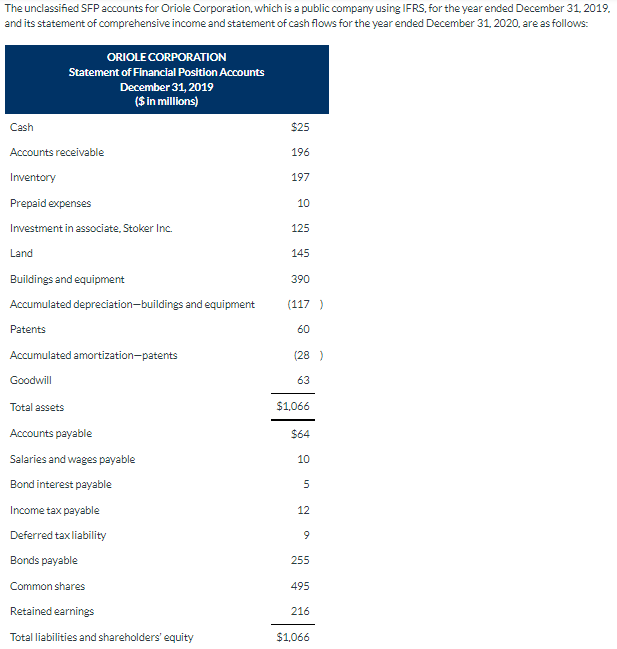

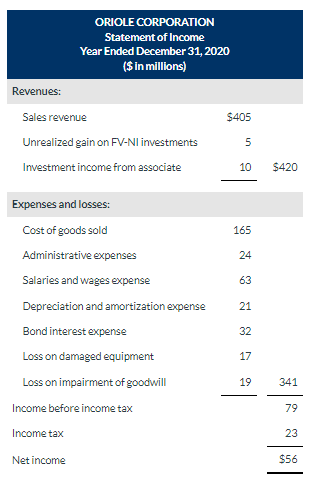

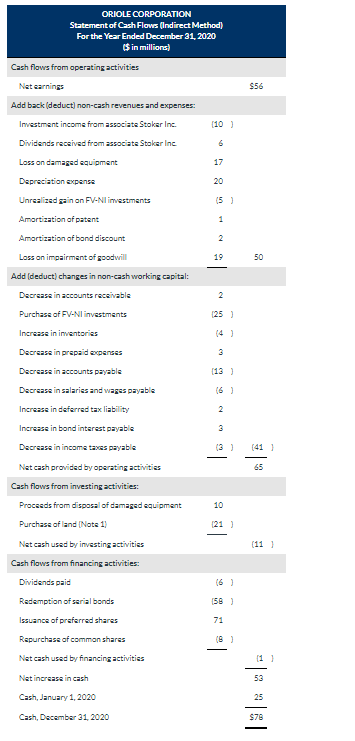

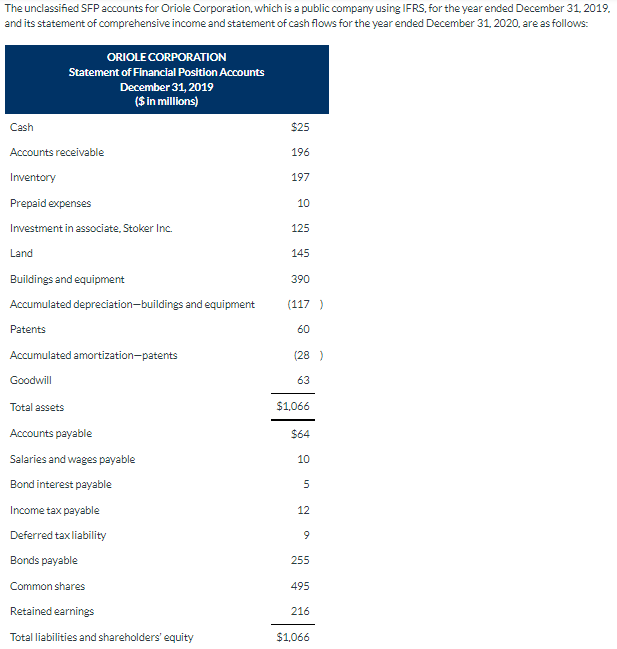

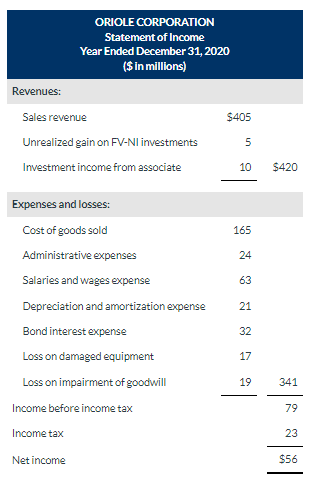

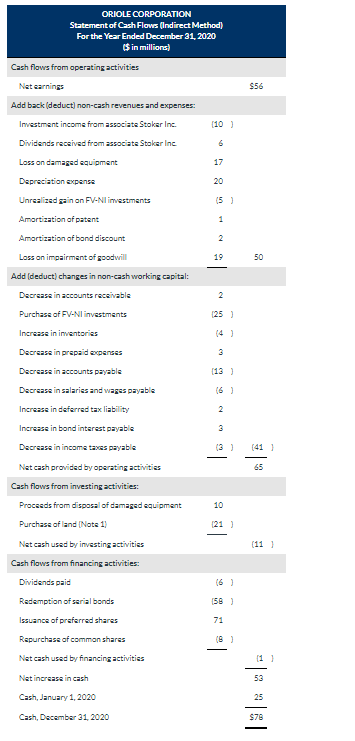

The unclassified SFP accounts for Oriole Corporation, which is a public company using IFRS, for the year ended December 31, 2019. and its statement of comprehensive income and statement of cash flows for the year ended December 31, 2020. are as follows: ORIOLE CORPORATION Statement of Financial Position Accounts December 31, 2019 ($ in millions) Cash $25 196 Accounts receivable Inventory 197 10 Prepaid expenses Investment in associate, Stoker Inc. 125 Land 145 390 Buildings and equipment Accumulated depreciation-buildings and equipment (117) Patents 60 (28) Accumulated amortization-patents Goodwill 63 Total assets $1,066 $64 10 5 12 Accounts payable Salaries and wages payable Bond interest payable Income tax payable Deferred tax liability Bonds payable Common shares Retained earnings Total liabilities and shareholders' equity 9 255 495 216 $1,066 ORIOLE CORPORATION Statement of Income Year Ended December 31, 2020 ($in millions) Revenues: $405 Sales revenue Unrealized gain on FV-Nl investments Investment income from associate 5 10 $420 165 24 63 Expenses and losses: Cost of goods sold Administrative expenses Salaries and wages expense Depreciation and amortization expense Bond interest expense Loss on damaged equipment Loss on impairment of goodwill Income before income tax 21 32 17 19 341 79 Income tax 23 Net income $56 ORIOLE CORPORATION Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2020 $ in millions) Cash flows from operating activities Net earnings $56 Add back (deduct) non-cash revenues and expenses: Investment income from associate Stoker Inc. (10) Dividends received from associate Stoker Inc Loss on damaged equipment 17 Depreciation expense 20 Unrealized gain on FV-Nl investments (5) Amortization of patent 1 2 Amortization of band discount Loss on impairment of goodwill Add (deduct) changes in non-cash working capital: 19 50 Decrease in accounts receivable 2 125) Purchase of FV-Nl investments Increase in inventories Decrease in prepaid expenses Decrease in accounts payable Decrease in salaries and wases payable Increase in deferred tax liability Increase in bond interest payable (13) (6) 2 3 Decrease in income taxes payable (41] 65 10 Nat cash provided by operating activities Cash flows from investing activities: Proceeds from disposal of damaged equipment Purchase of land (Note 11 Net cash used by investing activities Cash flows from financing activities: 121) (11) (6) Dividends paid Redemption of serial bonds 158) Issuance of preferred shares 71 (8) Repurchase of common shares Net cash used by financing activities [1] Net increase in cash 53 Cash, January 1, 2020 25 Cash, December 31, 2020 S78 Note 1. Non-cash investing and financing activities (a) During the year, land was acquired for $42 million in exchange for $21 million in cash and a $21-million, four-year, 10% note payable to the seller. Equipment was acquired through a finance lease that was capitalized initially at $85 million. (6) Additional information: 1. 