Answered step by step

Verified Expert Solution

Question

1 Approved Answer

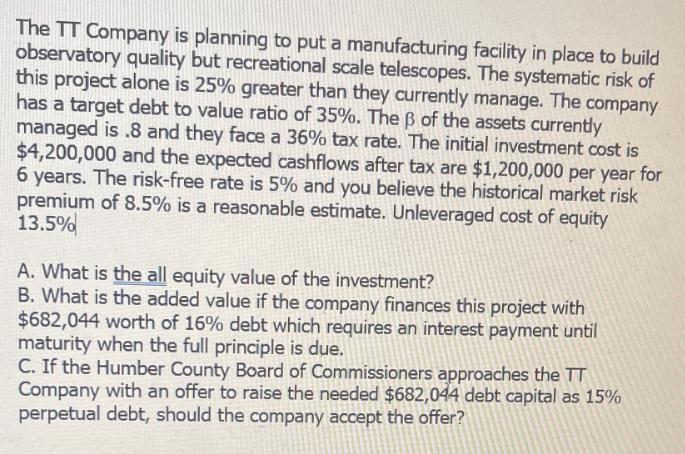

The TT Company is planning to put a manufacturing facility in place to build observatory quality but recreational scale telescopes. The systematic risk of

The TT Company is planning to put a manufacturing facility in place to build observatory quality but recreational scale telescopes. The systematic risk of this project alone is 25% greater than they currently manage. The company has a target debt to value ratio of 35%. The of the assets currently managed is .8 and they face a 36% tax rate. The initial investment cost is $4,200,000 and the expected cashflows after tax are $1,200,000 per year for 6 years. The risk-free rate is 5% and you believe the historical market risk premium of 8.5% is a reasonable estimate. Unleveraged cost of equity 13.5% A. What is the all equity value of the investment? B. What is the added value if the company finances this project with $682,044 worth of 16% debt which requires an interest payment until maturity when the full principle is due. C. If the Humber County Board of Commissioners approaches the TT Company with an offer to raise the needed $682,044 debt capital as 15% perpetual debt, should the company accept the offer?

Step by Step Solution

★★★★★

3.35 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the values well use the following formulas A The all equity value of the investment can be calculated using the following formula All Equity Value Present Value of Cash Flows 1 Unleverage...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started