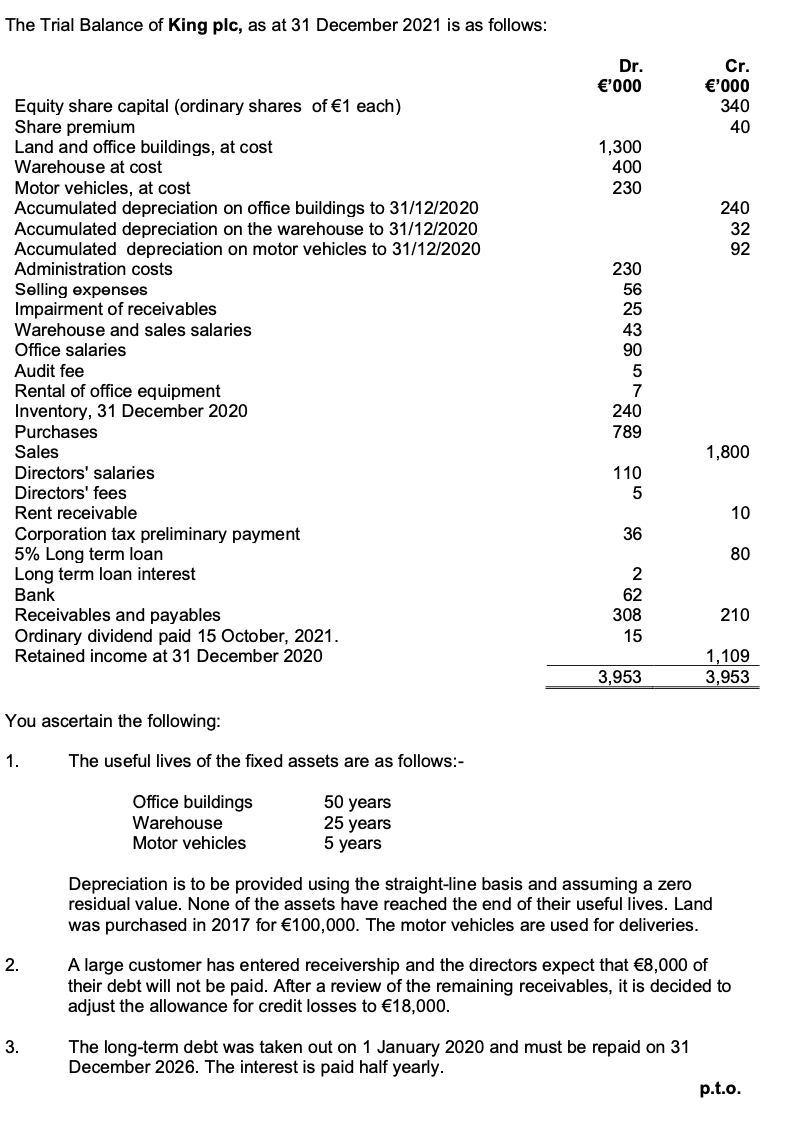

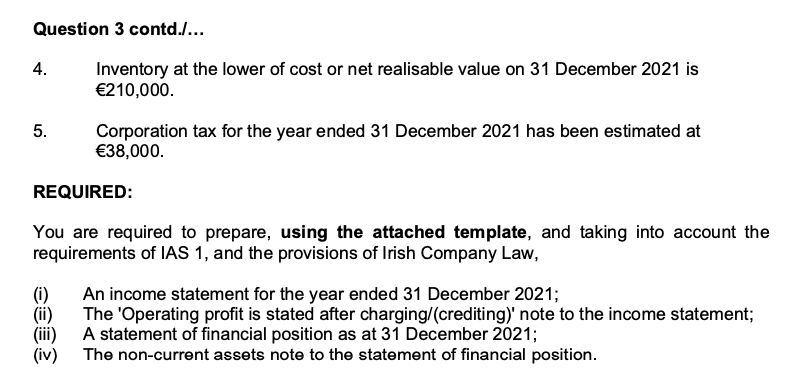

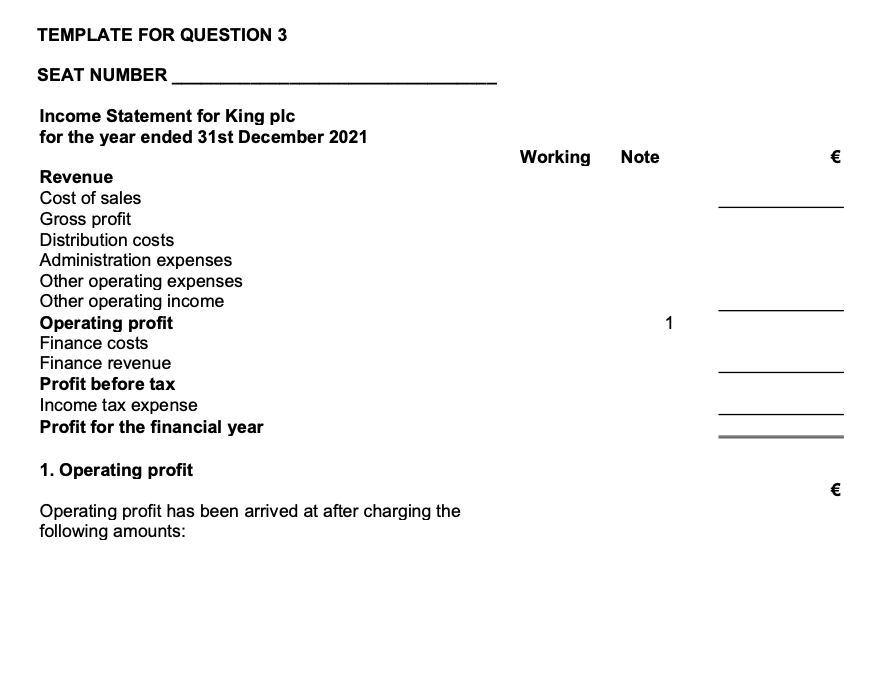

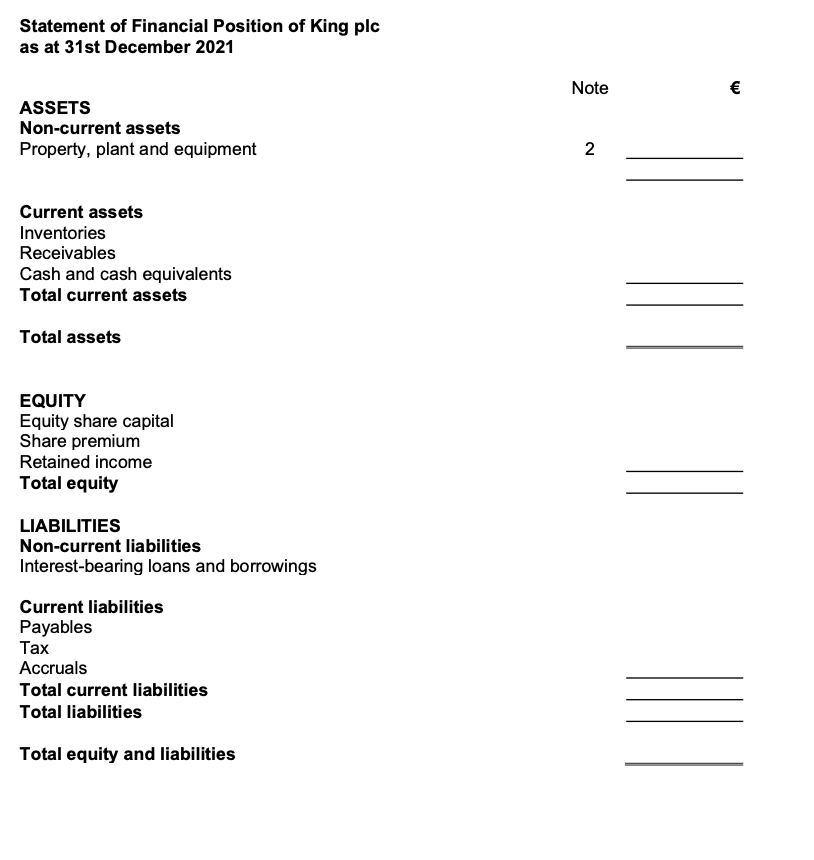

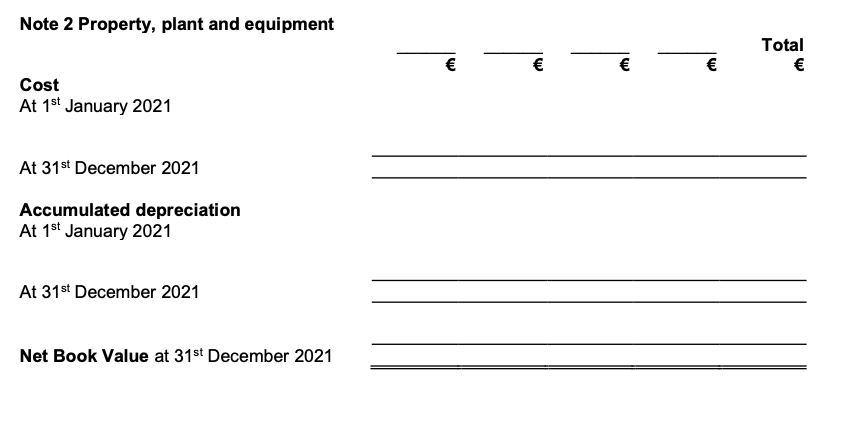

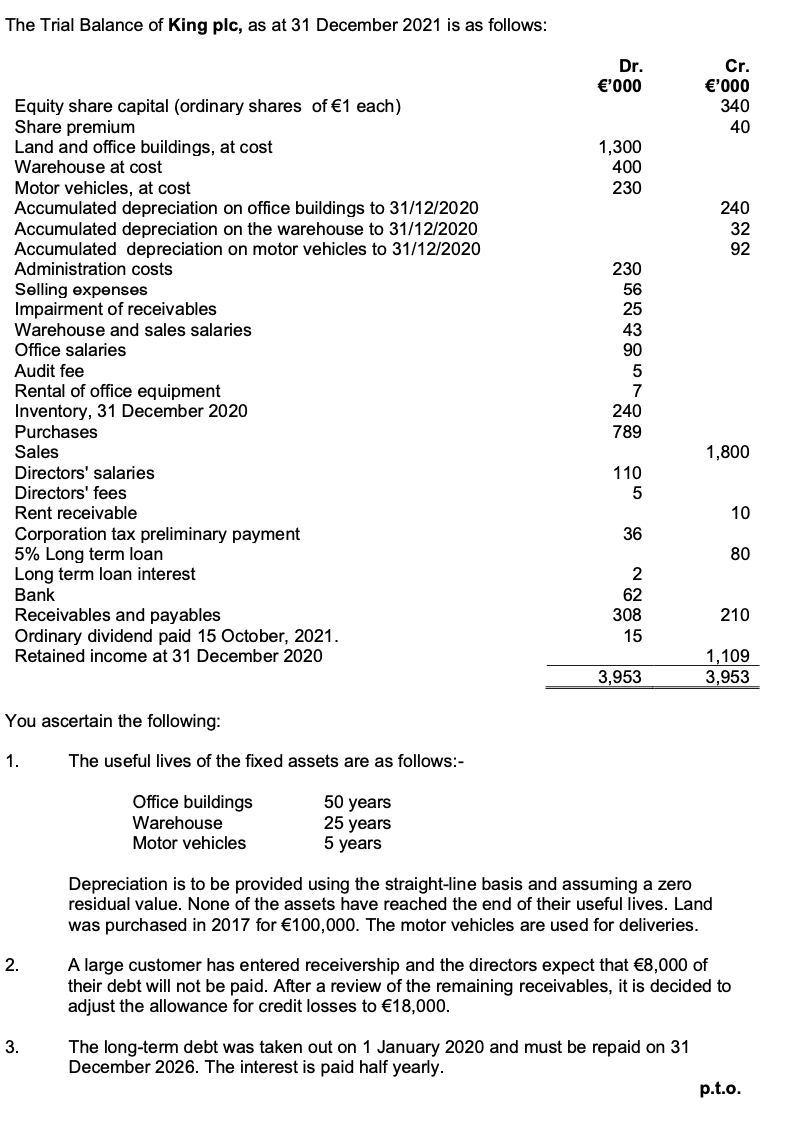

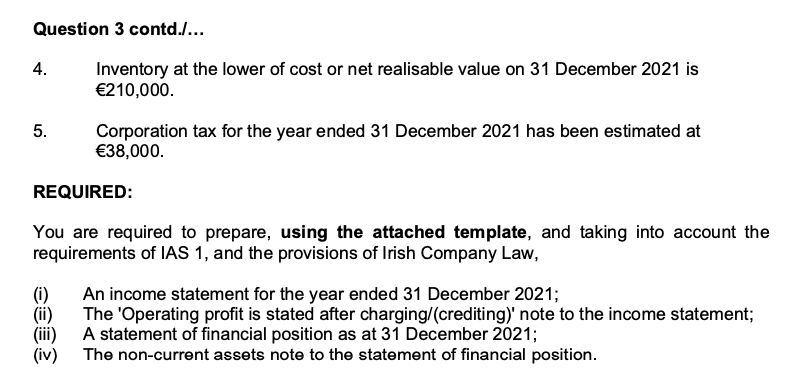

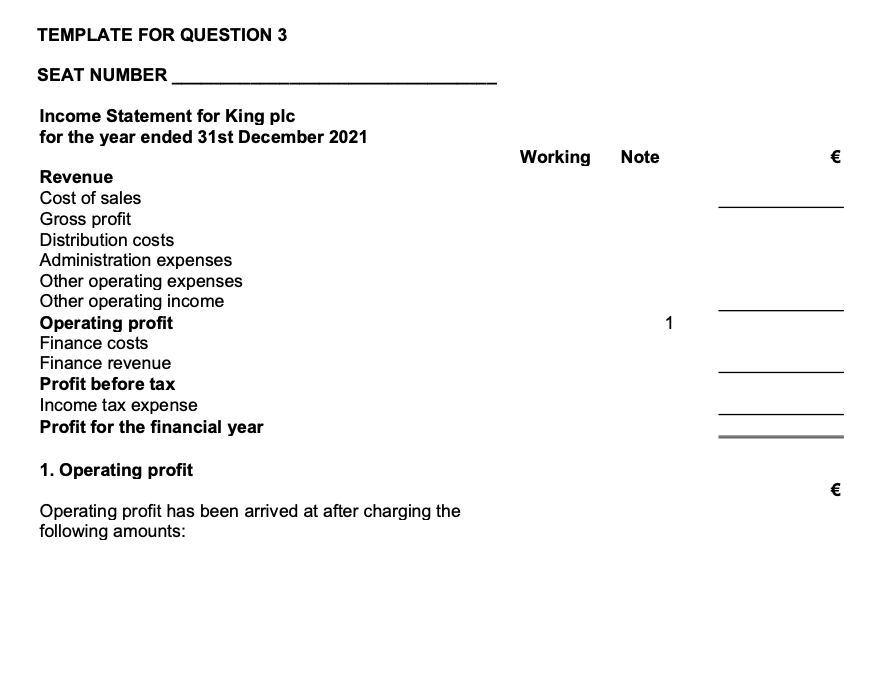

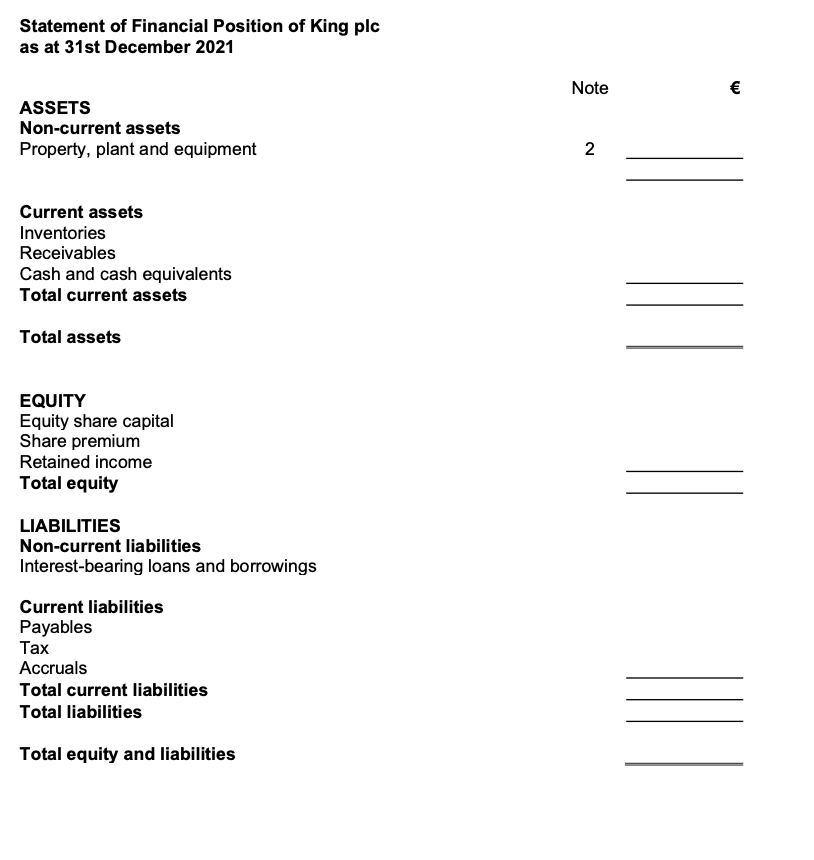

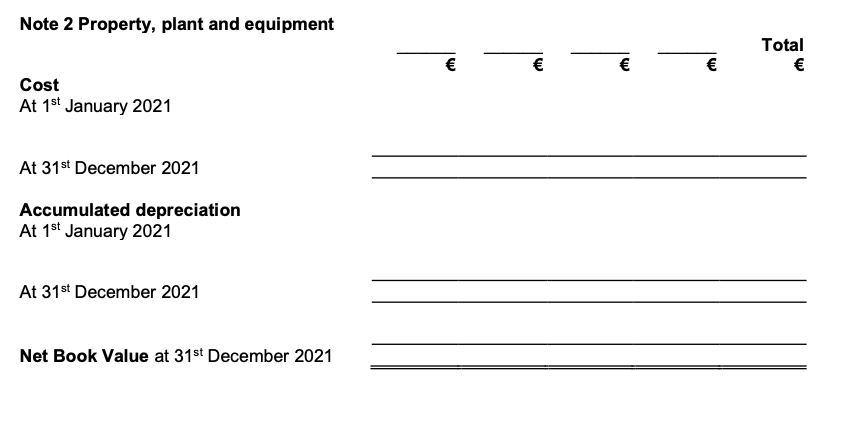

The Trial Balance of King plc, as at 31 December 2021 is as follows: You ascertain the following: 1. The useful lives of the fixed assets are as follows:- Depreciation