Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The United States federal personal income tax is calculated based on filing status and taxable income. There are four filing statuses: single filers, married filing

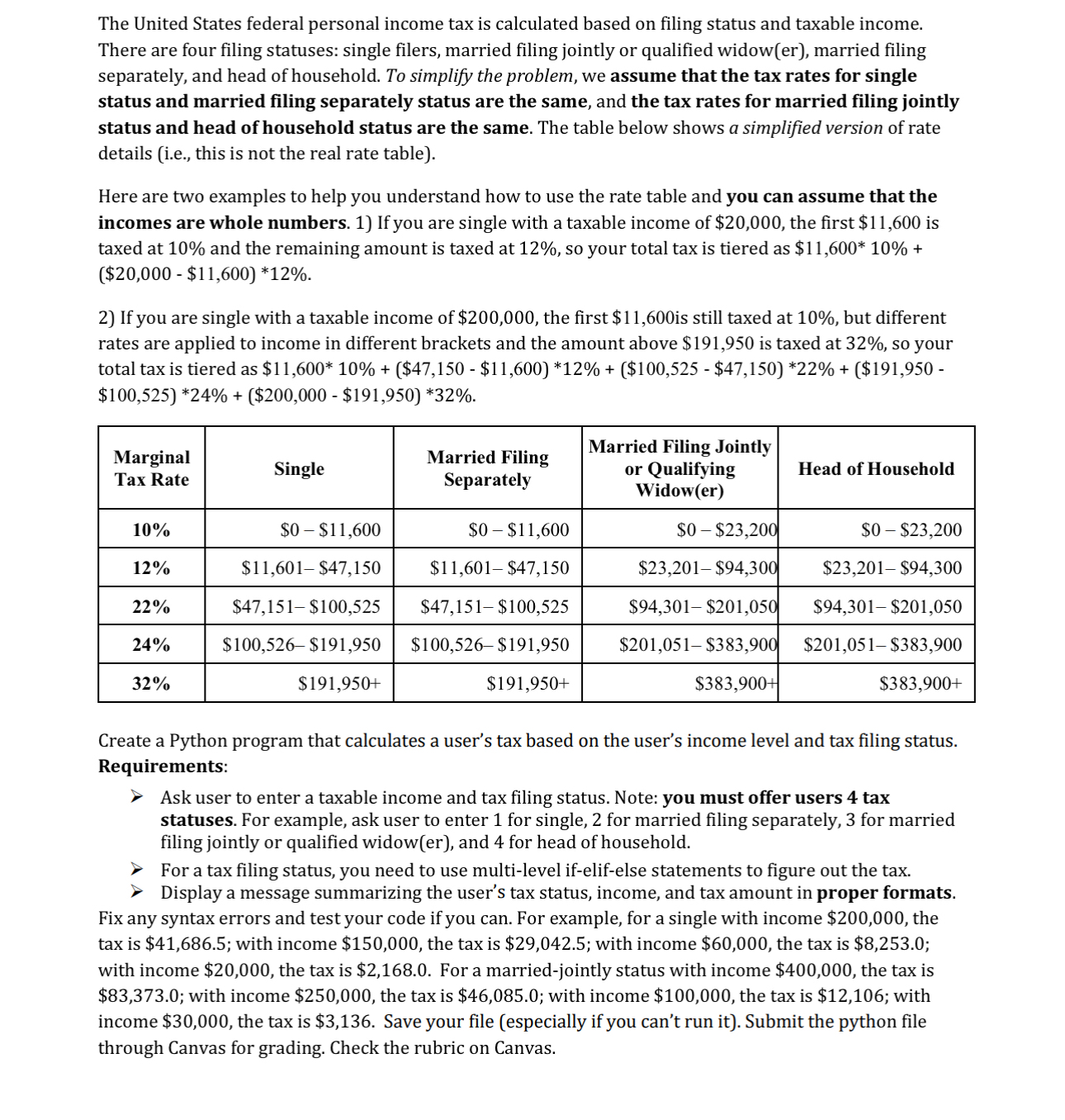

The United States federal personal income tax is calculated based on filing status and taxable income. There are four filing statuses: single filers, married filing jointly or qualified widower married filing separately, and head of household. To simplify the problem, we assume that the tax rates for single status and married filing separately status are the same, and the tax rates for married filing jointly status and head of household status are the same. The table below shows a simplified version of rate details ie this is not the real rate table

Here are two examples to help you understand how to use the rate table and you can assume that the incomes are whole numbers. If you are single with a taxable income of $ the first $ is taxed at and the remaining amount is taxed at so your total tax is tiered as $$$

If you are single with a taxable income of $ the first $ is still taxed at but different rates are applied to income in different brackets and the amount above $ is taxed at so your total tax is tiered as $

tabletableMarginalTax RateSingle,tableMarried FilingSeparatelytableMarried Filing Jointlyor QualifyingWidow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started