Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional information relates to the required

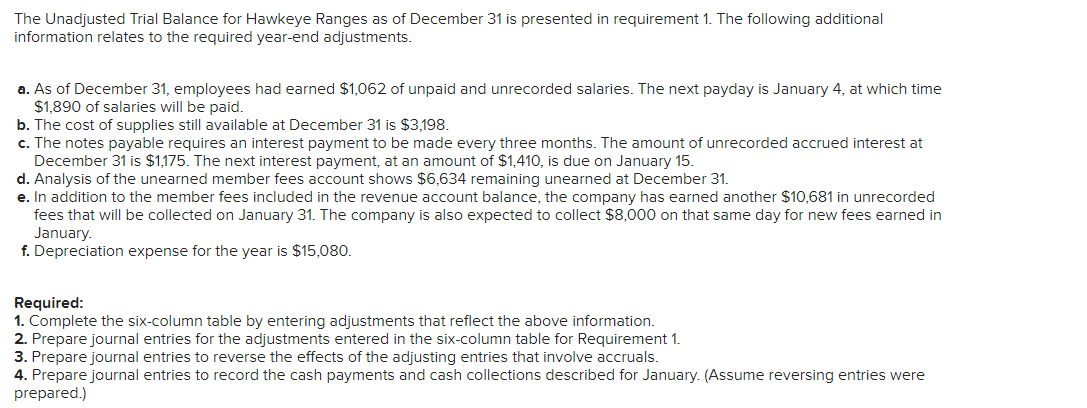

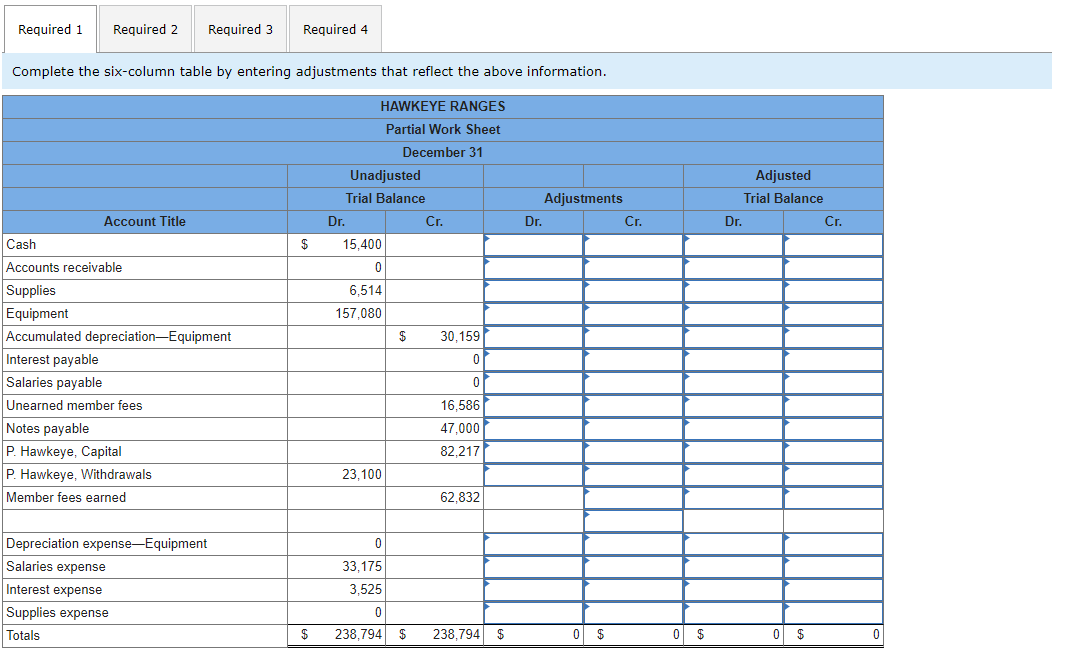

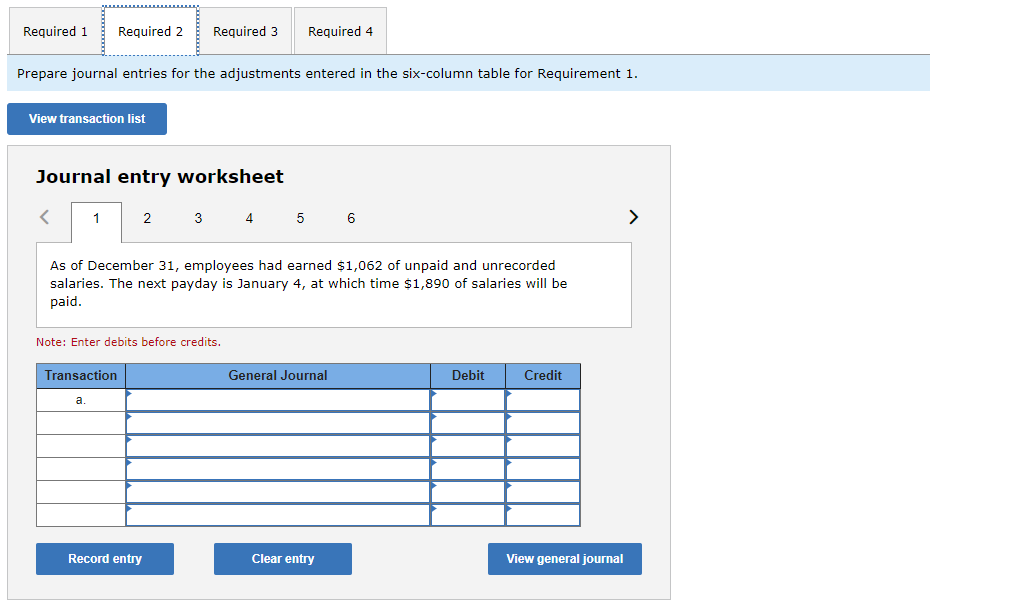

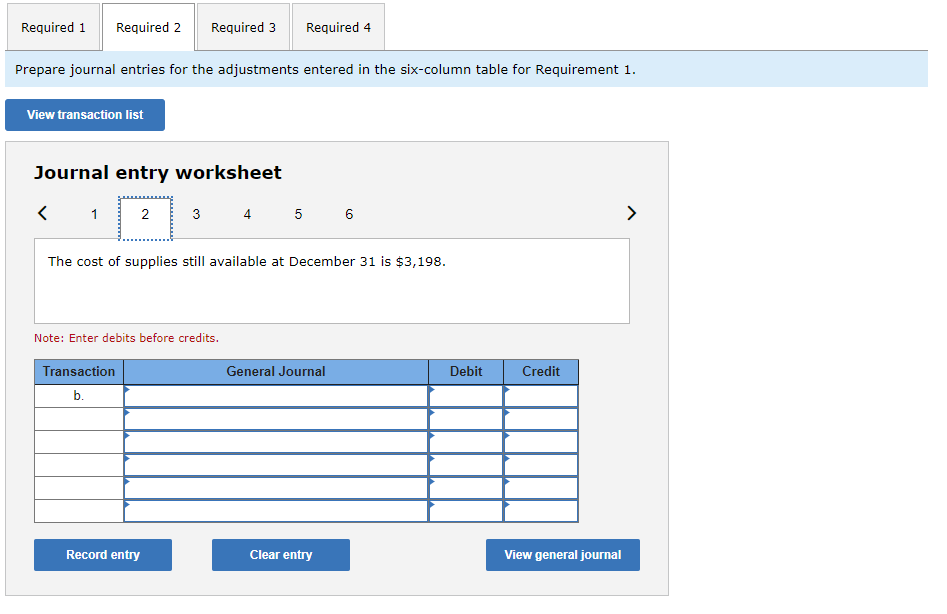

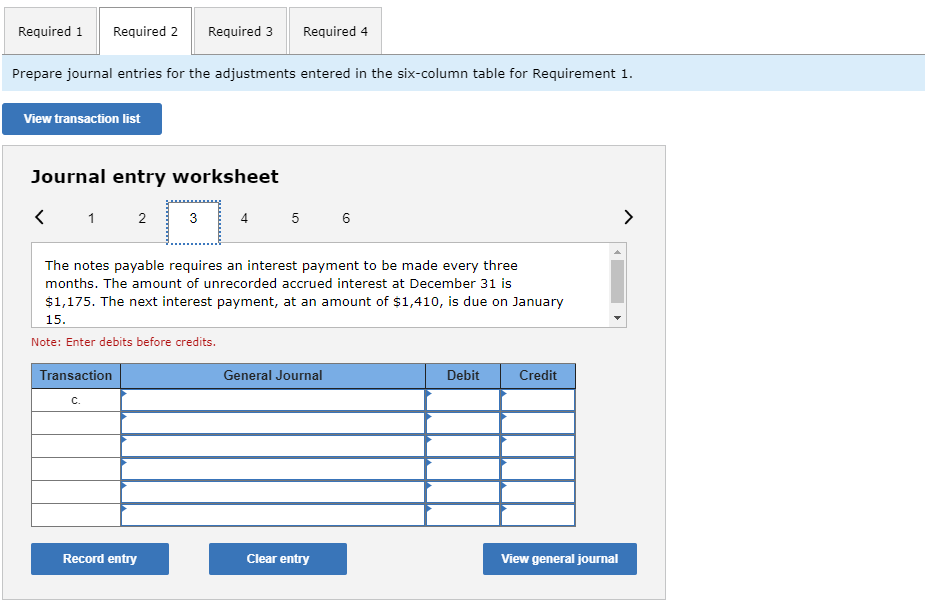

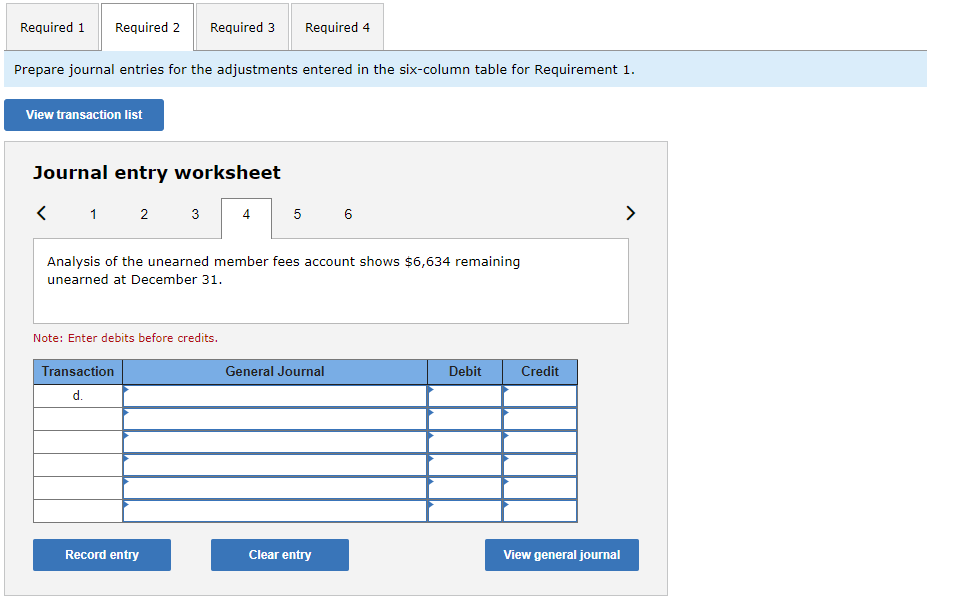

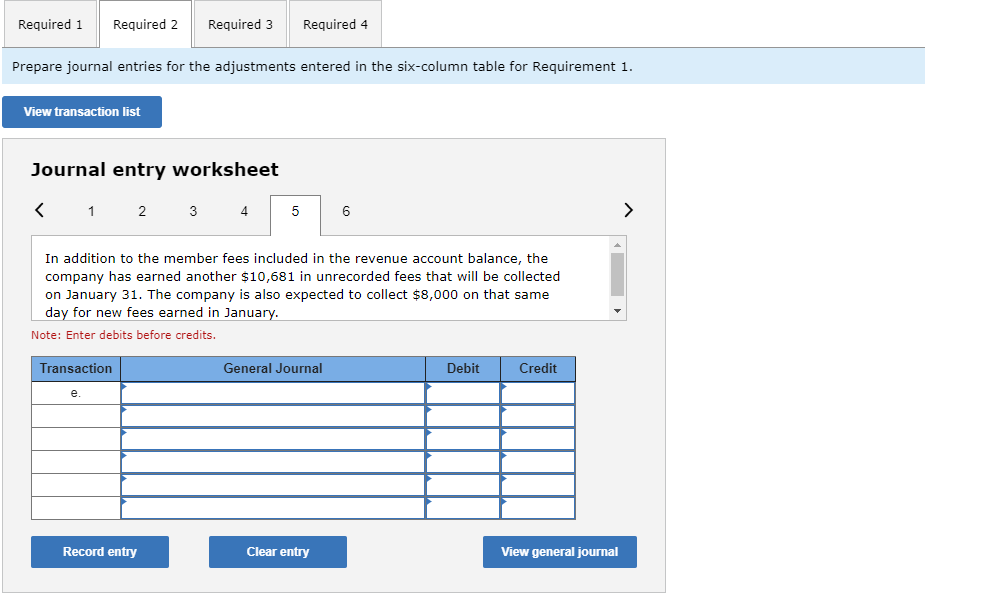

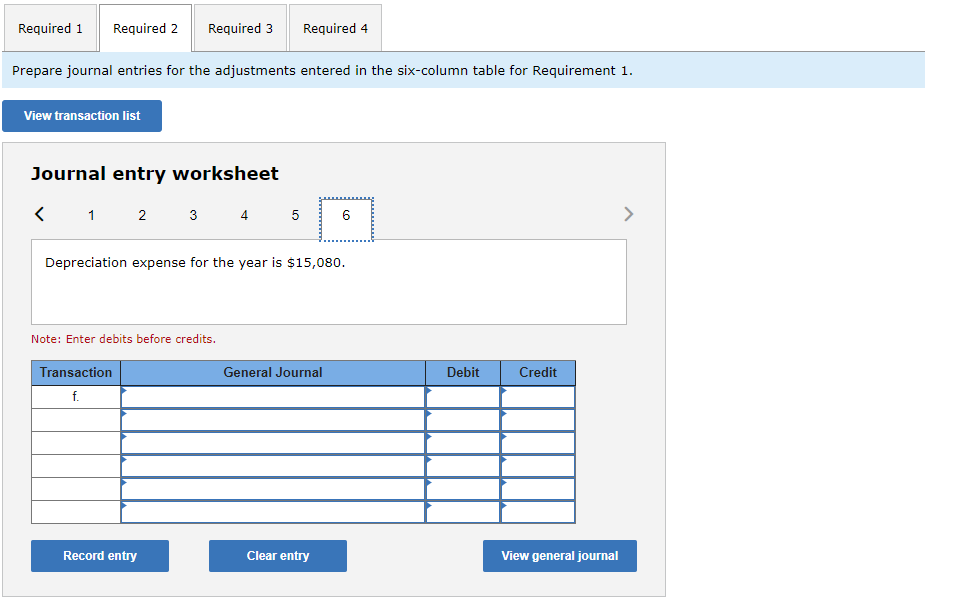

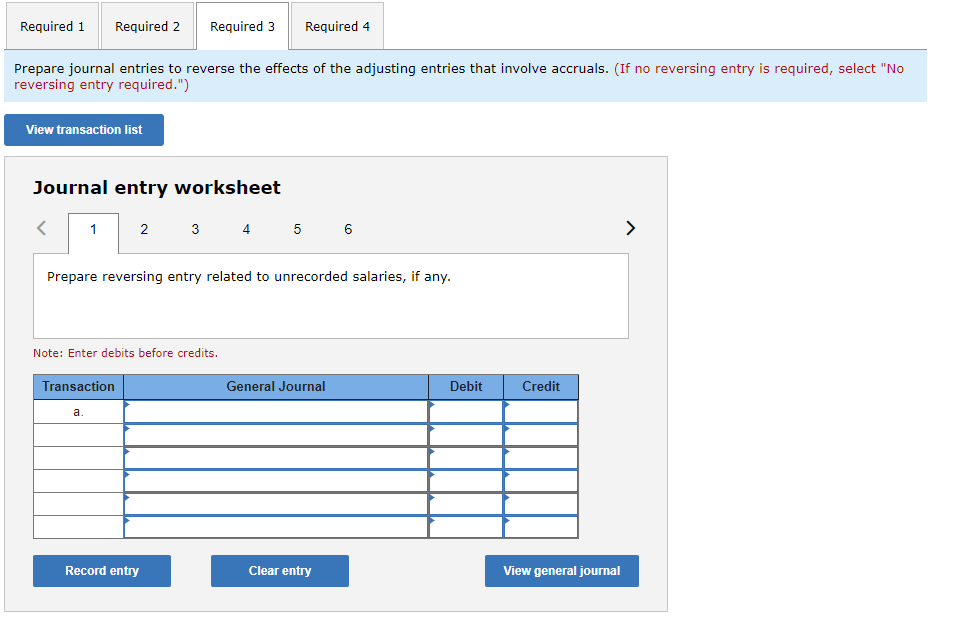

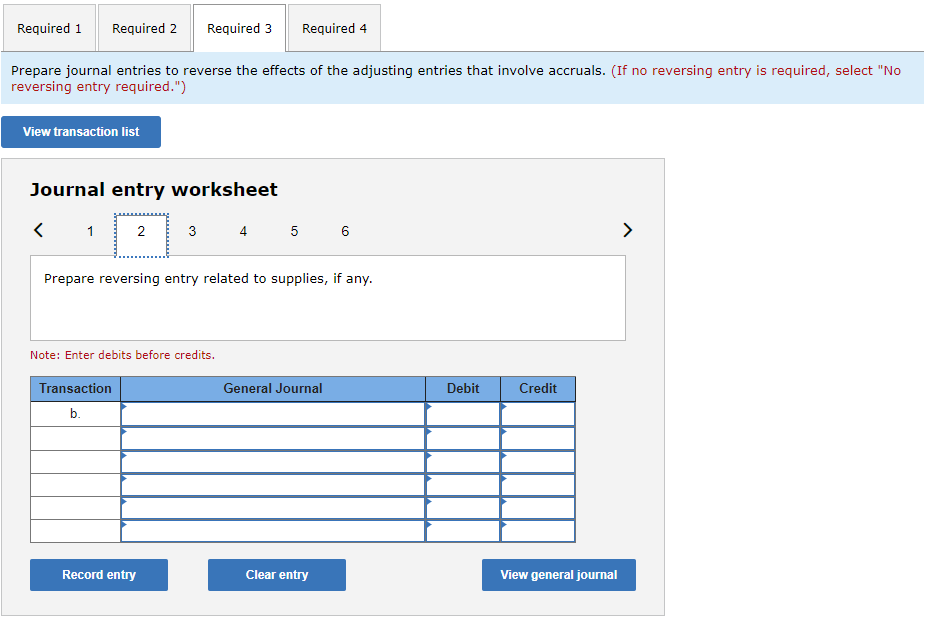

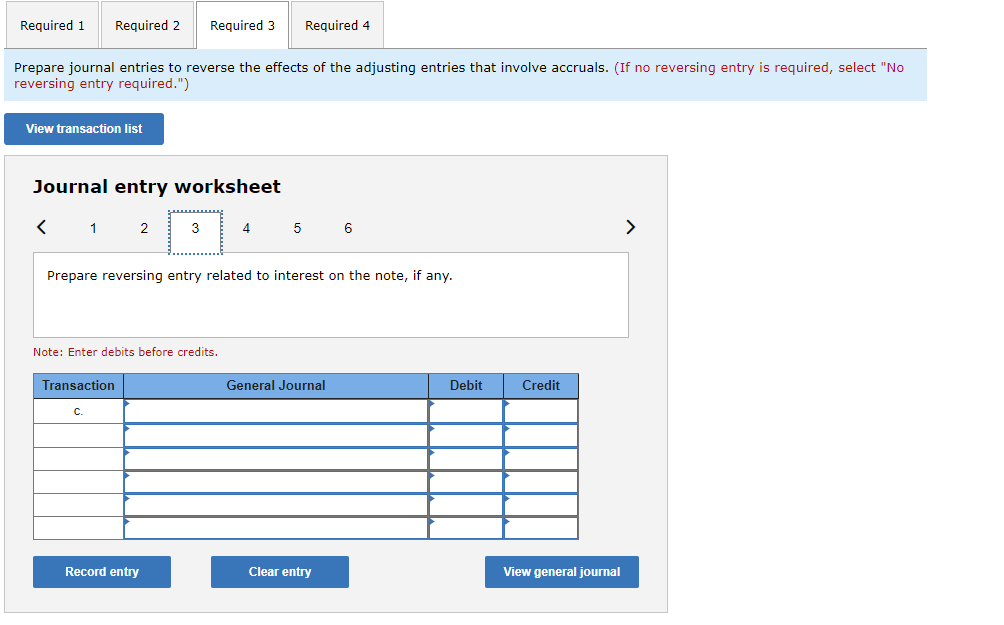

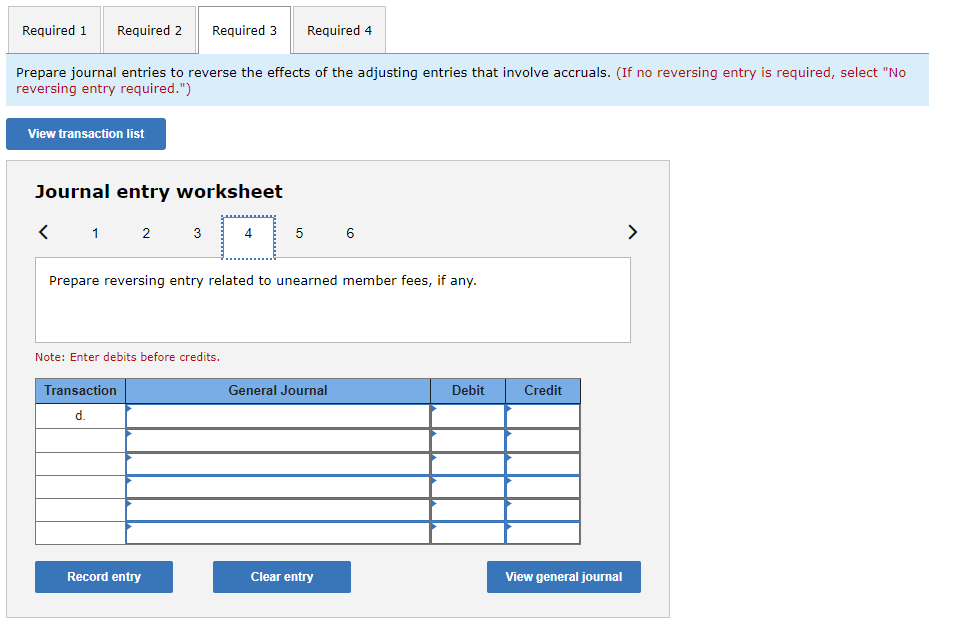

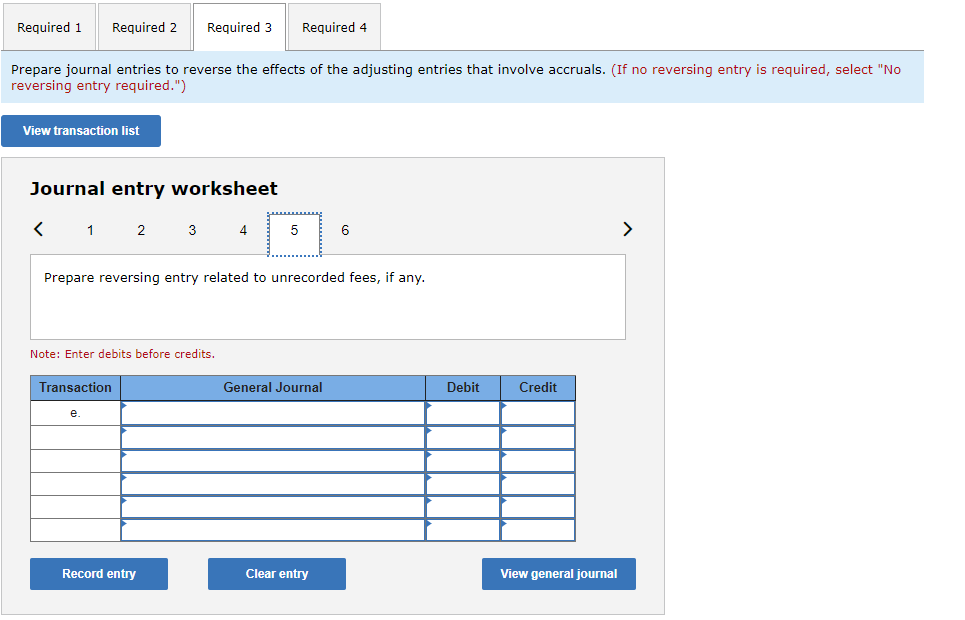

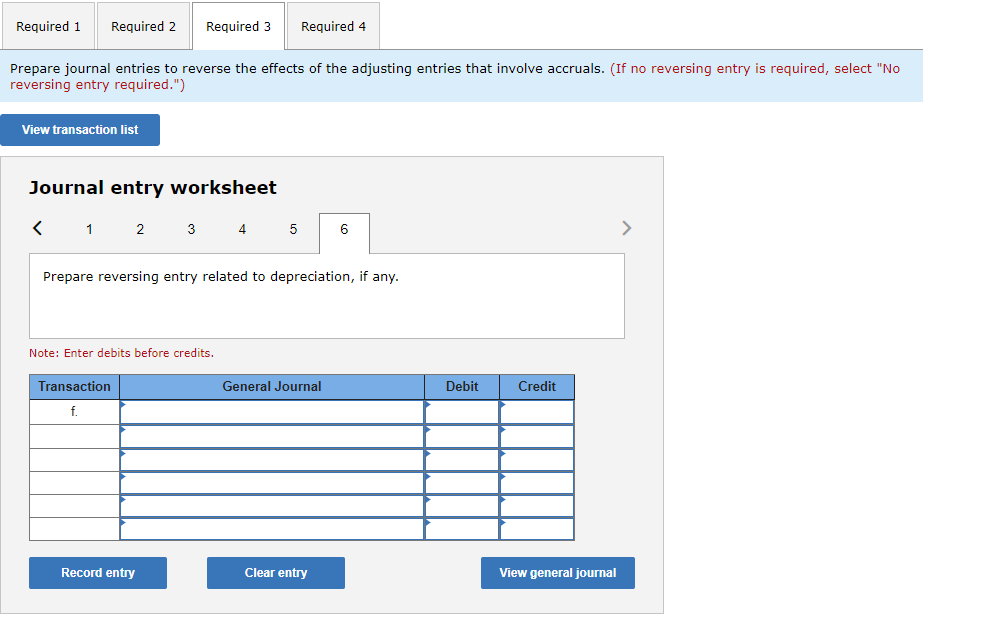

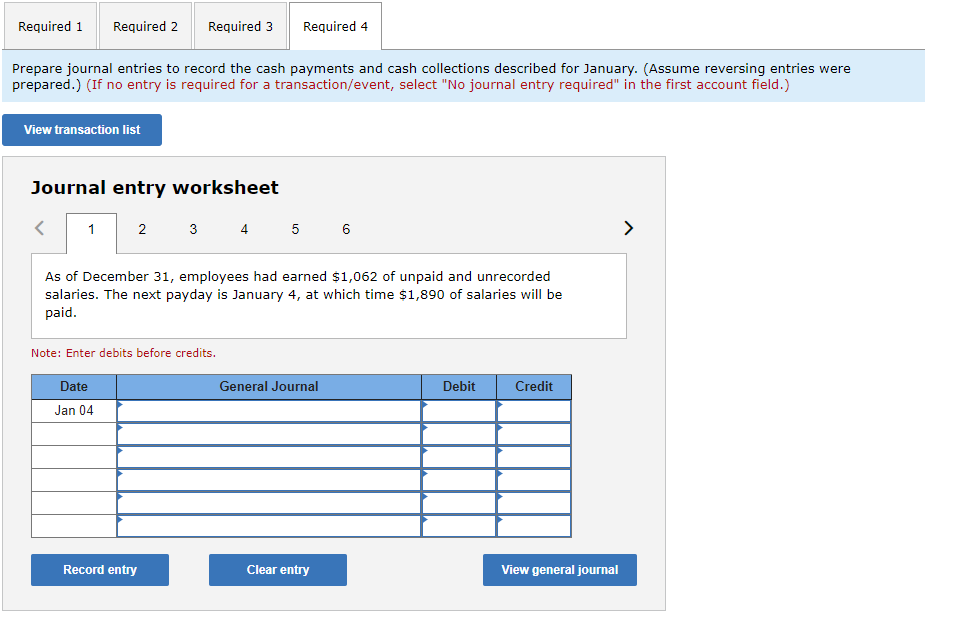

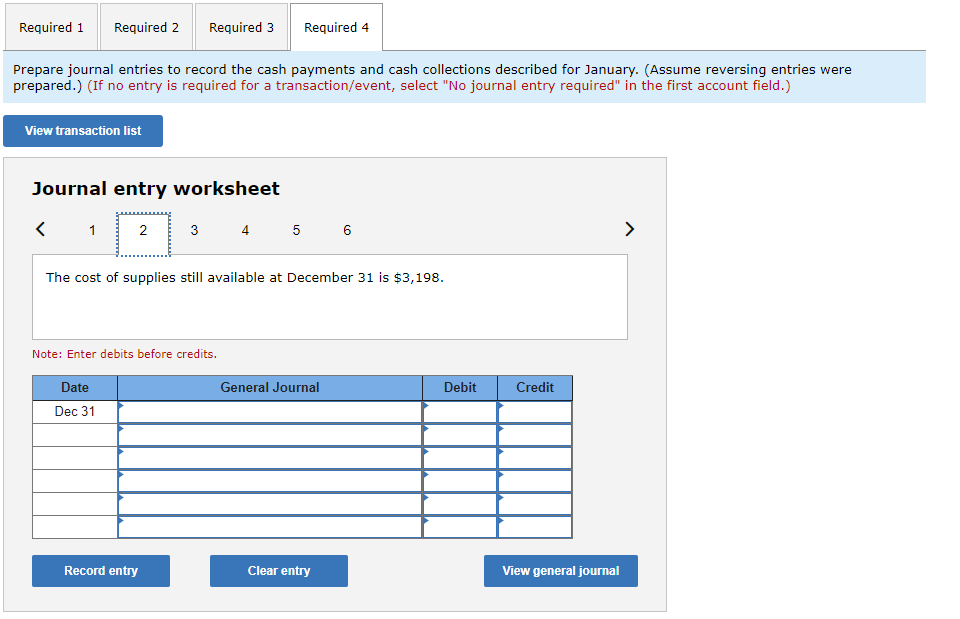

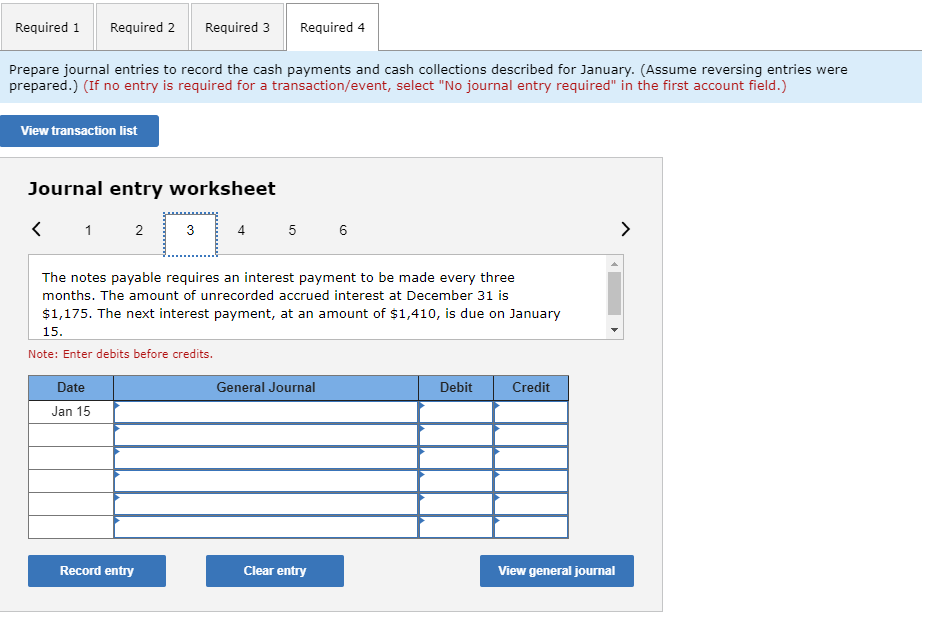

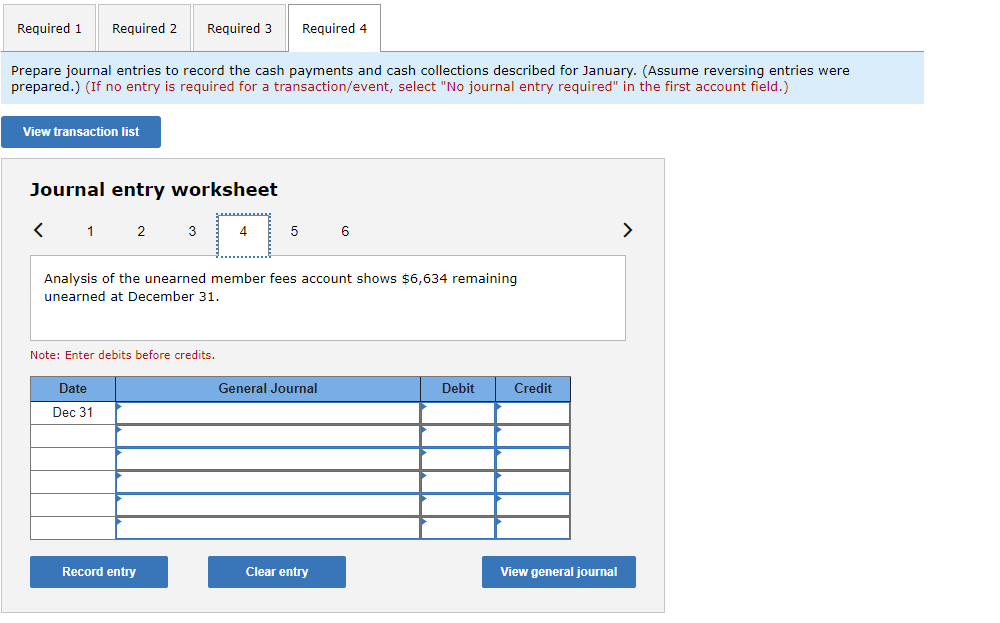

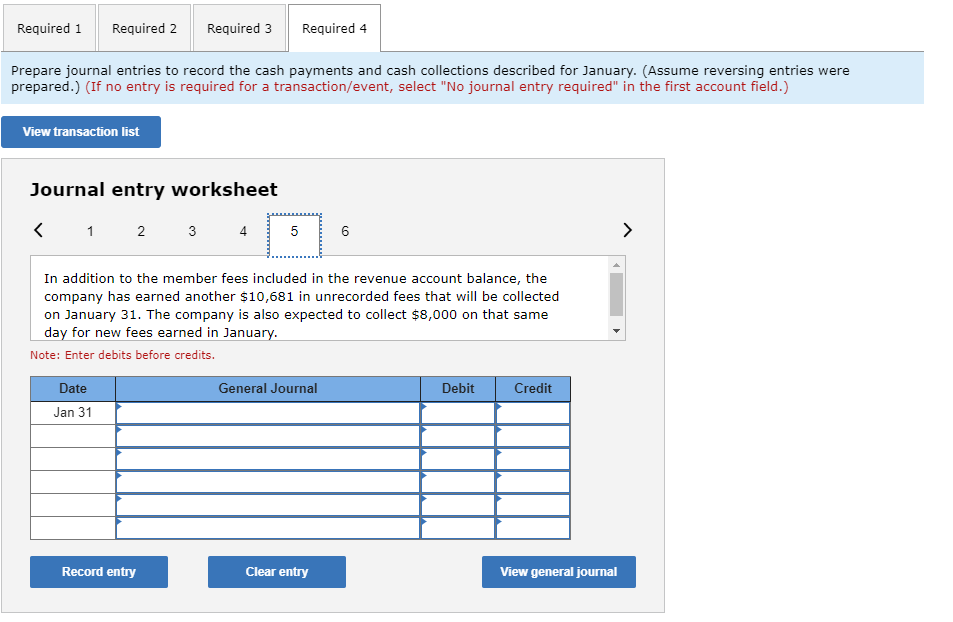

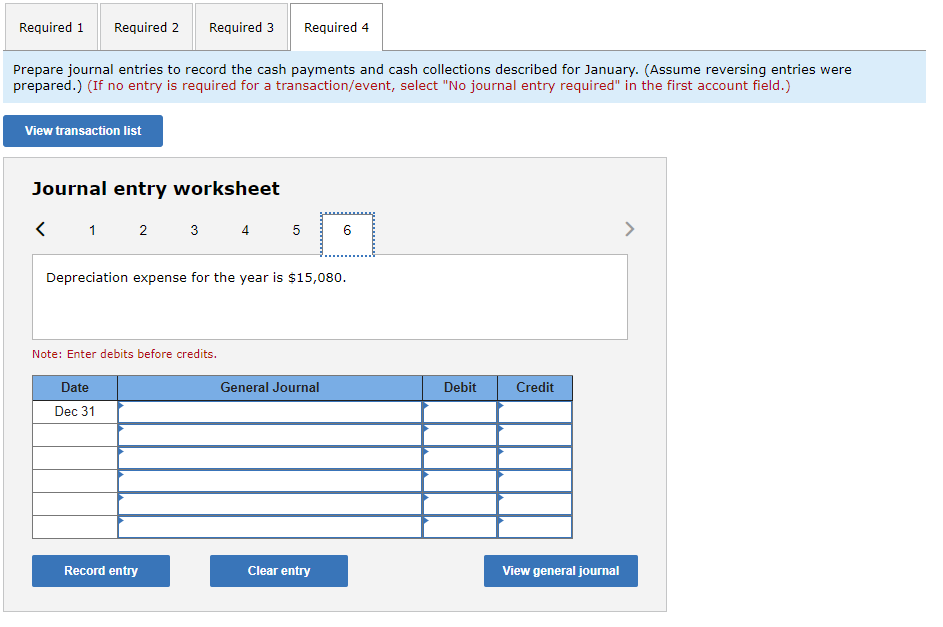

