Answered step by step

Verified Expert Solution

Question

1 Approved Answer

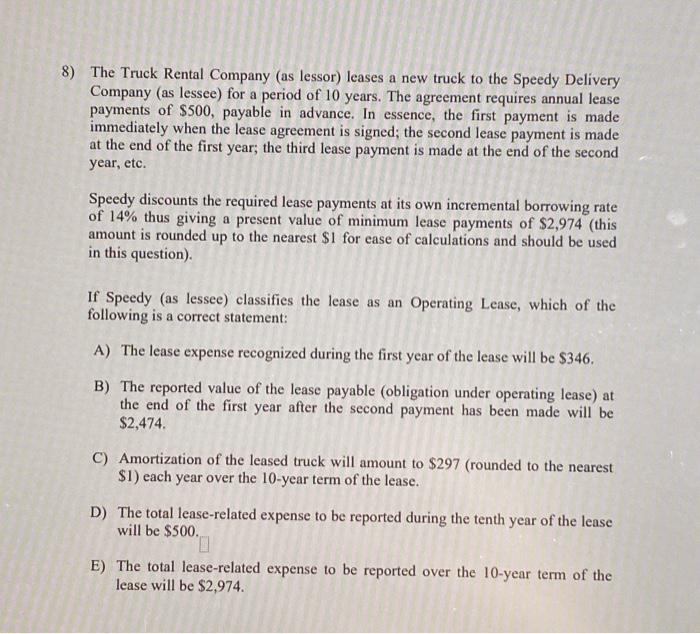

The Truck Rental Company (as lessor) leases a new truck to the Speedy Delivery Company (as lesse) for a period of 10 years. The agreement

The Truck Rental Company (as lessor) leases a new truck to the Speedy Delivery Company (as lesse) for a period of 10 years. The agreement requires annual kease payments of $500, payable in advance. In essense, the first payment is made immediately when the lease agreement is signed, the second lease payment is made at the end of the first year; the third lease payment is made at the end if the second year, etc.

The Truck Rental Company (as lessor) leases a new truck to the Speedy Delivery Company (as lessee) for a period of 10 years. The agreement requires annual lease payments of $500, payable in advance. In essence, the first payment is made immediately when the lease agreement is signed; the second lease payment is made at the end of the first year; the third lease payment is made at the end of the second year, etc. Speedy discounts the required lease payments at its own incremental borrowing rate of 14% thus giving a present value of minimum lease payments of $2,974 (this amount is rounded up to the nearest $1 for ease of calculations and should be used in this question). If Speedy (as lessee) classifies the lease as an Operating Lease, which of the following is a correct statement: A) The lease expense recognized during the first year of the lease will be $346. B) The reported value of the lease payable (obligation under operating lease) at the end of the first year after the second payment has been made will be $2,474. C) Amortization of the leased truck will amount to $297 (rounded to the nearest $1) each year over the 10-year term of the lease. D) The total lease-related expense to be reported during the tenth year of the lease will be $500. E) The total lease-related expense to be reported over the 10-year term of the lease will be $2,974 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started