Question

The TSLA Corporation currently uses a manufacturing facility costing $400,000 per year: 80% of the facility's capacity is currently being used. A start-up business

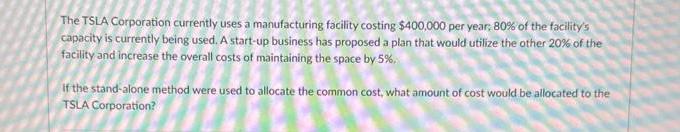

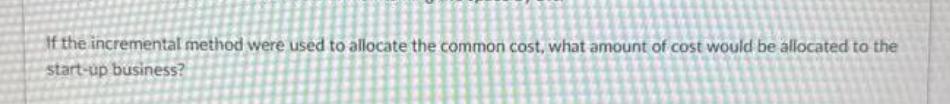

The TSLA Corporation currently uses a manufacturing facility costing $400,000 per year: 80% of the facility's capacity is currently being used. A start-up business has proposed a plan that would utilize the other 20% of the facility and increase the overall costs of maintaining the space by 5%. If the stand-alone method were used to allocate the common cost, what amount of cost would be allocated to the TSLA Corporation? If the incremental method were used to allocate the common cost, what amount of cost would be allocated to the start-up business?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost allocation using the standalone method and the incremental method we need to c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Industrial Relations in Canada

Authors: Fiona McQuarrie

4th Edition

978-1-118-8783, 1118878396, 9781119050599 , 978-1118878392

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App