Answered step by step

Verified Expert Solution

Question

1 Approved Answer

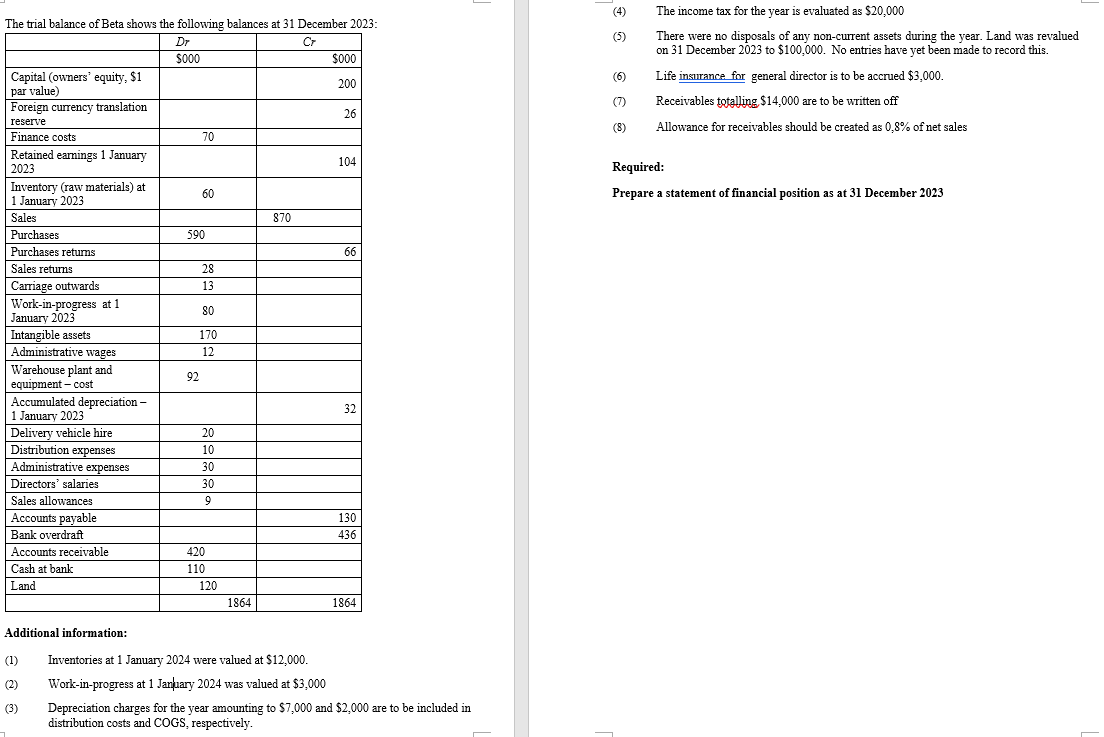

The income tax for the year is evaluated as $20,000 The trial balance of Beta shows the following balances at 31 December 2023: (5)

The income tax for the year is evaluated as $20,000 The trial balance of Beta shows the following balances at 31 December 2023: (5) Dr CT There were no disposals of any non-current assets during the year. Land was revalued on 31 December 2023 to $100,000. No entries have yet been made to record this. $000 $000 Capital (owners' equity, $1 (6) Life insurance for general director is to be accrued $3,000. 200 par value) Foreign currency translation reserve Finance costs Retained earnings 1 January 2023 Inventory (raw materials) at 1 January 2023 (7) Receivables totalling $14,000 are to be written off 26 70 104 Sales Purchases 60 870 590 (8) Allowance for receivables should be created as 0,8% of net sales Required: Prepare a statement of financial position as at 31 December 2023 Purchases returns 66 Sales returns 28 Carriage outwards 13 Work-in-progress at 1 80 January 2023 Intangible assets 170 Administrative wages 12 Warehouse plant and 92 equipment-cost Accumulated depreciation- 32 1 January 2023 Delivery vehicle hire 20 Distribution expenses 10 Administrative expenses 30 Directors' salaries 30 Sales allowances 9 Accounts payable Bank overdraft 130 436 Accounts receivable 420 Cash at bank 110 Land 120 1864 1864 Additional information: (1) (2) (3) Inventories at 1 January 2024 were valued at $12,000. Work-in-progress at 1 January 2024 was valued at $3,000 Depreciation charges for the year amounting to $7,000 and $2,000 are to be included in distribution costs and COGS, respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started