Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The two employees of Silver Company receive various fringe benefits. Silver Company provides vacation at the rate of $405 per day. Each employee earns

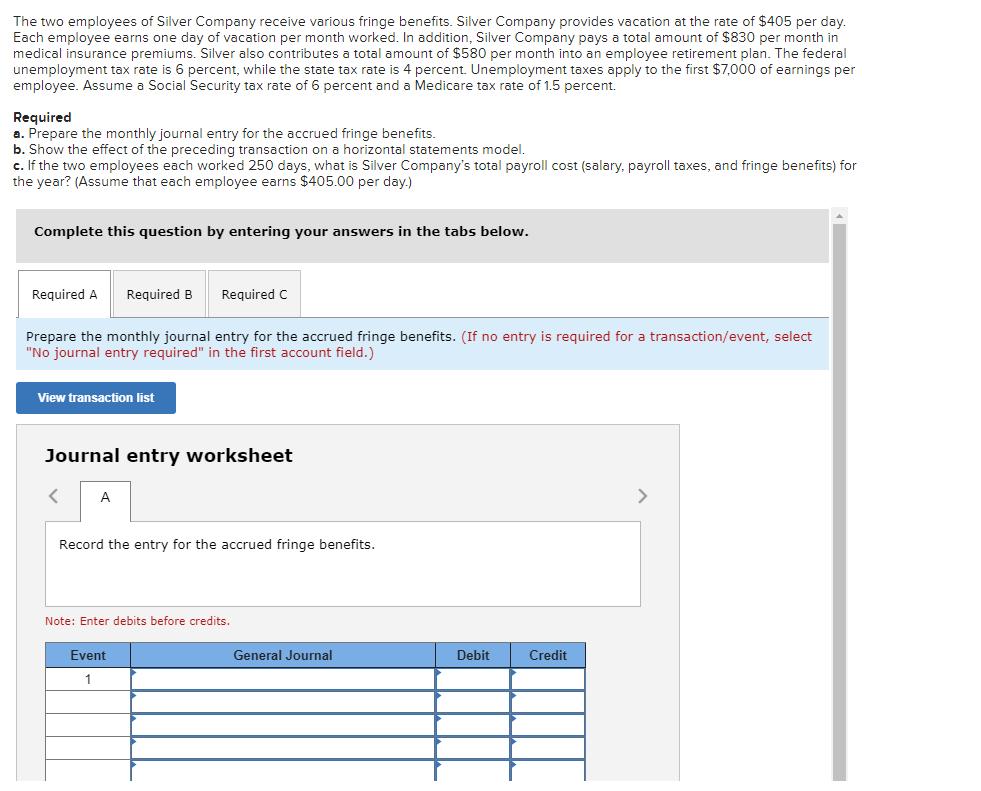

The two employees of Silver Company receive various fringe benefits. Silver Company provides vacation at the rate of $405 per day. Each employee earns one day of vacation per month worked. In addition, Silver Company pays a total amount of $830 per month in medical insurance premiums. Silver also contributes a total amount of $580 per month into an employee retirement plan. The federal unemployment tax rate is 6 percent, while the state tax rate is 4 percent. Unemployment taxes apply to the first $7,000 of earnings per employee. Assume a Social Security tax rate of 6 percent and a Medicare tax rate of 1.5 percent. Required a. Prepare the monthly journal entry for the accrued fringe benefits. b. Show the effect of the preceding transaction on a horizontal statements model. c. If the two employees each worked 250 days, what is Silver Company's total payroll cost (salary, payroll taxes, and fringe benefits) for the year? (Assume that each employee earns $405.00 per day.) Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare the monthly journal entry for the accrued fringe benefits. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < A Record the entry for the accrued fringe benefits. Note: Enter debits before credits. Event 1 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Monthly Journal Entry for Accrued Fringe Benefits Accrual of Fringe Benefits General Journa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started