2. 3. 4. 5. The investment income represents Oriole's reported income from its 35%-owned associate Stoker Inc. Oriole received a dividend from Stoker during the year. Early in 2020, Oriole purchased shares for $25 million as an FV-Nl investment. There were no sales of these shares during 2020, nor were any dividends received from this investment. Equipment that originally cost $70 million became unusable due to a flood. Most major components of the equipment were unharmed and were sold together for $10 million. Oriole had no insurance coverage for the loss because its insurance policy did not cover floods. Reversing differences in the year between pre-tax accounting income and taxable income resulted in an increase in future taxable amounts, causing the deferred tax liability to increase by $2 million. On December 30, 2020, land costing $42 million was acquired by paying $21 million cash and issuing a $21-million, four-year, 10% note payable to the seller. No repayments of principal were made on the note during 2020. Equipment was acquired through a 15-year financing lease. The present value of minimum lease payments was $85 million when signing the lease on December 31, 2020. Oriole made the initial lease payment of $2 million on January 1, 2021. Serial bonds with a face value of $58 million were retired at maturity on June 20, 2020. In order to finance this redemption and have additional cash available for operations, Oriole issued preferred shares for $71 million cash. In February, Oriole issued a 4% stock dividend at the shares' fair value (4 million shares). The market price of the com shares was $8.00 per share at the date of the declaration of the dividend. In April 2020, 1 million common shares were repurchased for $8 million. The weighted average original issue price of the repurchased shares was $11 million. 6. 7. 8. ommon 9. ORIOLE CORPORATION Statement of Financial Position Accounts Comparative December 31, 2020 and 2019 2020 2019 Cash (from statement of cash flows $ S FV-Nl investment Accounts receivable Inventory Prepaid expenses Investment in associate Land Buildings and equipment Accumulated depreciation Patents Accumulated amortization Goodwill Total assets S Accounts payable $ S Salaries and wages payable Bond interest payable Income tax payable Deferred tax liability Lease liability Bonds payable Note payable Preferred shares Common shares Contributed surplus Retained earnings Total liabilities and equity S Prepare the operating activities section of the statement of cash flows for Oriole Corporation using the direct method. (Show amounts that decrease cash flow with either a - signeg. -15,000 or in parenthesis