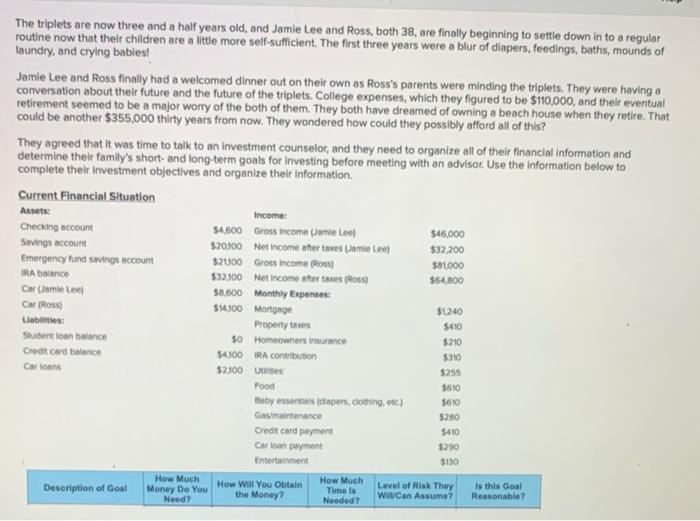

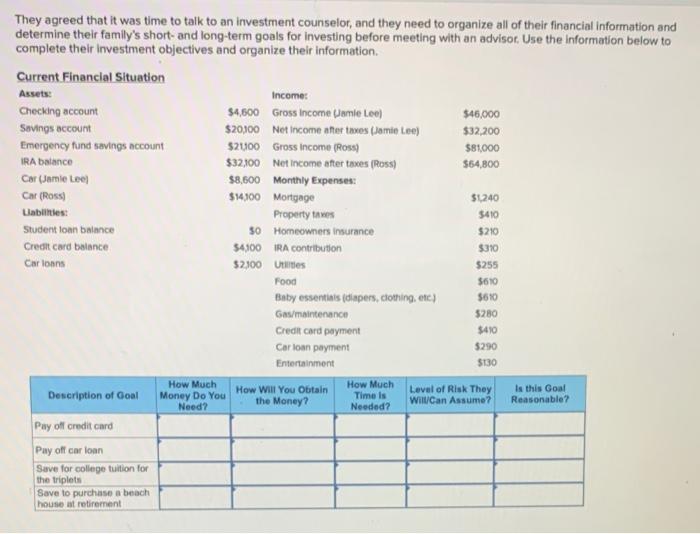

The triplets are now three and a half years old, and Jamie Lee and Ross, both 38, are finally beginning to settle down in to a regular routine now that their children are a little more self-sufficient. The first three years were a blur of diapers, feedings, baths, mounds of laundry, and crying babies! Jamie Lee and Ross finally had a welcomed dinner out on their own as Ross's parents were minding the triplets. They were having a conversation about their future and the future of the triplets. College expenses, which they figured to be $110,000, and their eventual retirement seemed to be a major worry of the both of them. They both have dreamed of owning a beach house when they retire. That could be another $355,000 thirty years from now. They wondered how could they possibly afford all of this? They agreed that it was time to talk to an investment counselor, and they need to organize all of their financial information and determine their family's short- and long-term goals for investing before meeting with an advisor. Use the information below to complete their investment objectives and organize their information. Current Financial Situation Assets Income Checking account 54,600 Gross income Uamie Lee) 346,000 Savings account $20500 Net Income after the mieleel $32.200 Emergency fund savings account $2100 Gross income (Ross) $84000 IRA Dance $32.300 Net Income after an Rossi $64.800 Cat Jamie Lee $2,000 Monthly Expenses Car Ross 514300 Mortgage $1240 Liabilities: Property to 5410 Student loan balance 50 Homeowners insurance 5210 Credit card balance 54100IRA contribution 3310 Cwloans 52300 3255 Food Baby essentials stapens, conting, etc) 3610 Gas/maintenance Credit card payment Carloan payment Entertainment 3130 How Much Description of Goal Money Do You How Will You Obtain Level of Risk They Need? the Money? WillCan Assume? 5610 $280 $410 $290 How Much Time is Needed? Is this Goal Reasonable? They agreed that it was time to talk to an investment counselor, and they need to organize all of their financial information and determine their family's short and long-term goals for Investing before meeting with an advisor. Use the information below to complete their investment objectives and organize their information Current Financial Situation Assets: Income: Checking account $4,500 Gross income Uomie Lee) $46,000 Savings account $20300 Net Income after taxes (Jamie Lee) $32,200 Emergency fund savings account $2400 Gross income (Ross) $81,000 IRA balance $32,100 Net Income after taxes (Ross) $54,800 Car Jamie Lee $8,600 Monthly Expenses Car (Rossi $14100 Mortgage $1240 Llabilities: Property taxes $410 Student loan balance 30 Homeowners Insurance $210 Credit card balance 34100 TRA contribution $310 Cartoons 52100 Unities 5255 Food 5610 Baby essentials (diapers, clothing, etc) $610 Gas/maintenance 3280 Credit card payment $410 Carloan payment $290 Entertainment How Much How Much Description of Goal How Will You Obtain Level of Risk They Is this Goal Money Do You Time is Need? the Money? Reasonable? Needed? WillCan Assumei Pay off credit card Pay off car loan Save for college tuition for the triplets Save to