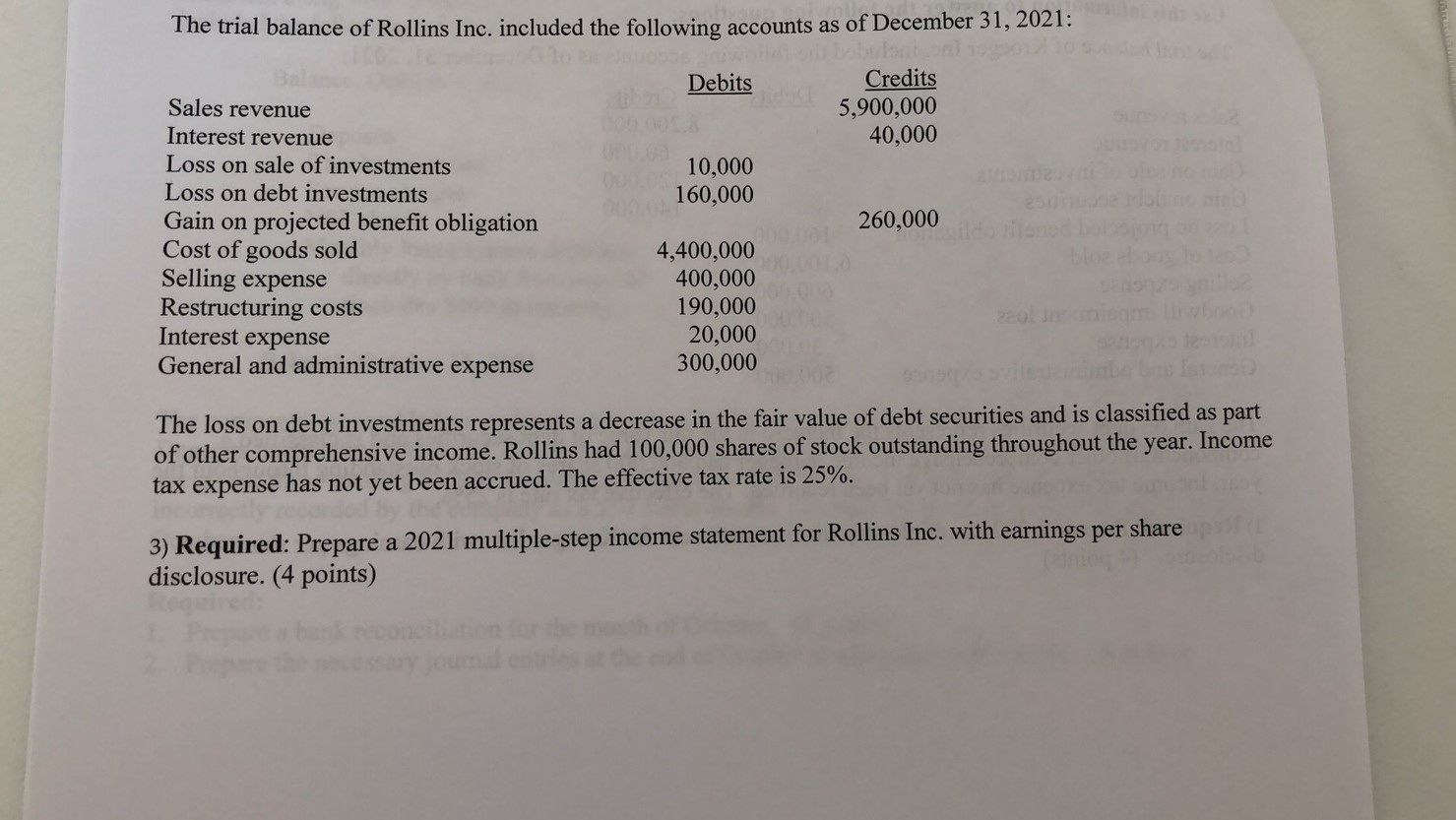

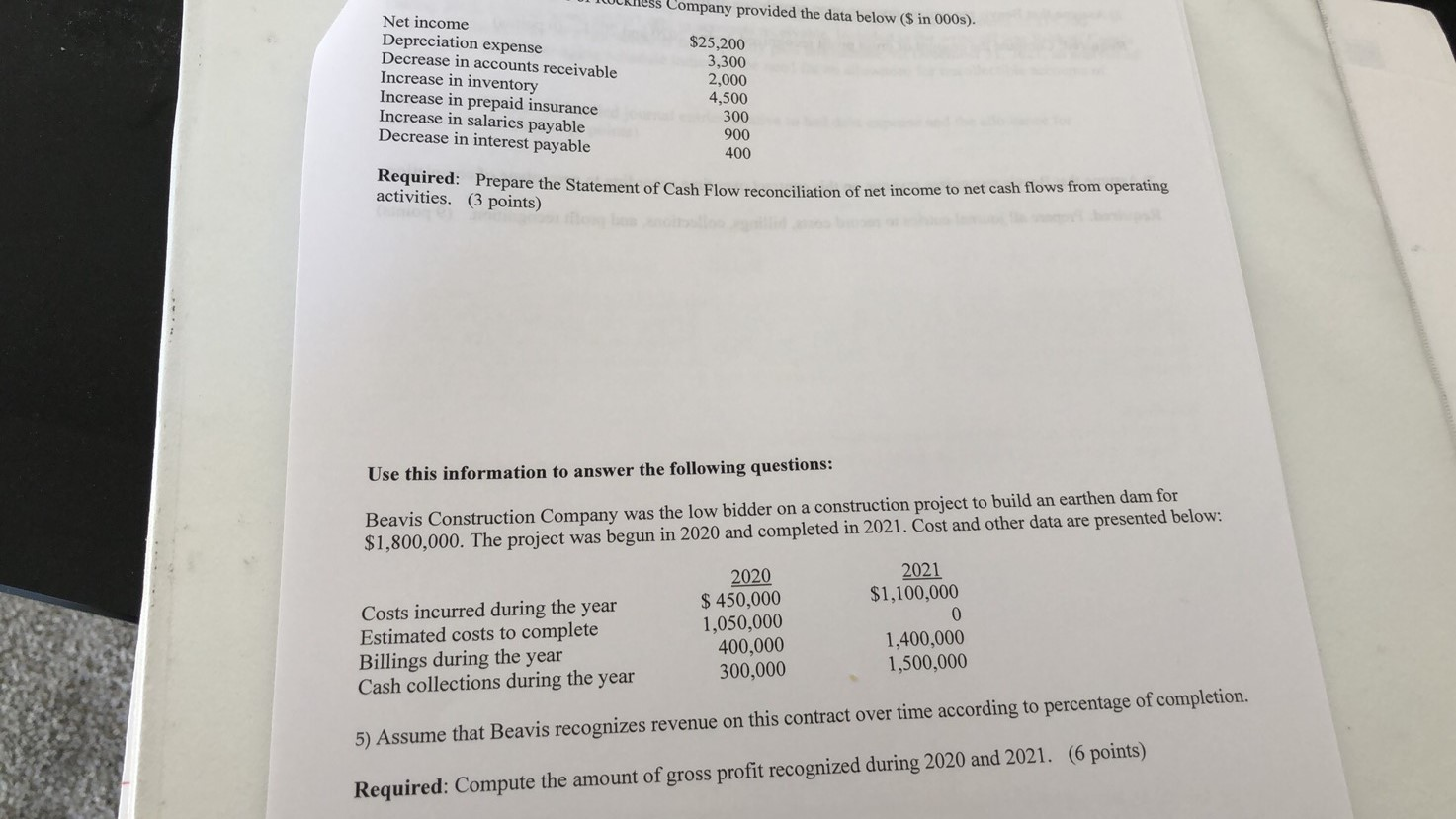

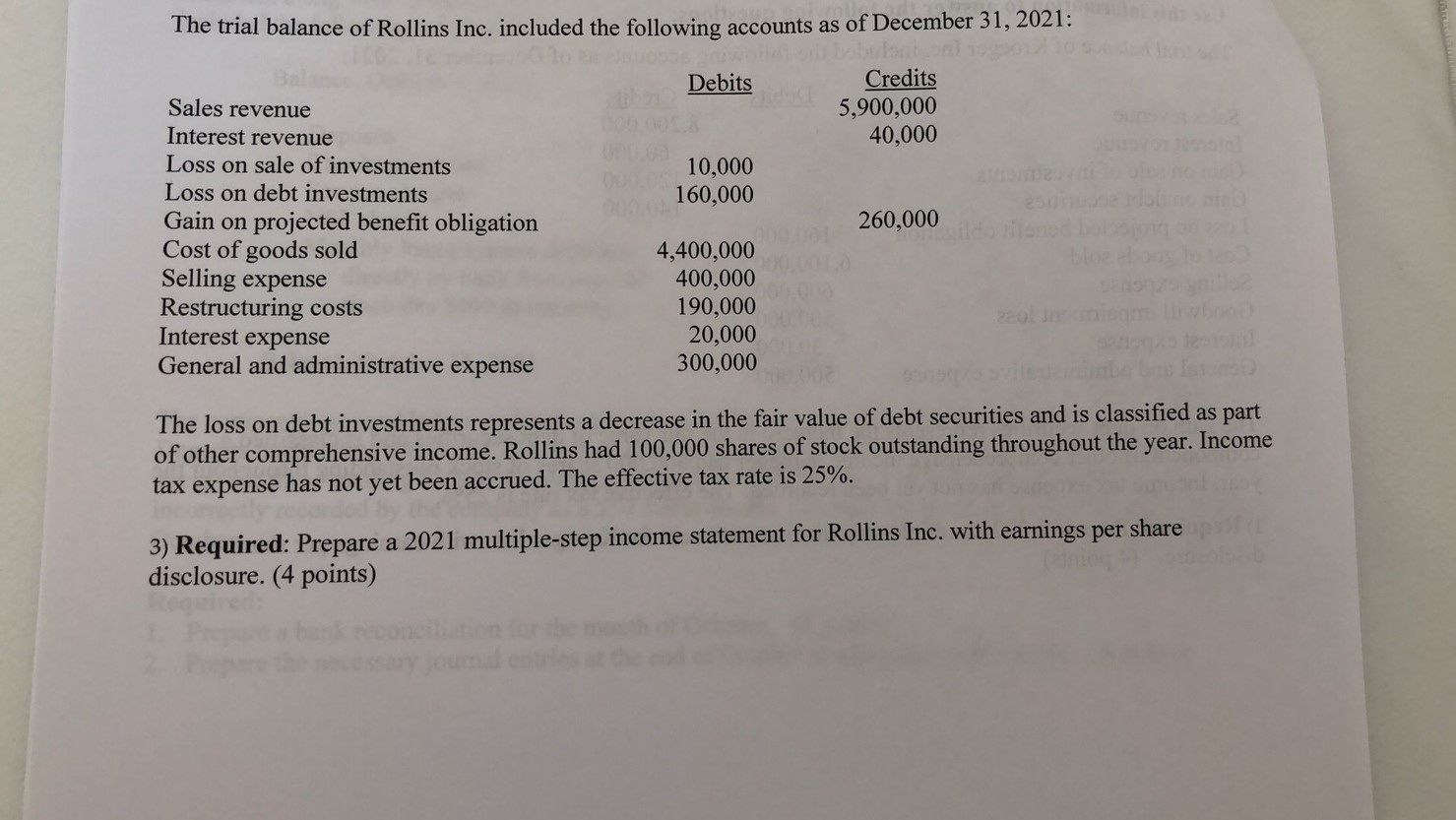

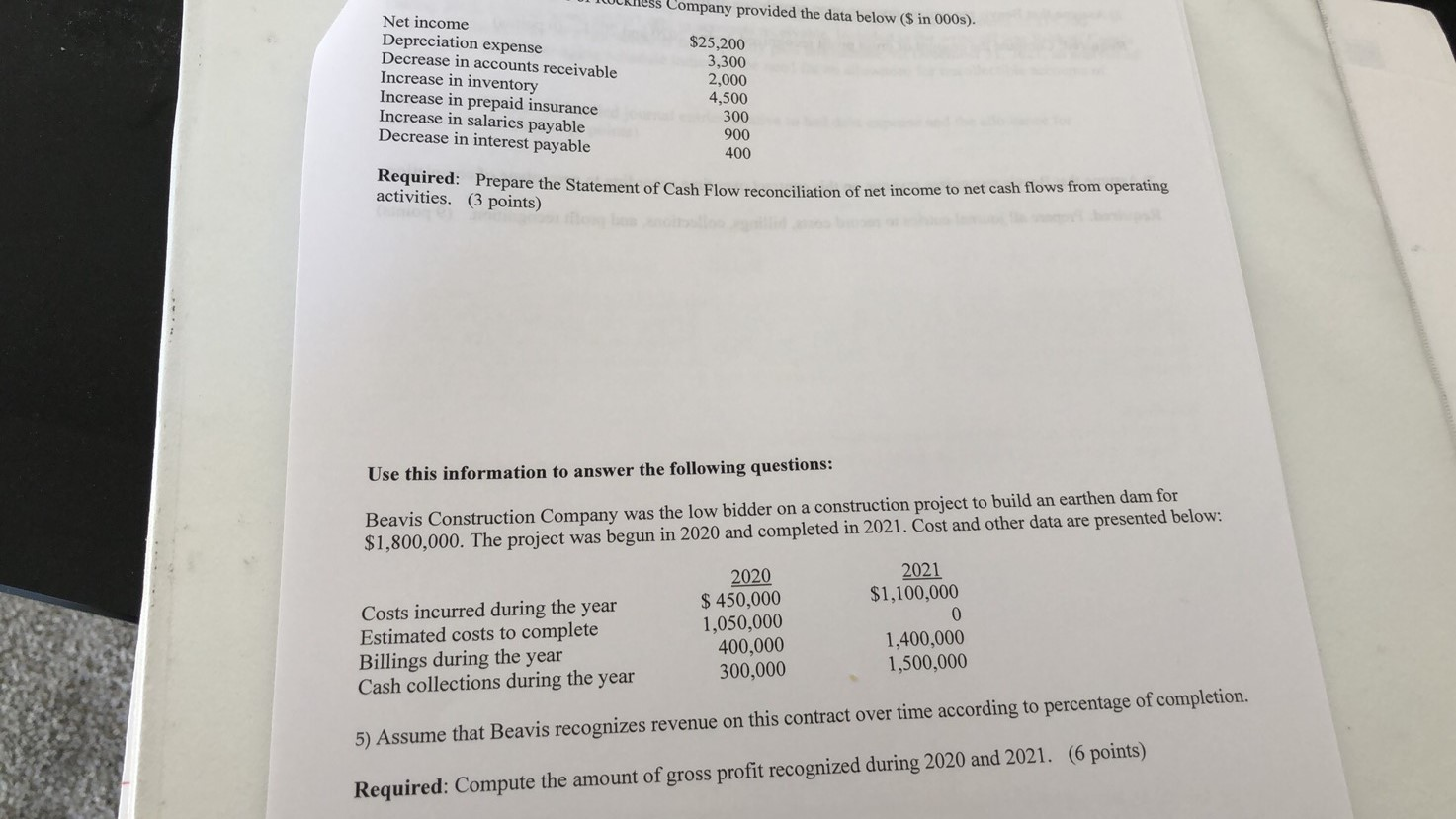

The trial balance of Rollins Inc. included the following accounts as of December 31, 2021: Debits Credits 5,900,000 40,000 10,000 160,000 Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense 260,000 4,400,000 400,000 190,000 20,000 300,000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. 3) Required: Prepare a 2021 multiple-step income statement for Rollins Inc. with earnings per share disclosure. (4 points) 10 I ness Company provided the data below ($ in 0005). Net income Depreciation expense $25,200 Decrease in accounts receivable 3,300 Increase in inventory 2,000 4,500 Increase