The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional information relates to the required year-end adjustments. a. As of December 31, employees had earned $1,062 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,890 of salaries will be paid. b. The cost of supplies still available at December 31 is $3,198. c. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $1,175. The next interest payment, at an amount of $1,410, is due on January 15. d. Analysis of the unearned member fees account shows $6,634 remaining unearned at December 31. e. In addition to the member fees included in the revenue account balance, the company has earned another $10,681 in unrecorded fees that will be collected on January 31. The company is also expected to collect $8,000 on that same day for new fees earned in January. f. Depreciation expense for the year is $15,080. Required: 1. Complete the six-column table by entering adjustments that reflect the above information. 2. Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. 3. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. 4. Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) Required 1 Required 2 Required 3 Required 4 Complete the six-column table by entering adjustments that reflect the above information. HAWKEYE RANGES Partial Work Sheet December 31 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash $ 15,400 Accounts receivable Supplies 6,514 Equipment 157,080 Accumulated depreciation-Equipment Interest payable $ 30,159 Salaries payable Unearned member fees 16,586 Notes payable 47,000 P. Hawkeye, Capital 82.217 P. Hawkeye, Withdrawals 23,100 Member fees earned 62,832 Depreciation expense-Equipment Salaries expense 33,175 Interest expense 3,525 Supplies expense Totals $ 238,794 $ 238,794 $ 0 $ 0 $ 0 $ Required 1 Required 2 Required 3 Required 4 Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. View transaction list Journal entry worksheet 1 3 4 6 > As of December 31, employees had earned $1,062 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,890 of salaries will be paid. