Question

The US stock market experienced an historic boom during the 90s, driven in part by investors optimism about the prospects of new information technologies. This

The US stock market experienced an historic boom during the 90’s, driven in part by investors optimism about the prospects of new information technologies. This optimism faded at the end of the decade, and average stock prices fell by about 25 percent from August 2000 to August 2001.

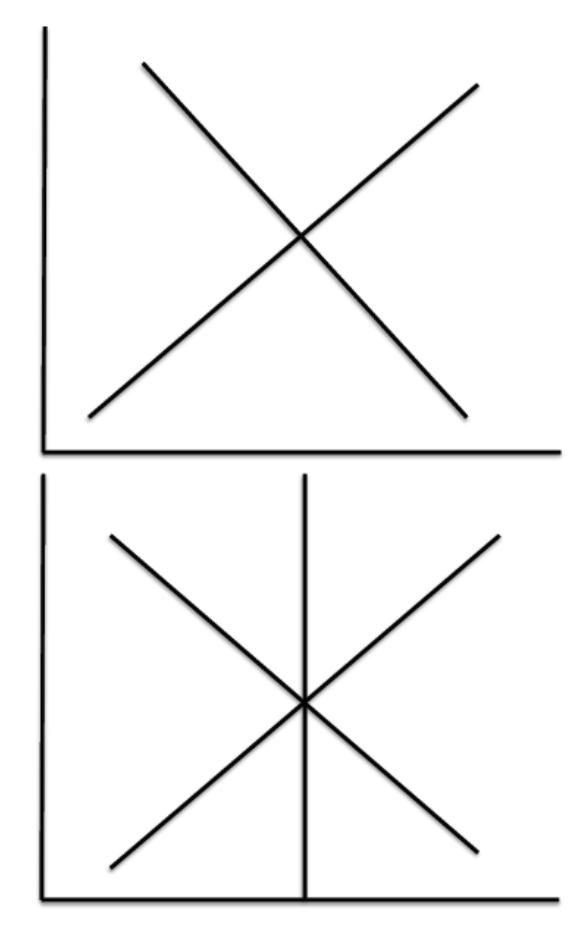

i. Using the IS-LM and the AS-AD diagrams, explain how a collapse in the stock market affects output and prices in the IS-LM model in the short run.

ii. Congress passed major tax cuts in 2001 and in 2003. Use the IS-LM and AS-AD diagrams below to show how the tax cuts could have helped the recovery.

iii. What would have happened if, instead of cutting taxes, the government had increased expenditures? According to the IS-LM model, which of the two policies is more effective at stimulating the economy?

Use the following diagrams to answer questions (i) and (ii):

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer TJ el IS the long LM 1MPC IS Stock market which reduces IS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started