is to be provided using the straight-line basis and assuming a zero residual value. None of the assets have reached the end of their useful lives. Land was purchased in 2017 for 100,000. The motor vehicles are used for deliveries. 2. A large customer has entered receivership and the directors expect that 8,000 of their debt will not be paid. After a review of the remaining receivables, it is decided to adjust the allowance for credit losses to 18,000. 3. The long-term debt was taken out on 1 January 2020 and must be repaid on 31 December 2026. The interest is paid half yearly. Question 3 contd./... 4. Inventory at the lower of cost or net realisable value on 31 December 2021 is 210,000. 5. Corporation tax for the year ended 31 December 2021 has been estimated at 38,000. REQUIRED: You are required to prepare, using the attached template, and taking into account the requirements of IAS 1, and the provisions of Irish Company Law, (i) An income statement for the year ended 31 December 2021; (ii) The 'Operating profit is stated after charging/(crediting)' note to the income statement; (iii) A statement of financial position as at 31 December 2021 ; (iv) The non-current assets note to the statement of financial position. TEMPLATE FOR QUESTION 3 SEAT NUMBER Income Statement for King plc for the year ended 31st December 2021 Revenue Cost of sales Gross profit Distribution costs Administration expenses Other operating expenses Other operating income Operating profit Finance costs Finance revenue Profit before tax Income tax expense Profit for the financial year 1. Operating profit Operating profit has been arrived at after charging the following amounts: Statement of Financial Position of King plc as at 31st December 2021 Note ASSETS Non-current assets Property, plant and equipment Current assets Inventories Receivables Cash and cash equivalents Total current assets Total assets EQUITY Equity share capital Share premium Retained income Total equity LIABILITIES Non-current liabilities Interest-bearing loans and borrowings Current liabilities Payables Tax Accruals Total current liabilities Total liabilities Total equity and liabilities Note 2 Property, plant and equipment Total Cost At 1st January 2021 At 31 1st December 2021 Accumulated depreciation At 1st January 2021 At 31st December 2021 Net Book Value at 31st December 2021