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. View transaction list Journal entry worksheet 1 5 6 > 2 3 4 The cost of supplies still available at December 31 is $3,198. Note: Enter debits before credits. Transaction General Journal Debit Credit b. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. View transaction list Journal entry worksheet 2 3 4 5 6 > The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $1,175. The next interest payment, at an amount of $1,410, is due on January 15. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. View transaction list Journal entry worksheet < 1 2 > 3 4 6 Analysis of the unearned member fees account shows $6,634 remaining unearned at December 31. Note: Enter debits before credits. Transaction General Journal Debit Credit d. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. View transaction list Journal entry worksheet 1 2 3 4 5 6 > In addition to the member fees included in the revenue account balance, the company has earned another $10,681 in unrecorded fees that will be collected on January 31. The company is also expected to collect $8,000 on that same day for new fees earned in January. Note: Enter debits before credits. Transaction General Journal Debit Credit . Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries for the adjustments entered in the six-column table for Requirement 1. View transaction list Journal entry worksheet 2 3 4 5 6 > Depreciation expense for the year is $15,080. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. (If no reversing entry is required, select "No reversing entry required.") View transaction list Journal entry worksheet 1 2 3 4 5 6 > Prepare reversing entry related to unrecorded salaries, if any. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. (If no reversing entry is required, select "No reversing entry required.") View transaction list Journal entry worksheet 1 2 3 4 5 6 > Prepare reversing entry related to supplies, if any. Note: Enter debits before credits. Transaction General Journal Debit Credit b. