parts (a-c). a. Suppose you pay $3,300,000 for the bond at auction. Solve for the interest rate you receive on this bond. Round to four decimal places (otherwise, you will lose credit). b. What is the relationship between bond prices and the corresponding interest rate? c. In order to encourage an increased number of bonds to be sold, to help finance the national debt, the interest rate on the bond should increase. What impact will this increased interest rate, resulting from the increased number of bonds to finance government spending have on the aggregate expenditures? What is the name of the effect that arises in this situation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Intermediation

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot

4th Edition

0124052088, 978-0124052086

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App