The University of Danville is a private not-for-profit university that starts the current year with $700,000 in net assets: $400,000 without donor restrictions and $300,000 with donor restrictions. The $300,000 is composed of $200,000 with purpose restrictions and $100,000 that must be held permanently.

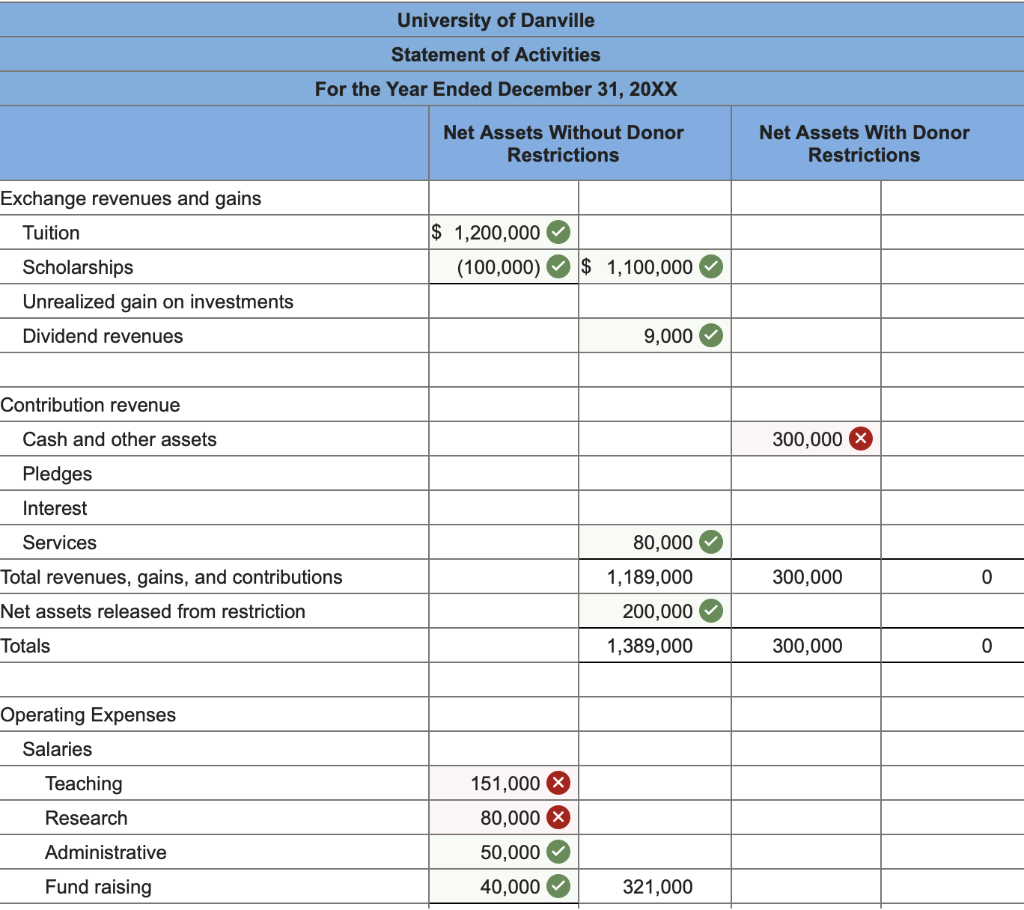

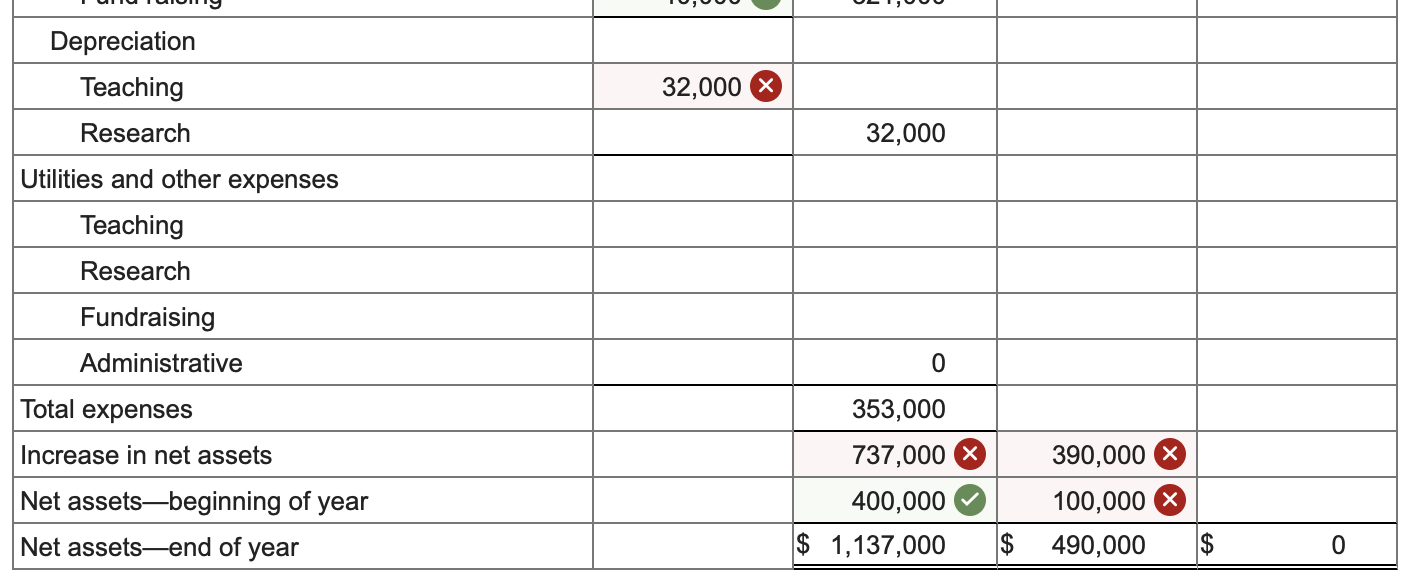

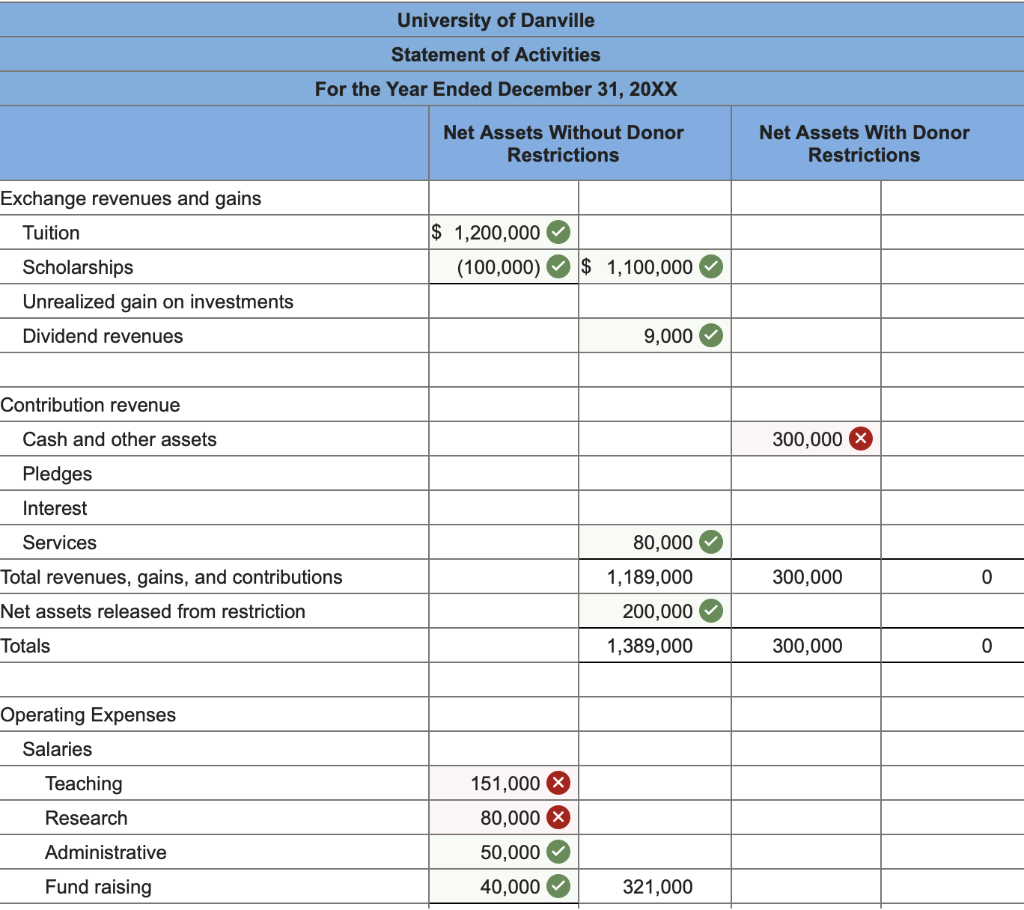

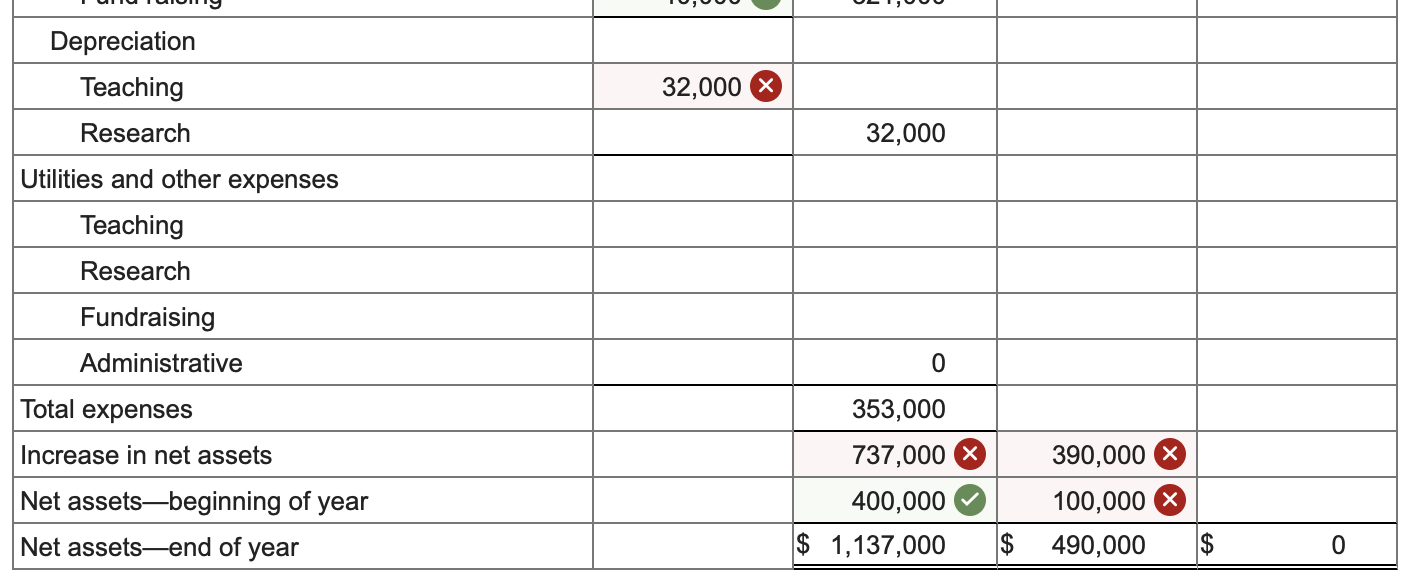

b. Determine the end-of-year balances for net assets without donor restrictions and net assets with donor restrictions by creating a statement of activities for the period. The school has two program services: education and research. It also has two supporting services: fundraising and administration. (Negative amounts should be indicated by a minus sign. Enter your answers in dollars not in millions and round your answers to the nearest whole dollar amount.)