eg. (15,000). Enter amounts in millions.) ORIOLE CORPORATION Statement of Cash Flows (Direct Method) - Operating Activities $ The unclassified SFP accounts for Oriole Corporation, which is a public company using IFRS, for the year ended December 31, 2019. and its statement of comprehensive income and statement of cash flows for the year ended December 31, 2020. are as follows: ORIOLE CORPORATION Statement of Financial Position Accounts December 31, 2019 ($ in millions) Cash $25 196 Accounts receivable Inventory 197 10 Prepaid expenses Investment in associate, Stoker Inc. 125 Land 145 390 Buildings and equipment Accumulated depreciation-buildings and equipment (117) Patents 60 (28) Accumulated amortization-patents Goodwill 63 Total assets $1,066 $64 10 5 12 Accounts payable Salaries and wages payable Bond interest payable Income tax payable Deferred tax liability Bonds payable Common shares Retained earnings Total liabilities and shareholders' equity 9 255 495 216 $1,066 ORIOLE CORPORATION Statement of Income Year Ended December 31, 2020 ($in millions) Revenues: $405 Sales revenue Unrealized gain on FV-Nl investments Investment income from associate 5 10 $420 165 24 63 Expenses and losses: Cost of goods sold Administrative expenses Salaries and wages expense Depreciation and amortization expense Bond interest expense Loss on damaged equipment Loss on impairment of goodwill Income before income tax 21 32 17 19 341 79 Income tax 23 Net income $56 ORIOLE CORPORATION Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2020 $ in millions) Cash flows from operating activities Net earnings $56 Add back (deduct) non-cash revenues and expenses: Investment income from associate Stoker Inc. (10) Dividends received from associate Stoker Inc Loss on damaged equipment 17 Depreciation expense 20 Unrealized gain on FV-Nl investments (5) Amortization of patent 1 2 Amortization of band discount Loss on impairment of goodwill Add (deduct) changes in non-cash working capital: 19 50 Decrease in accounts receivable 2 125) Purchase of FV-Nl investments Increase in inventories Decrease in prepaid expenses Decrease in accounts payable Decrease in salaries and wases payable Increase in deferred tax liability Increase in bond interest payable (13) (6) 2 3 Decrease in income taxes payable (41] 65 10 Nat cash provided by operating activities Cash flows from investing activities: Proceeds from disposal of damaged equipment Purchase of land (Note 11 Net cash used by investing activities Cash flows from financing activities: 121) (11) (6) Dividends paid Redemption of serial bonds 158) Issuance of preferred shares 71 (8) Repurchase of common shares Net cash used by financing activities [1] Net increase in cash 53 Cash, January 1, 2020 25 Cash, December 31, 2020 S78 Note 1. Non-cash investing and financing activities (a) During the year, land was acquired for $42 million in exchange for $21 million in cash and a $21-million, four-year, 10% note payable to the seller. Equipment was acquired through a finance lease that was capitalized initially at $85 million. (6) Additional information: 1. 