in prepaid insurance 300 Increase in salaries payable 900 Decrease in interest payable 400 Required: Prepare the Statement of Cash Flow reconciliation activities. (3 points) Statement of Cash Flow reconciliation of net income to net cash flows from operating Use this information to answer the following questions: Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. The project was begun in 2020 and completed in 2021. Cost and other data are presented below: 2021 $1,100,000 Costs incurred during the year Estimated costs to complete Billings during the year Cash collections during the year 2020 $ 450,000 1,050,000 400,000 300,000 1,400,000 1,500,000 5) Assume that Beavis recognizes revenue on this contract over time according to percentage of completion. Required: Compute the amount of gross profit recognized during 2020 and 2021. (6 points) The trial balance of Rollins Inc. included the following accounts as of December 31, 2021: Debits Credits 5,900,000 40,000 10,000 160,000 Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense 260,000 4,400,000 400,000 190,000 20,000 300,000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. 3) Required: Prepare a 2021 multiple-step income statement for Rollins Inc. with earnings per share disclosure. (4 points) 10 I ness Company provided the data below ($ in 0005). Net income Depreciation expense $25,200 Decrease in accounts receivable 3,300 Increase in inventory 2,000 4,500 Increase in prepaid insurance 300 Increase in salaries payable 900 Decrease in interest payable 400 Required: Prepare the Statement of Cash Flow reconciliation activities. (3 points) Statement of Cash Flow reconciliation of net income to net cash flows from operating Use this information to answer the following questions: Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. The project was begun in 2020 and completed in 2021. Cost and other data are presented below: 2021 $1,100,000 Costs incurred during the year Estimated costs to complete Billings during the year Cash collections during the year 2020 $ 450,000 1,050,000 400,000 300,000 1,400,000 1,500,000 5) Assume that Beavis recognizes revenue on this contract over time according to percentage of completion. Required: Compute the amount of gross profit recognized during 2020 and 2021. (6 points)