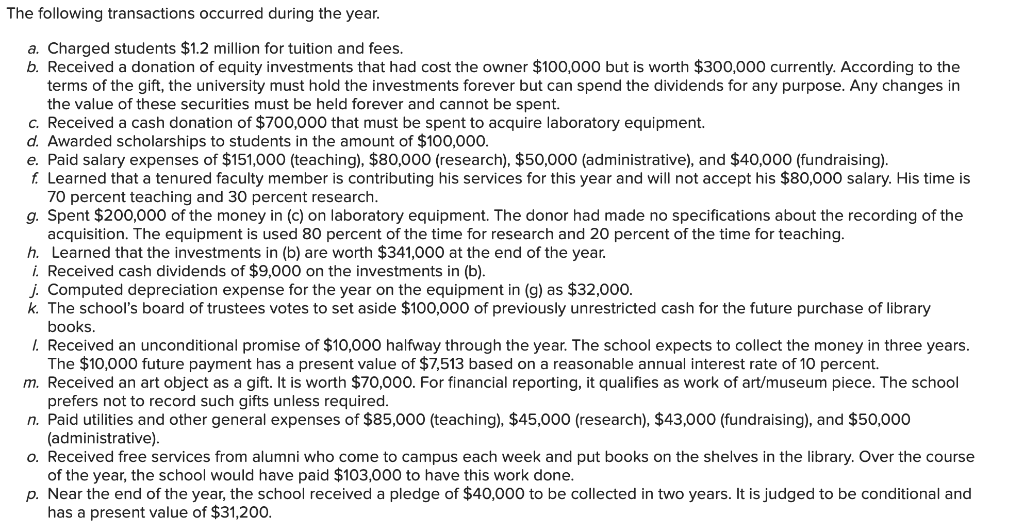

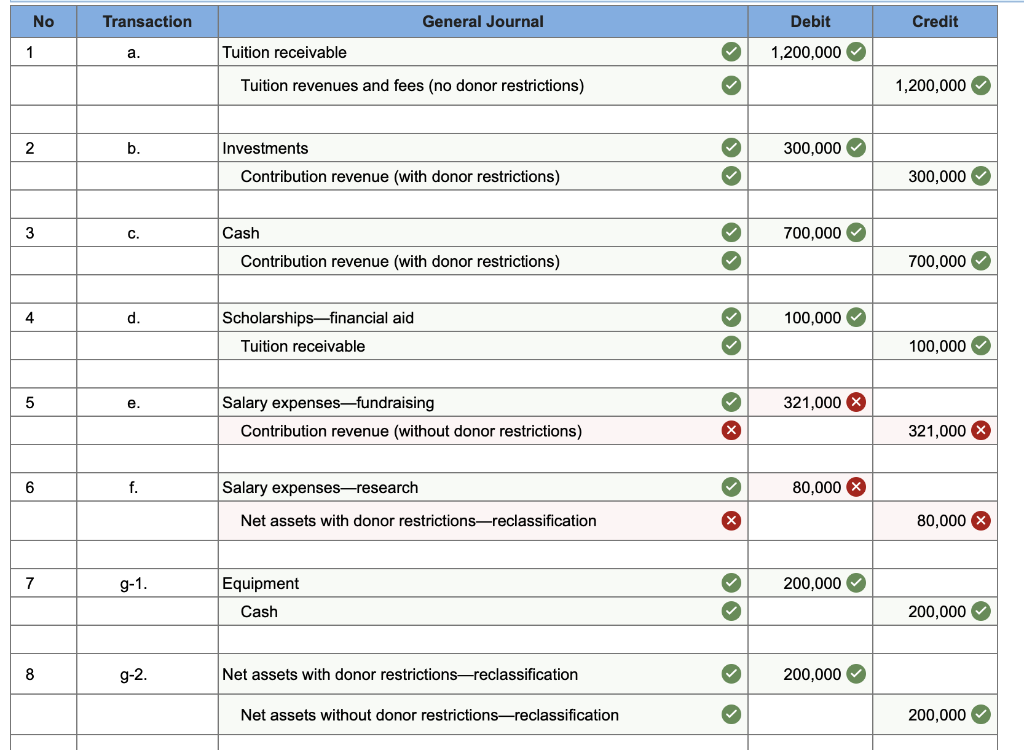

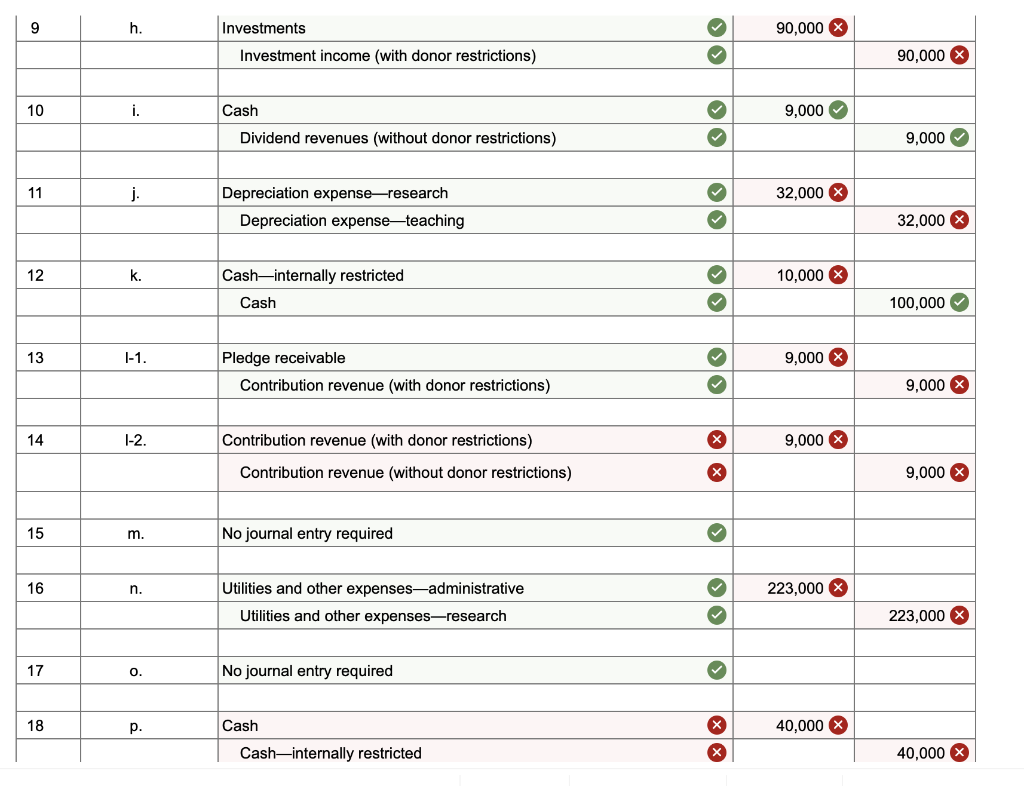

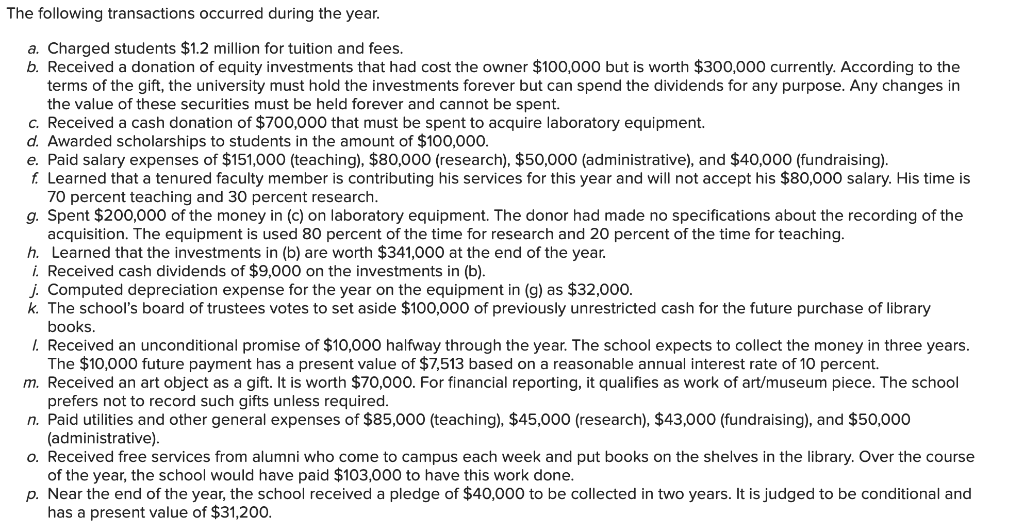

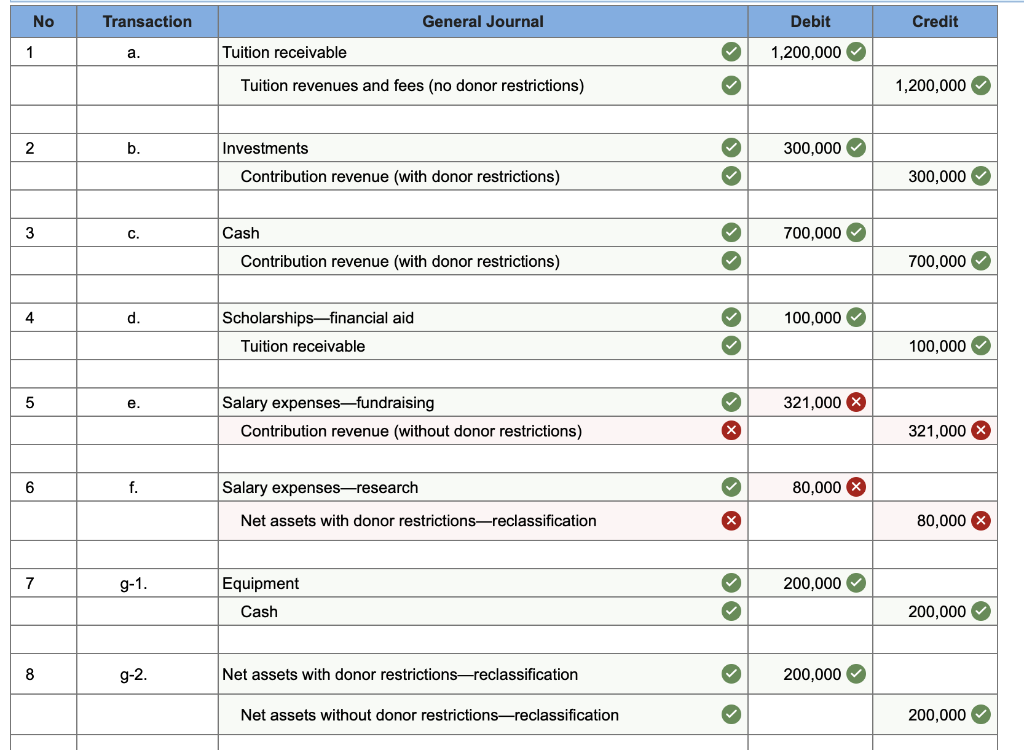

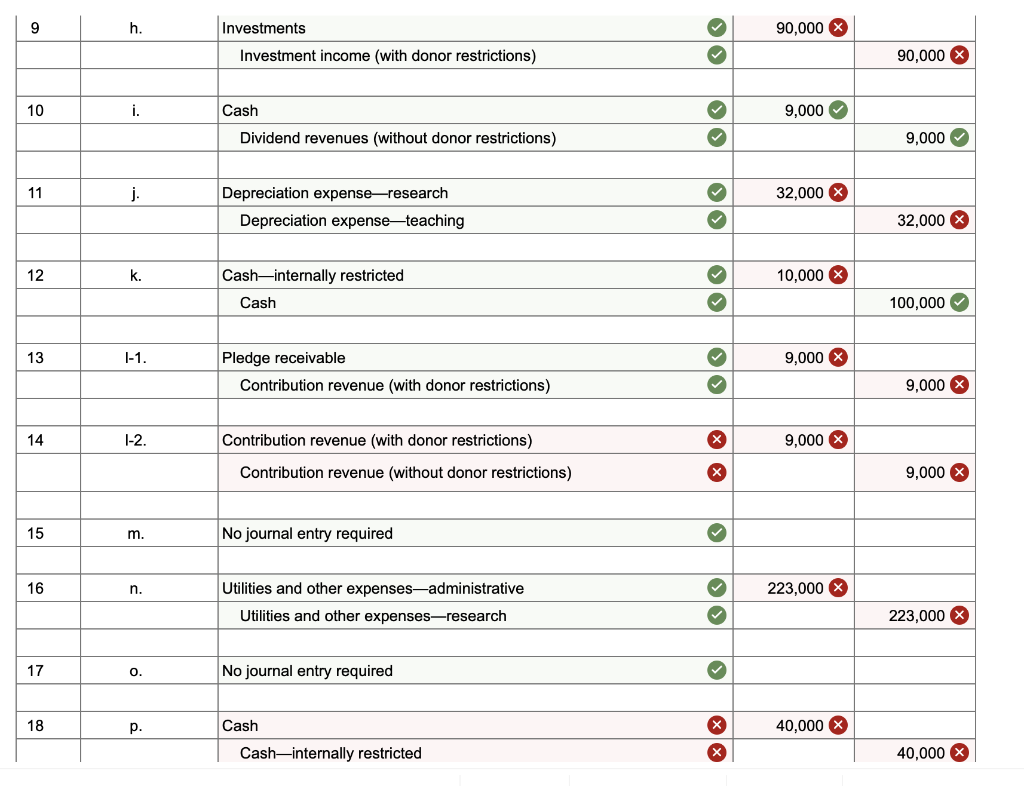

The following transactions occurred during the year. a. Charged students $1.2 million for tuition and fees. b. Received a donation of equity investments that had cost the owner $100,000 but is worth $300,000 currently. According to the terms of the gift, the university must hold the investments forever but can spend the dividends for any purpose. Any changes in the value of these securities must be held forever and cannot be spent. C. Received a cash donation of $700,000 that must be spent to acquire laboratory equipment. d. Awarded scholarships to students in the amount of $100,000. e. Paid salary expenses of $151,000 (teaching), $80,000 (research), $50,000 (administrative), and $40,000 (fundraising). f. Learned that a tenured faculty member is contributing his services for this year and will not accept his $80,000 salary. His time is 70 percent teaching and 30 percent research. g. Spent $200,000 of the money in (c) on laboratory equipment. The donor had made no specifications about the recording