Answered step by step

Verified Expert Solution

Question

1 Approved Answer

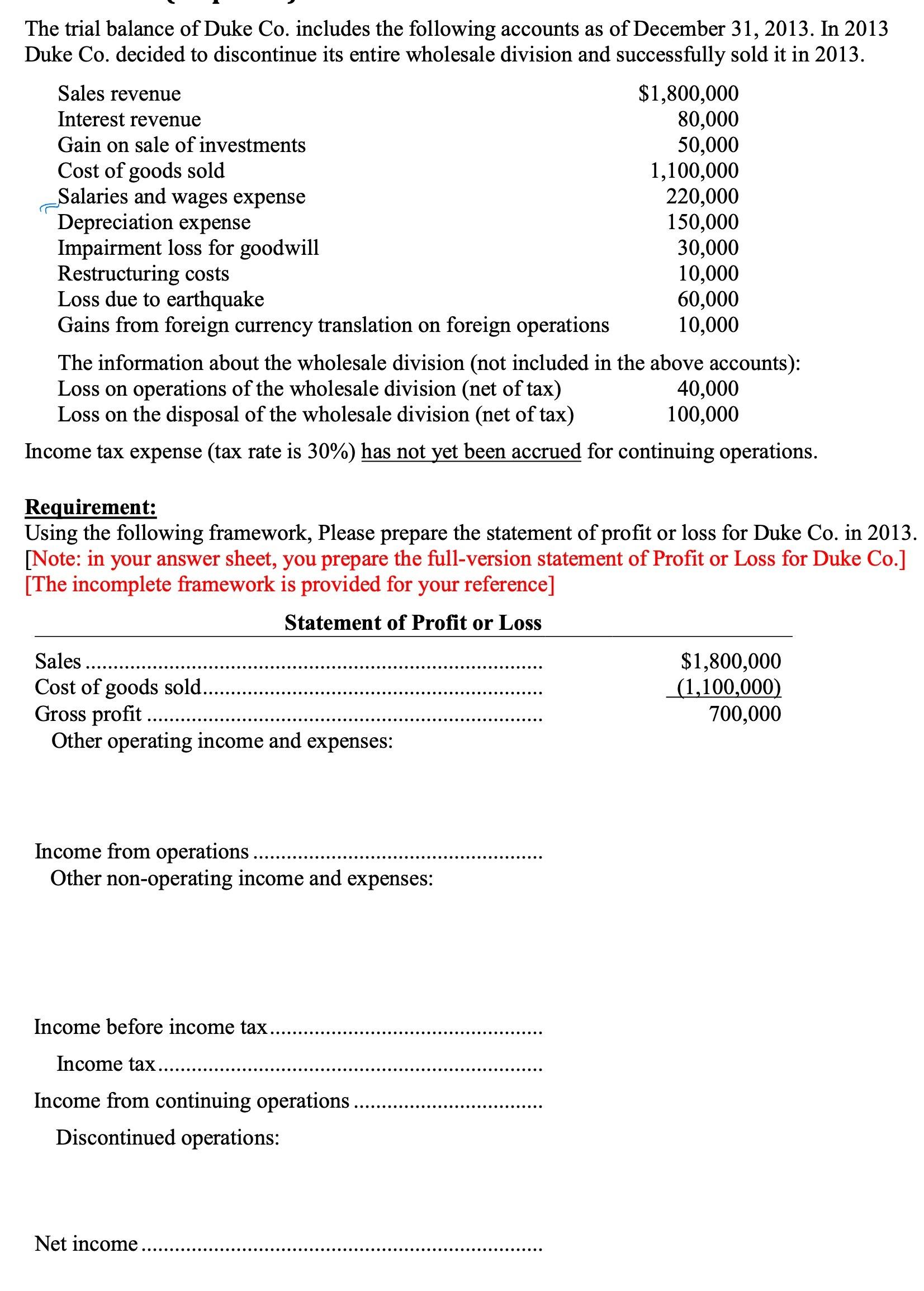

The trial balance of Duke Co. includes the following accounts as of December 31, 2013. In 2013 Duke Co. decided to discontinue its entire

The trial balance of Duke Co. includes the following accounts as of December 31, 2013. In 2013 Duke Co. decided to discontinue its entire wholesale division and successfully sold it in 2013. Sales revenue Interest revenue Gain on sale of investments Cost of goods sold Salaries and wages expense Depreciation expense Impairment loss for goodwill Restructuring costs Loss due to earthquake Gains from foreign currency translation on foreign operations Sales ......... Cost of goods sold. Gross profit Other operating income and expenses: The information about the wholesale division (not included in the above accounts): Loss on operations of the wholesale division (net of tax) Loss on the disposal of the wholesale division (net of tax) Income tax expense (tax rate is 30%) has not yet been accrued for continuing operations. Income from operations Other non-operating income and expenses: $1,800,000 80,000 50,000 Income before income tax. Income tax. Income from continuing operations ... Discontinued operations: 1,100,000 220,000 150,000 Requirement: Using the following framework, Please prepare the statement of profit or loss for Duke Co. in 2013. [Note: in your answer sheet, you prepare the full-version statement of Profit or Loss for Duke Co.] [The incomplete framework is provided for your reference] Statement of Profit or Loss Net income... 30,000 10,000 60,000 10,000 40,000 100,000 $1,800,000 (1,100,000) 700,000

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Profit or Loss Sales revenue 1800000 Cost of goods sold 1100000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started