The Tumbling Domino Superannuation Fund, a complying fund, had the following payments and receipts for the 2021/22 tax year: RECEIPTS Contributions from employers Contributions

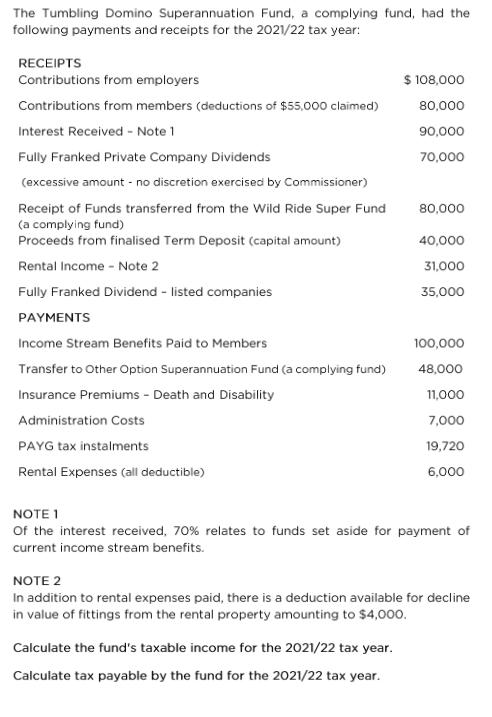

The Tumbling Domino Superannuation Fund, a complying fund, had the following payments and receipts for the 2021/22 tax year: RECEIPTS Contributions from employers Contributions from members (deductions of $55,000 claimed) Interest Received - Note 1 Fully Franked Private Company Dividends (excessive amount - no discretion exercised by Commissioner) Receipt of Funds transferred from the Wild Ride Super Fund (a complying fund) Proceeds from finalised Term Deposit (capital amount) Rental Income - Note 2 Fully Franked Dividend - listed companies PAYMENTS Income Stream Benefits Paid to Members Transfer to Other Option Superannuation Fund (a complying fund) Insurance Premiums - Death and Disability Administration Costs PAYG tax instalments Rental Expenses (all deductible) $ 108,000 80,000 90,000 70,000 80,000 Calculate the fund's taxable income for the 2021/22 tax year. Calculate tax payable by the fund for the 2021/22 tax year. 40,000 31,000 35,000 100,000 48,000 11,000 7,000 19,720 6,000 NOTE 1 of the interest received, 70% relates to funds set aside for payment of current income stream benefits. NOTE 2 In addition to rental expenses paid, there is a deduction available for decline in value of fittings from the rental property amounting to $4,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Tumbling Domino Superannuation Funds taxable income for the 202122 tax year we need ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started