Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The two methods that consider the time value of money concept to analyze capital investment proposals are: a. the internal rate of return method

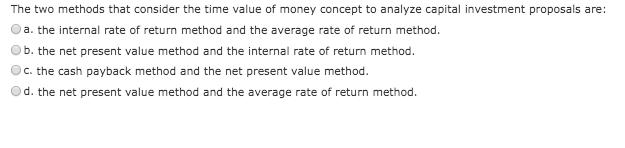

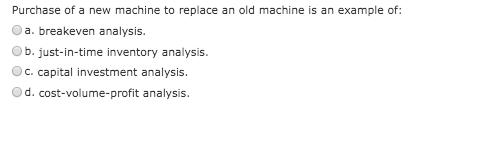

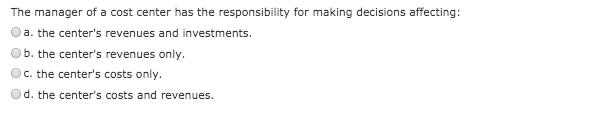

The two methods that consider the time value of money concept to analyze capital investment proposals are: a. the internal rate of return method and the average rate of return method. b. the net present value method and the internal rate of return method. c. the cash payback method and the net present value method. d. the net present value method and the average rate of return method. Purchase of a new machine to replace an old machine is an example of: a. breakeven analysis. b. just-in-time inventory analysis. c. capital investment analysis. analysis. d. cost-volume-profit The manager of a cost center has the responsibility for making decisions affecting: a. the center's revenues and investments. b. the center's revenues only. c. the center's costs only. d. the center's costs and revenues. The two methods that consider the time value of money concept to analyze capital investment proposals are: a. the internal rate of return method and the average rate of return method. b. the net present value method and the internal rate of return method. c. the cash payback method and the net present value method. d. the net present value method and the average rate of return method. Purchase of a new machine to replace an old machine is an example of: a. breakeven analysis. b. just-in-time inventory analysis. c. capital investment analysis. analysis. d. cost-volume-profit The manager of a cost center has the responsibility for making decisions affecting: a. the center's revenues and investments. b. the center's revenues only. c. the center's costs only. d. the center's costs and revenues. The two methods that consider the time value of money concept to analyze capital investment proposals are: a. the internal rate of return method and the average rate of return method. b. the net present value method and the internal rate of return method. c. the cash payback method and the net present value method. d. the net present value method and the average rate of return method. Purchase of a new machine to replace an old machine is an example of: a. breakeven analysis. b. just-in-time inventory analysis. c. capital investment analysis. analysis. d. cost-volume-profit The manager of a cost center has the responsibility for making decisions affecting: a. the center's revenues and investments. b. the center's revenues only. c. the center's costs only. d. the center's costs and revenues. The two methods that consider the time value of money concept to analyze capital investment proposals are: a. the internal rate of return method and the average rate of return method. b. the net present value method and the internal rate of return method. c. the cash payback method and the net present value method. d. the net present value method and the average rate of return method. Purchase of a new machine to replace an old machine is an example of: a. breakeven analysis. b. just-in-time inventory analysis. c. capital investment analysis. analysis. d. cost-volume-profit The manager of a cost center has the responsibility for making decisions affecting: a. the center's revenues and investments. b. the center's revenues only. c. the center's costs only. d. the center's costs and revenues.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 b the net present value method and internal rate of return meth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started