Answered step by step

Verified Expert Solution

Question

1 Approved Answer

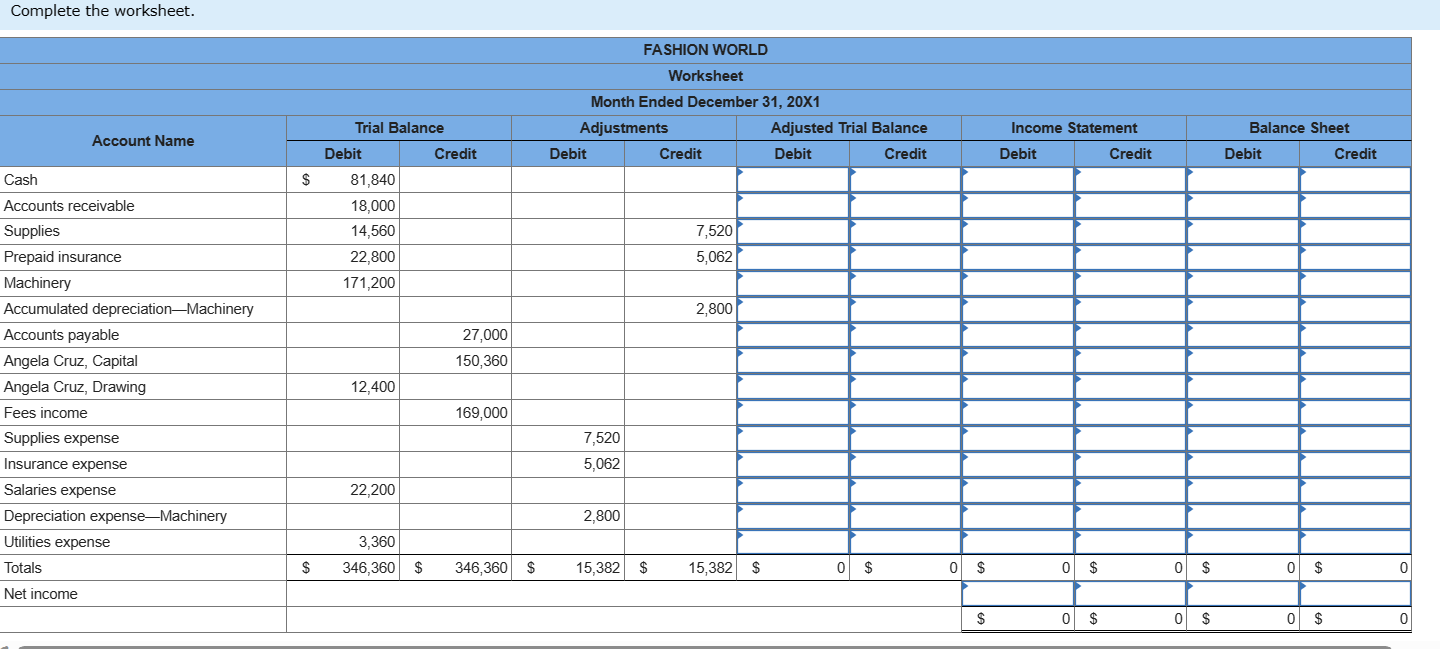

The Trial Balance section of the worksheet for Fashion World for the period ended December 31, 20X1, appears below. Adjustments data are also given. ADJUSTMENTS

The Trial Balance section of the worksheet for Fashion World for the period ended December 31, 20X1, appears below. Adjustments data are also given.

ADJUSTMENTS

- Supplies used, $7,520

- Expired insurance, $5,062

- Depreciation expense for machinery, $2,800

Required:

- Complete the worksheet.

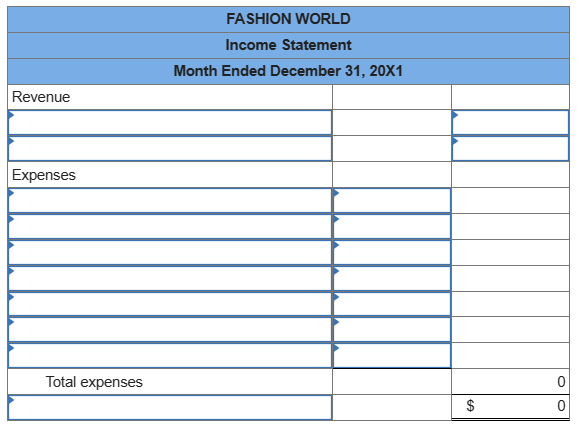

- Prepare an income statement.

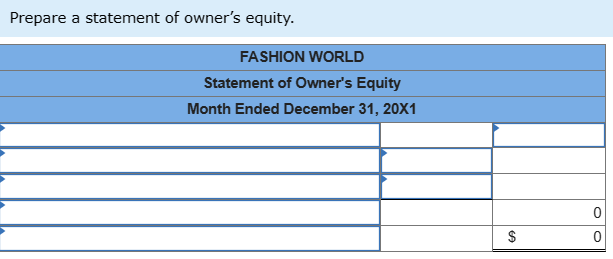

- Prepare a statement of owners equity.