of the acquisition. The equipment is used 80 percent of the time for research and 20 percent of the time for teaching. h. Learned that the investments in (b) are worth $341,000 at the end of the year. i. Received cash dividends of $9,000 on the investments in (b). j. Computed depreciation expense for the year on the equipment in (g) as $32,000. k. The school's board of trustees votes to set aside $100,000 of previously unrestricted cash for the future purchase of library books. 1. Received an unconditional promise of $10,000 halfway through the year. The school expects to collect the money in three years. The $10,000 future payment has a present value of $7,513 based on a reasonable annual interest rate of 10 percent. m. Received an art object as a gift. It is worth $70,000. For financial reporting, it qualifies as work of art/museum piece. The school prefers not to record such gifts unless required. n. Paid utilities and other general expenses of $85,000 (teaching), $45,000 (research), $43,000 (fundraising), and $50,000 (administrative) o. Received free services from alumni who come to campus each week and put books on the shelves in the library. Over the course of the year, the school would have paid $103,000 to have this work done. p. Near the end of the year, the school received a pledge of $40,000 to be collected in two years. It is judged to be conditional and has a present value of $31,200. No Transaction General Journal Debit Credit 1 a. Tuition receivable 1,200,000 Tuition revenues and fees (no donor restrictions) 1,200,000 2 b. Investments 300,000 Contribution revenue (with donor restrictions) 300,000 3 C. Cash 700,000 > Contribution revenue (with donor restrictions) 700,000 4 d. Scholarshipsfinancial aid 100,000 Tuition receivable 100,000 > 5 e. 321,000 X Salary expensesfundraising Contribution revenue (without donor restrictions) 321,000 X 6 f. Salary expenses-research 80,000 Net assets with donor restrictions-reclassification X 80,000 > 7 9-1 200,000 Equipment Cash 200,000 8 g-2. Net assets with donor restrictions-reclassification 200,000 Net assets without donor restrictions-reclassification 200,000 9 h. Investments 90,000 X Investment income (with donor restrictions) 90,000 10 i. Cash 9,000 Dividend revenues (without donor restrictions) 9,000 11 j. 32,000 X Depreciation expense-research Depreciation expenseteaching 32,000 X 12 k. Cash-internally restricted 10,000 X Cash 100,000 13 1-1. 