Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The US produces apples and Germany produces bananas. The nominal exchange rate in the US is 1.1. The price of apples is 2USD and price

The US produces apples and Germany produces bananas. The nominal exchange rate in the US is 1.1. The price of apples is 2USD and price of bananas 5 USD in the states.

What is the long-run real exchange rate in absence of trade barriers and home biases?

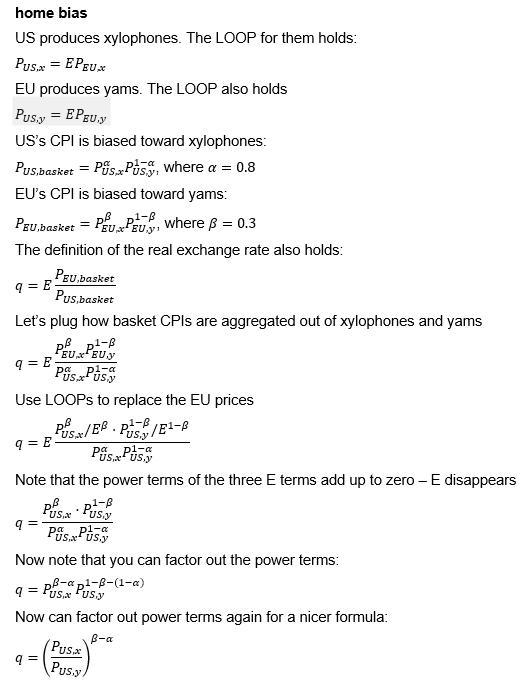

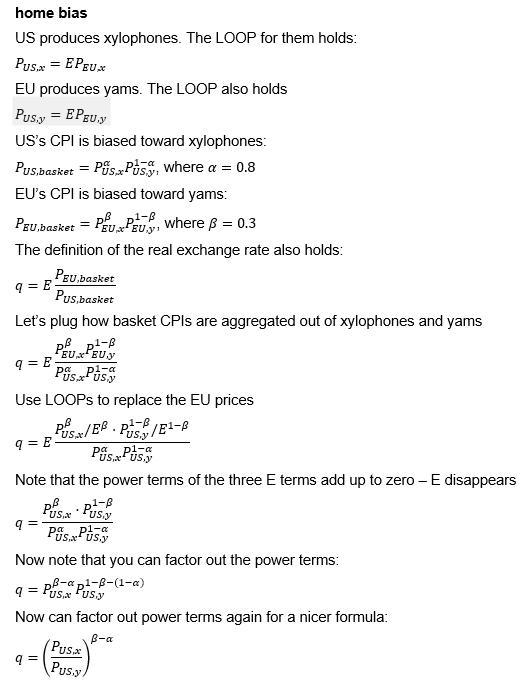

Continue from the previous question. But now countries are biased toward their domestic output. The US CPI is composed as

P = Pa^0.75 * Pb^0.25

and the German CPI is

P* = P*a^0.5 * P*b^0.5

Set up the US real exchange rate formula in terms of the US price level P and the German price level P*. Simplify it so that it is in terms of US prices of bananas and apples and solve for the US real exchange rate under home bias.

What is the long-run real exchange rate in absence of trade barriers and home biases?

Continue from the previous question. But now countries are biased toward their domestic output. The US CPI is composed as

P = Pa^0.75 * Pb^0.25

and the German CPI is

P* = P*a^0.5 * P*b^0.5

Set up the US real exchange rate formula in terms of the US price level P and the German price level P*. Simplify it so that it is in terms of US prices of bananas and apples and solve for the US real exchange rate under home bias.

home bias US produces xylophones. The LOOP for them holds: PUS,x = EPEUX EU produces yams. The LOOP also holds PUs,y = EPEU,y US's CPI is biased toward xylophones: 1-a PUs,basket = Pus. Psy, where a = 0.8 EU's CPI is biased toward yams: PEU,basket = PEU PEU, where = 0.3 The definition of the real exchange rate also holds: q=E PEU,basket PUs,basket Let's plug how basket CPIs are aggregated out of xylophones and yams 9=E 1-B PEUX PEUY Pus Use LOOPS to replace the EU prices 1- Pus.x/EB.PL/E-B 9=E Pus P Note that the power terms of the three E terms add up to zero - E disappears 1-B B q= PUS. PUSY PUS. PUS . Now note that you can factor out the power terms: q=PB-pl-b-(1-a) Now can factor out power terms again for a nicer formula: q= Pus Pusy) B-a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started