Question

9) Debra Technologies invests $68,000 to acquire $68,000 face value, 10%, five-year corporate bonds on December 31, 2010. The bonds will mature on December

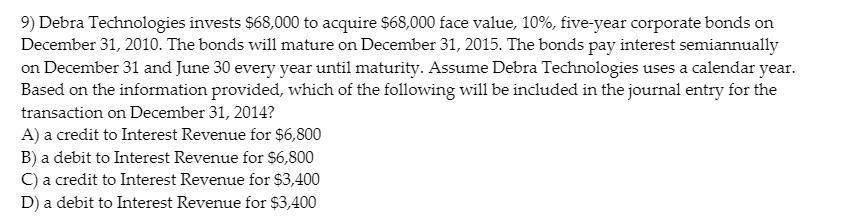

9) Debra Technologies invests $68,000 to acquire $68,000 face value, 10%, five-year corporate bonds on December 31, 2010. The bonds will mature on December 31, 2015. The bonds pay interest semiannually on December 31 and June 30 every year until maturity. Assume Debra Technologies uses a calendar year. Based on the information provided, which of the following will be included in the journal entry for the transaction on December 31, 2014? A) a credit to Interest Revenue for $6,800 B) a debit to Interest Revenue for $6,800 C) a credit to Interest Revenue for $3,400 D) a debit to Interest Revenue for $3,400

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Semi annual interest payment Bond face value x Int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Interpreting and Analyzing Financial Statements

Authors: Karen P. Schoenebeck, Mark P. Holtzman

6th edition

132746247, 978-0132746243

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App