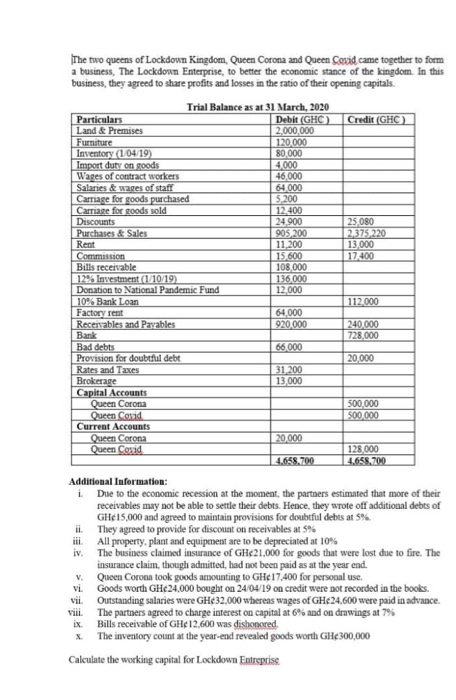

The two queens of Lockdown Kingdom, Queen Corona and Queen Coxid came together to form a business, The Lockdown Enterprise, to better the economic stance of the kingdom. In this business, they agreed to share profits and losses in the ratio of their opening capitals. Trial Balance as at 31 March, 2020 Particulars Debit (GHC) Credit (GHC) Land & Premises 2.000.000 Furniture 120,000 Inventory (1/04/19) 80,000 Import duty on goods 4000 Wages of contract workers 46,000 Salaries & wages of staff 64.000 Carriage for goods purchased 5,200 Carriage for goods sold 12.400 Discounts 24.900 25.080 Purchases & Sales 905,200 2.375, 220 Rent 11,200 13,000 Commission 15,600 17.400 Bills receivable 108.000 12% Investment (1/10/19 136,000 Donation to National Pandemic Fund 12,000 10% Bank Loan 112,000 Factory rent 64.000 Receivables and Payables 920,000 240,000 Bank 728,000 Bad debts 66.000 Provision for doubtful debt 20,000 Rates and Taxes Brokerage 13,000 Capital Accounts Queen Corona 500,000 Queen Cowd 500.000 Current Accounts Queen Corona 20.000 Queen Cosid 128,000 4.658.700 4.658.700 Additional Information: i Due to the economic recession at the moment, the partners estimated that more of their receivables may not be able to settle their debts. Hence, they wrote off additional debts of GHe 15,000 and agreed to maintain provisions for doubtful debts at 5%. ii They agreed to provide for discount on receivables at % All property, plant and equipment are to be depreciated at 10% iv. The business claimed insurance of GHc21,000 for goods that were lost due to fire. The insurance claim, though admitted, had not been paid as at the year end. V. Queen Corona took goods amounting to GHC 17.400 for personal use. vi. Goods worth GHc24.000 bought on 24/04/19 on credit were not recorded in the books. vii Outstanding salaries were GH 32,000 whereas wages of GH24.600 were paid in advance. viii. The partners agreed to charge interest on capital at 6% and on drawings at 7% ix Bills receivable of GHe 12,600 was dishonored X The inventory count at the year-end revealed goods worth GH300,000 Calculate the working capital for Lockdown Entreprise 31 200 The two queens of Lockdown Kingdom, Queen Corona and Queen Coxid came together to form a business, The Lockdown Enterprise, to better the economic stance of the kingdom. In this business, they agreed to share profits and losses in the ratio of their opening capitals. Trial Balance as at 31 March, 2020 Particulars Debit (GHC) Credit (GHC) Land & Premises 2.000.000 Furniture 120,000 Inventory (1/04/19) 80,000 Import duty on goods 4000 Wages of contract workers 46,000 Salaries & wages of staff 64.000 Carriage for goods purchased 5,200 Carriage for goods sold 12.400 Discounts 24.900 25.080 Purchases & Sales 905,200 2.375, 220 Rent 11,200 13,000 Commission 15,600 17.400 Bills receivable 108.000 12% Investment (1/10/19 136,000 Donation to National Pandemic Fund 12,000 10% Bank Loan 112,000 Factory rent 64.000 Receivables and Payables 920,000 240,000 Bank 728,000 Bad debts 66.000 Provision for doubtful debt 20,000 Rates and Taxes Brokerage 13,000 Capital Accounts Queen Corona 500,000 Queen Cowd 500.000 Current Accounts Queen Corona 20.000 Queen Cosid 128,000 4.658.700 4.658.700 Additional Information: i Due to the economic recession at the moment, the partners estimated that more of their receivables may not be able to settle their debts. Hence, they wrote off additional debts of GHe 15,000 and agreed to maintain provisions for doubtful debts at 5%. ii They agreed to provide for discount on receivables at % All property, plant and equipment are to be depreciated at 10% iv. The business claimed insurance of GHc21,000 for goods that were lost due to fire. The insurance claim, though admitted, had not been paid as at the year end. V. Queen Corona took goods amounting to GHC 17.400 for personal use. vi. Goods worth GHc24.000 bought on 24/04/19 on credit were not recorded in the books. vii Outstanding salaries were GH 32,000 whereas wages of GH24.600 were paid in advance. viii. The partners agreed to charge interest on capital at 6% and on drawings at 7% ix Bills receivable of GHe 12,600 was dishonored X The inventory count at the year-end revealed goods worth GH300,000 Calculate the working capital for Lockdown Entreprise 31 200