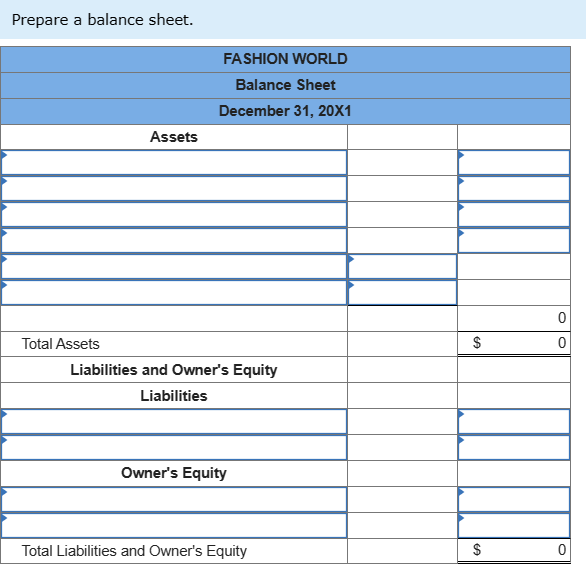

- Prepare a balance sheet.

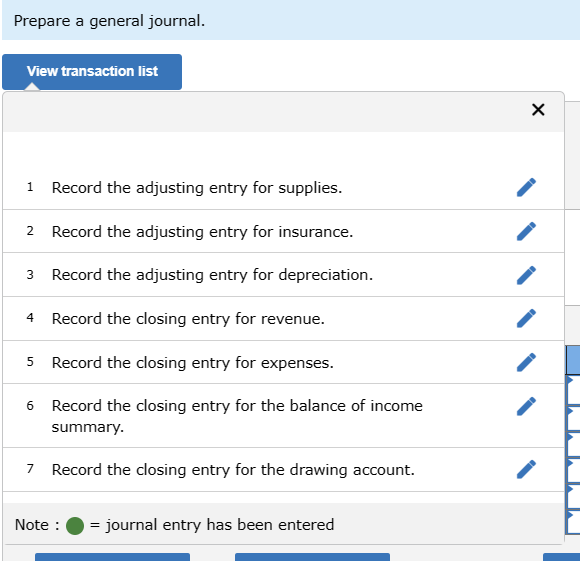

- Journalize the adjusting entries in the general journal.

- Journalize the closing entries in the general journal.

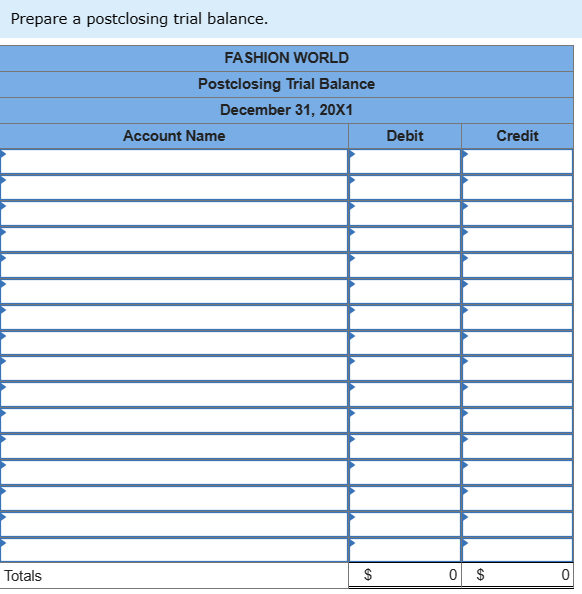

- Prepare a postclosing trial balance.

Analyze:

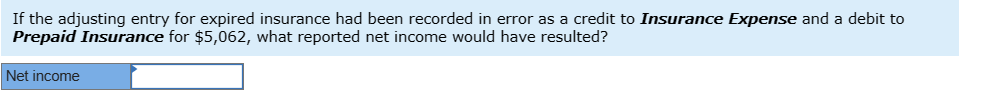

If the adjusting entry for expired insurance had been recorded in error as a credit to Insurance Expense and a debit to Prepaid Insurance for $5,062, what reported net income would have resulted?

Complete the worksheet. FASHION WORLD Worksheet Month Ended December 31, 20X1 Prepare a statement of owner's equity. Prepare a balance sheet. Prepare a general journal. 1 Record the adjusting entry for supplies. 2 Record the adjusting entry for insurance. 3 Record the adjusting entry for depreciation. 4 Record the closing entry for revenue. 5 Record the closing entry for expenses. 6 Record the closing entry for the balance of income summary. 7 Record the closing entry for the drawing account. Note : = journal entry has been entered m . - 1 If the adjusting entry for expired insurance had been recorded in error as a credit to Insurance Expense and a debit to Prepaid Insurance for $5,062, what reported net income would have resulted

Complete the worksheet. FASHION WORLD Worksheet Month Ended December 31, 20X1 Prepare a statement of owner's equity. Prepare a balance sheet. Prepare a general journal. 1 Record the adjusting entry for supplies. 2 Record the adjusting entry for insurance. 3 Record the adjusting entry for depreciation. 4 Record the closing entry for revenue. 5 Record the closing entry for expenses. 6 Record the closing entry for the balance of income summary. 7 Record the closing entry for the drawing account. Note : = journal entry has been entered m . - 1 If the adjusting entry for expired insurance had been recorded in error as a credit to Insurance Expense and a debit to Prepaid Insurance for $5,062, what reported net income would have resulted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started