purchase a beach house at retirement $130 The triplets are now three and a half years old, and Jamie Lee and Ross, both 38, are finally beginning to settle down in to a regular routine now that their children are a little more self-sufficient. The first three years were a blur of diapers, feedings, baths, mounds of laundry, and crying babies! Jamie Lee and Ross finally had a welcomed dinner out on their own as Ross's parents were minding the triplets. They were having a conversation about their future and the future of the triplets. College expenses, which they figured to be $110,000, and their eventual retirement seemed to be a major worry of the both of them. They both have dreamed of owning a beach house when they retire. That could be another $355,000 thirty years from now. They wondered how could they possibly afford all of this? They agreed that it was time to talk to an investment counselor, and they need to organize all of their financial information and determine their family's short- and long-term goals for investing before meeting with an advisor. Use the information below to complete their investment objectives and organize their information. Current Financial Situation Assets Income Checking account 54,600 Gross income Uamie Lee) 346,000 Savings account $20500 Net Income after the mieleel $32.200 Emergency fund savings account $2100 Gross income (Ross) $84000 IRA Dance $32.300 Net Income after an Rossi $64.800 Cat Jamie Lee $2,000 Monthly Expenses Car Ross 514300 Mortgage $1240 Liabilities: Property to 5410 Student loan balance 50 Homeowners insurance 5210 Credit card balance 54100IRA contribution 3310 Cwloans 52300 3255 Food Baby essentials stapens, conting, etc) 3610 Gas/maintenance Credit card payment Carloan payment Entertainment 3130 How Much Description of Goal Money Do You How Will You Obtain Level of Risk They Need? the Money? WillCan Assume? 5610 $280 $410 $290 How Much Time is Needed? Is this Goal Reasonable? They agreed that it was time to talk to an investment counselor, and they need to organize all of their financial information and determine their family's short and long-term goals for Investing before meeting with an advisor. Use the information below to complete their investment objectives and organize their information Current Financial Situation Assets: Income: Checking account $4,500 Gross income Uomie Lee) $46,000 Savings account $20300 Net Income after taxes (Jamie Lee) $32,200 Emergency fund savings account $2400 Gross income (Ross) $81,000 IRA balance $32,100 Net Income after taxes (Ross) $54,800 Car Jamie Lee $8,600 Monthly Expenses Car (Rossi $14100 Mortgage $1240 Llabilities: Property taxes $410 Student loan balance 30 Homeowners Insurance $210 Credit card balance 34100 TRA contribution $310 Cartoons 52100 Unities 5255 Food 5610 Baby essentials (diapers, clothing, etc) $610 Gas/maintenance 3280 Credit card payment $410 Carloan payment $290 Entertainment How Much How Much Description of Goal How Will You Obtain Level of Risk They Is this Goal Money Do You Time is Need? the Money? Reasonable? Needed? WillCan Assumei Pay off credit card Pay off car loan Save for college tuition for the triplets Save to purchase a beach house at retirement $130