Answered step by step

Verified Expert Solution

Question

1 Approved Answer

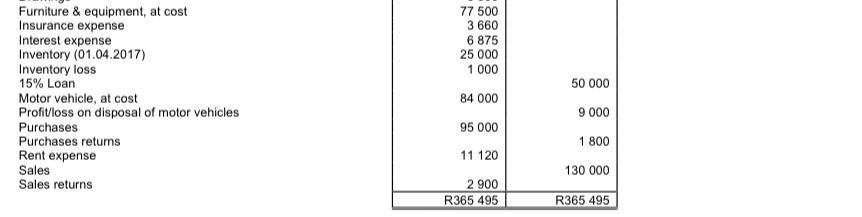

The trial balance of Happy Hunting Traders at 31 March 2018 was as follows: Accounts payable Accounts receivable Accumulated depreciation - Furniture & equipment

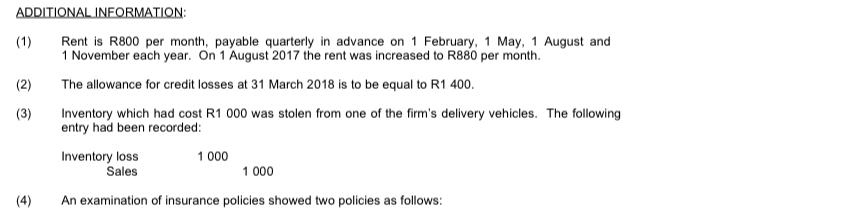

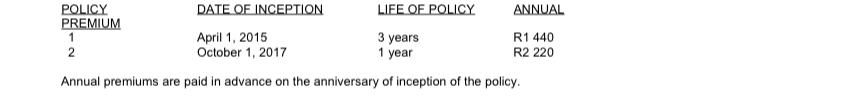

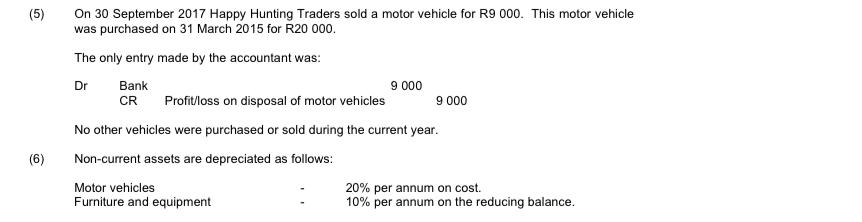

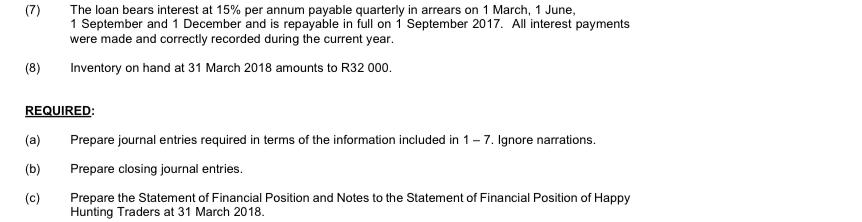

The trial balance of Happy Hunting Traders at 31 March 2018 was as follows: Accounts payable Accounts receivable Accumulated depreciation - Furniture & equipment (01.04.2017) Accumulated depreciation - Motor vehicles (01.04.2017) Administrative expenses Allowance for credit losses (01.04.2017) Bad debts expense Bank Capital (01.04.2017) Carriage inwards Carriage outwards Drawings DR R 14 000 9310 2000 26 530 1 200 400 5 000 CR R 41 500 14 170 30 000 2025 87 000 Furniture & equipment, at cost Insurance expense Interest expense Inventory (01.04.2017) Inventory loss 15% Loan Motor vehicle, at cost Profit/loss on disposal of motor vehicles Purchases Purchases returns Rent expense Sales Sales returns 77 500 3 660 6 875 25 000 1 000 84 000 95 000 11 120 2 900 R365 495 50 000 9 000 1.800 130 000 R365 495 ADDITIONAL INFORMATION: Rent is R800 per month, payable quarterly in advance on 1 February, 1 May, 1 August and 1 November each year. On 1 August 2017 the rent was increased to R880 per month. The allowance for credit losses at 31 March 2018 is to be equal to R1 400. (1) (2) (3) (4) Inventory which had cost R1 000 was stolen from one of the firm's delivery vehicles. The following entry had been recorded: Inventory loss Sales 1 000 An examination of insurance policies showed two policies as follows: 1 000 DATE OF INCEPTION LIFE OF POLICY April 1, 2015 October 1, 2017 3 years 1 year Annual premiums are paid in advance on the anniversary of inception of the policy. POLICY PREMIUM 1 2 ANNUAL R1 440 R2 220 (5) (6) On 30 September 2017 Happy Hunting Traders sold a motor vehicle for R9 000. This motor vehicle was purchased on 31 March 2015 for R20 000. The only entry made by the accountant was: Dr Bank CR 9 000 Profit/loss on disposal of motor vehicles No other vehicles were purchased or sold during the current year. Non-current assets are depreciated as follows: Motor vehicles Furniture and equipment 9 000 20% per annum on cost. 10% per annum on the reducing balance. (7) (8) The loan bears interest at 15% per annum payable quarterly in arrears on 1 March, 1 June, 1 September and 1 December and is repayable in full on 1 September 2017. All interest payments were made and correctly recorded during the current year. Inventory on hand at 31 March 2018 amounts to R32 000. REQUIRED: (a) (b) (c) Prepare journal entries required in terms of the information included in 1-7. Ignore narrations. Prepare closing journal entries. Prepare the Statement of Financial Position and Notes to the Statement of Financial Position of Happy Hunting Traders at 31 March 2018.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started