Answered step by step

Verified Expert Solution

Question

1 Approved Answer

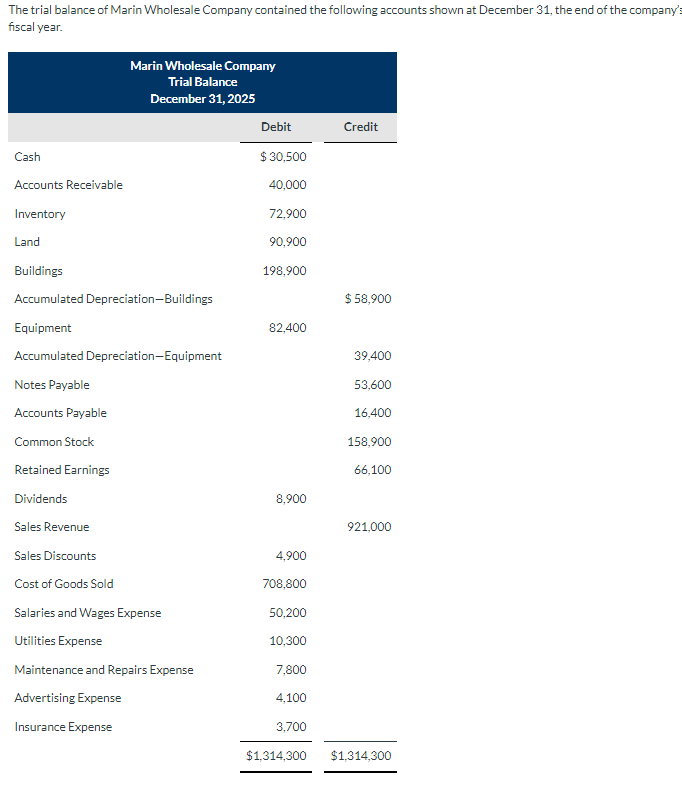

The trial balance of Marin Wholesale Company contained the following accounts shown at December 31, the end of the company's fiscal year. Marin Wholesale

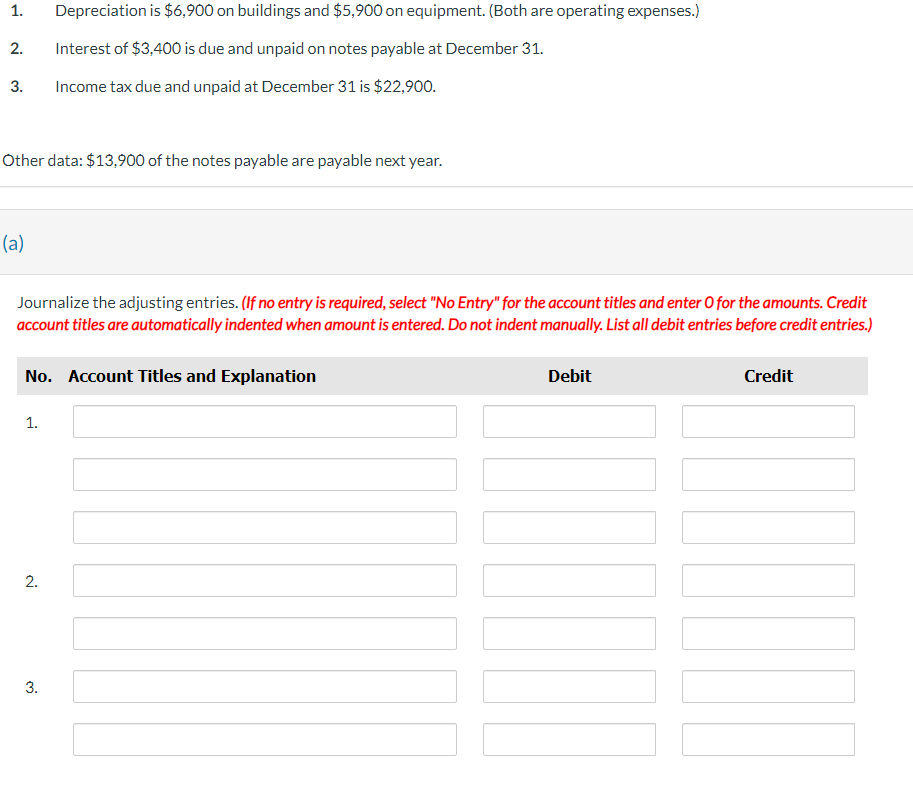

The trial balance of Marin Wholesale Company contained the following accounts shown at December 31, the end of the company's fiscal year. Marin Wholesale Company Trial Balance December 31, 2025 Debit Credit Cash $30,500 Accounts Receivable 40,000 Inventory 72,900 Land 90,900 Buildings 198,900 Accumulated Depreciation-Buildings $ 58,900 Equipment 82,400 Accumulated Depreciation-Equipment 39,400 Notes Payable 53,600 Accounts Payable 16,400 Common Stock 158,900 Retained Earnings 66,100 Dividends 8,900 Sales Revenue 921,000 Sales Discounts 4,900 Cost of Goods Sold 708,800 Salaries and Wages Expense 50,200 Utilities Expense 10,300 Maintenance and Repairs Expense 7,800 Advertising Expense 4,100 Insurance Expense 3.700 $1,314,300 $1,314,300 1. Depreciation is $6,900 on buildings and $5,900 on equipment. (Both are operating expenses.) 2. Interest of $3,400 is due and unpaid on notes payable at December 31. 3. Income tax due and unpaid at December 31 is $22,900. Other data: $13,900 of the notes payable are payable next year. (a) Journalize the adjusting entries. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) No. Account Titles and Explanation 1. Debit Credit 2. 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the adjusting journal entries with calculations 1 Depreciation ExpenseBuildings Buildings b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started