Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher feder tax rates. Being in a tax bracket

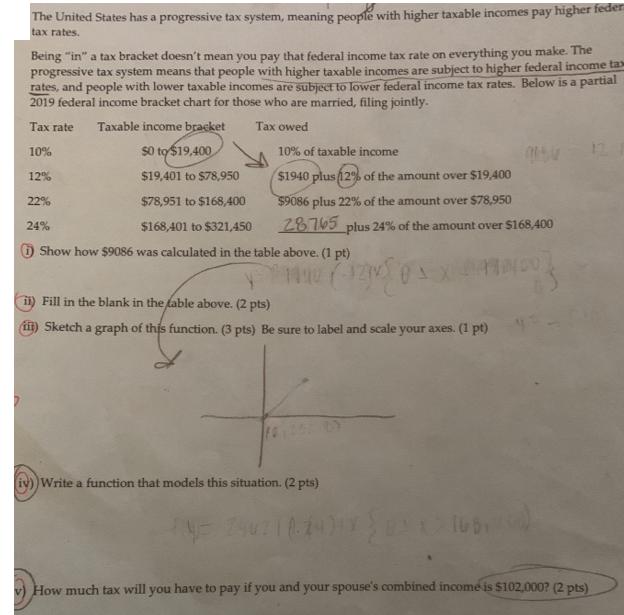

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher feder tax rates. Being "in" a tax bracket doesn't mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. Below is a partial 2019 federal income bracket chart for those who are married, filing jointly. Tax rate Taxable income bracket Tax owed 10% $0 to $19,400 $19,401 to $78,950 $78,951 to $168,400 $168,401 to $321,450 Show how $9086 was calculated in the table above. (1 pt) 1490 ( 12% 22% 24% 10% of taxable income $1940 plus 12% of the amount over $19,400 $9086 plus 22% of the amount over $78,950 28765 plus 24% of the amount over $168,400 BAX iz ii) Fill in the blank in the table above. (2 pts) (i) Sketch a graph of this function. (3 pts) Be sure to label and scale your axes. (1 pt) iv)) Write a function that models this situation. (2 pts) 4= 24421(024) X 16540) How much tax will you have to pay if you and your spouse's combined income is $102,000? (2 pts) 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started