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. (If no reversing entry is required, select "No reversing entry required.") View transaction list Journal entry worksheet < 1 2 3 4 5 6 > Prepare reversing entry related to interest on the note, if any. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. (If no reversing entry is required, select "No reversing entry required.") View transaction list Journal entry worksheet < 1 2 > 3 4 5 6 Prepare reversing entry related to unearned member fees, if any. Note: Enter debits before credits. Transaction General Journal Debit Credit d. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. (If no reversing entry is required, select "No reversing entry required.") View transaction list Journal entry worksheet < 1 2 3 4 5 > 6 Prepare reversing entry related to unrecorded fees, if any. Note: Enter debits before credits. Transaction General Journal Debit Credit e. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. (If no reversing entry is required, select "No reversing entry required.") View transaction list Journal entry worksheet < 1 2 3 4 5 6 > Prepare reversing entry related to depreciation, if any. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 > 1 As of December 31, employees had earned $1,062 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,890 of salaries will be paid. Note: Enter debits before credits. Date General Journal Debit Credit Jan 04 Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 > The cost of supplies still available at December 31 is $3,198. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 4 5 6 > The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $1,175. The next interest payment, at an amount of $1,410, is due on January 15. Note: Enter debits before credits. Date General Journal Debit Credit Jan 15 Record entry Clear entry View general journal 3. Required 1 Required 2 Required 3 Required 4 Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 2 > 3 4 6 Analysis of the unearned member fees account shows $6,634 remaining unearned at December 31. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 6 > In addition to the member fees included in the revenue account balance, the company has earned another $10,681 in unrecorded fees that will be collected on January 31. The company is also expected to collect $8,000 on that same day for new fees earned in January. Note: Enter debits before credits. Date General Journal Debit Credit Jan 31 Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Prepare journal entries to record the cash payments and cash collections described for January. (Assume reversing entries were prepared.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 > 6 Depreciation expense for the year is $15,080. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Hawkeye Rawyer Partial Wooksheet De cember 31 Una...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started