9,000 X Pledge receivable Contribution revenue (with donor restrictions) 9,000 14 1-2. x 9,000 X Contribution revenue (with donor restrictions) Contribution revenue (without donor restrictions) X 9,000 X 15 m. No journal entry required 0 16 n. 223,000 X Utilities and other expenses-administrative Utilities and other expenses-research 223,000 X 17 > 0. No journal entry required 18 p. Cash 40,000 X Cash-internally restricted 40,000 x University of Danville Statement of Activities For the Year Ended December 31, 20XX Net Assets Without Donor Restrictions Net Assets With Donor Restrictions Exchange revenues and gains Tuition $ 1,200,000 (100,000) $ 1,100,000 Scholarships Unrealized gain on investments Dividend revenues 9,000 Contribution revenue Cash and other assets 300,000 Pledges Interest Services Total revenues, gains, and contributions Net assets released from restriction Totals 300,000 0 80,000 1,189,000 200,000 1,389,000 300,000 0 Operating Expenses Salaries Teaching Research Administrative 151,000 X 80,000 X 50,000 40,000 Fund raising 321,000 Depreciation Teaching Research 32,000 32,000 Utilities and other expenses Teaching Research Fundraising Administrative 0 Total expenses Increase in net assets 353,000 737,000 X 400,000 $ 1,137,000 Net assetsbeginning of year Net assets-end of year 390,000 100,000 $ 490,000 $ 0