Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The typical term of a fixed rate mortgage for a house is 30 years. The mortgage has a nominal annual interest rate of 4.75

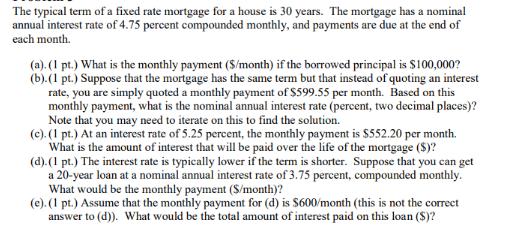

The typical term of a fixed rate mortgage for a house is 30 years. The mortgage has a nominal annual interest rate of 4.75 percent compounded monthly, and payments are due at the end of each month. (a). (1 pt.) What is the monthly payment ($/month) if the borrowed principal is $100,000? (b). (1 pt.) Suppose that the mortgage has the same term but that instead of quoting an interest rate, you are simply quoted a monthly payment of $599.55 per month. Based on this monthly payment, what is the nominal annual interest rate (percent, two decimal places)? Note that you may need to iterate on this to find the solution. (c). (1 pt.) At an interest rate of 5.25 percent, the monthly payment is $552.20 per month. What is the amount of interest that will be paid over the life of the mortgage ($)? (d). (1 pt.) The interest rate is typically lower if the term is shorter. Suppose that you can get a 20-year loan at a nominal annual interest rate of 3.75 percent, compounded monthly. What would be the monthly payment ($/month)? (e). (1 pt.) Assume that the monthly payment for (d) is $600/month (this is not the correct answer to (d)). What would be the total amount of interest paid on this loan ($)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the monthly payment for a fixedrate mortgage with a principal of 100000 an annual interest rate of 475 compounded monthly and a term of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started