2. 3. 4. 5. The investment income represents Oriole's reported income from its 35%-owned associate Stoker Inc. Oriole received a dividend from Stoker during the year. Early in 2020, Oriole purchased shares for $25 million as an FV-Nl investment. There were no sales of these shares during 2020, nor were any dividends received from this investment. Equipment that originally cost $70 million became unusable due to a flood. Most major components of the equipment were unharmed and were sold together for $10 million. Oriole had no insurance coverage for the loss because its insurance policy did not cover floods. Reversing differences in the year between pre-tax accounting income and taxable income resulted in an increase in future taxable amounts, causing the deferred tax liability to increase by $2 million. On December 30, 2020, land costing $42 million was acquired by paying $21 million cash and issuing a $21-million, four-year, 10% note payable to the seller. No repayments of principal were made on the note during 2020. Equipment was acquired through a 15-year financing lease. The present value of minimum lease payments was $85 million when signing the lease on December 31, 2020. Oriole made the initial lease payment of $2 million on January 1, 2021. Serial bonds with a face value of $58 million were retired at maturity on June 20, 2020. In order to finance this redemption and have additional cash available for operations, Oriole issued preferred shares for $71 million cash. In February, Oriole issued a 4% stock dividend at the shares' fair value (4 million shares). The market price of the com shares was $8.00 per share at the date of the declaration of the dividend. In April 2020, 1 million common shares were repurchased for $8 million. The weighted average original issue price of the repurchased shares was $11 million. 6. 7. 8. ommon 9. ORIOLE CORPORATION Statement of Financial Position Accounts Comparative December 31, 2020 and 2019 2020 2019 Cash (from statement of cash flows $ S FV-Nl investment Accounts receivable Inventory Prepaid expenses Investment in associate Land Buildings and equipment Accumulated depreciation Patents Accumulated amortization Goodwill Total assets S Accounts payable $ S Salaries and wages payable Bond interest payable Income tax payable Deferred tax liability Lease liability Bonds payable Note payable Preferred shares Common shares Contributed surplus Retained earnings Total liabilities and equity S Prepare the operating activities section of the statement of cash flows for Oriole Corporation using the direct method. (Show amounts that decrease cash flow with either a - signeg. -15,000 or in parenthesis eg. (15,000). Enter amounts in millions.) ORIOLE CORPORATION Statement of Cash Flows (Direct Method) - Operating Activities $