Answered step by step

Verified Expert Solution

Question

1 Approved Answer

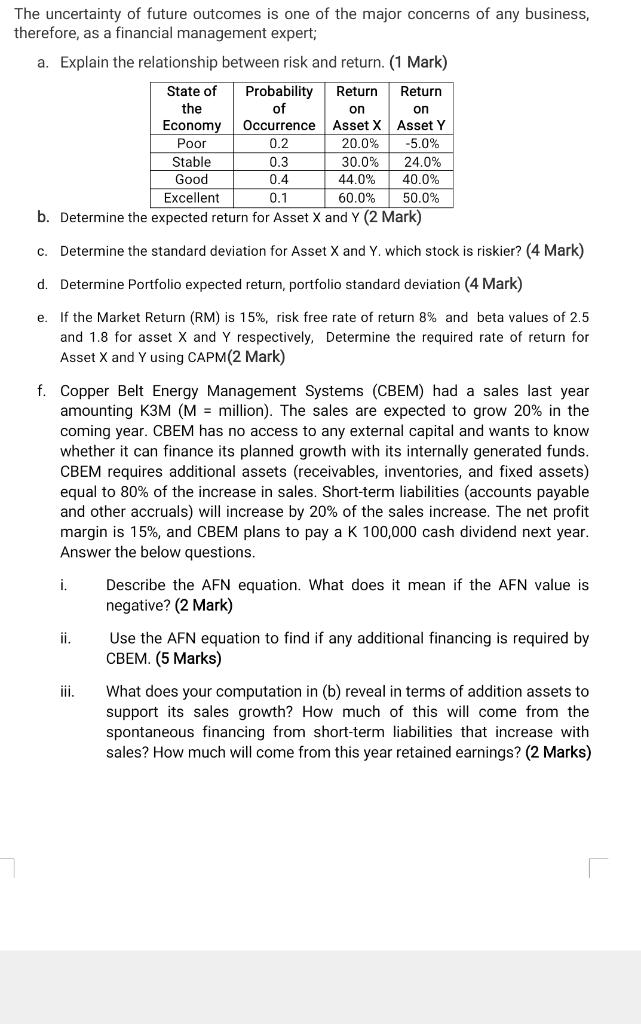

The uncertainty of future outcomes is one of the major concerns of any business, therefore, as a financial management expert; a. Explain the relationship

The uncertainty of future outcomes is one of the major concerns of any business, therefore, as a financial management expert; a. Explain the relationship between risk and return. (1 Mark) State of the Economy Poor i. Stable Good Excellent iii. Probability Return of on Occurrence Asset X 0.2 0.3 0.4 0.1 20.0% 30.0% 44.0% Return on Asset Y 60.0% b. Determine the expected return for Asset X and Y (2 Mark) c. Determine the standard deviation for Asset X and Y. which stock is riskier? (4 Mark) d. Determine Portfolio expected return, portfolio standard deviation (4 Mark) e. If the Market Return (RM) is 15%, risk free rate of return 8% and beta values of 2.5 and 1.8 for asset X and Y respectively, Determine the required rate of return for Asset X and Y using CAPM(2 Mark) -5.0% 24.0% 40.0% 50.0% f. Copper Belt Energy Management Systems (CBEM) had a sales last year amounting K3M (M = million). The sales are expected to grow 20% in the coming year. CBEM has no access to any external capital and wants to know whether it can finance its planned growth with its internally generated funds. CBEM requires additional assets (receivables, inventories, and fixed assets) equal to 80% of the increase in sales. Short-term liabilities (accounts payable and other accruals) will increase by 20% of the sales increase. The net profit margin is 15%, and CBEM plans to pay a K 100,000 cash dividend next year. Answer the below questions. Describe the AFN equation. What does it mean if the AFN value is negative? (2 Mark) Use the AFN equation to find if any additional financing is required by CBEM. (5 Marks) What does your computation in (b) reveal in terms of addition assets to support its sales growth? How much of this will come from the spontaneous financing from short-term liabilities that increase with sales? How much will come from this year retained earnings? (2 Marks)

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started