Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The valuation of Hansel Limited has been done by an investment analyst. Based on an expected free cash flow of 54 lakhs for the following

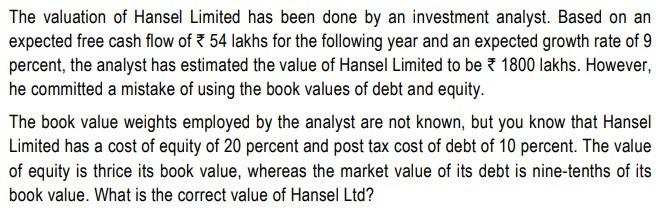

The valuation of Hansel Limited has been done by an investment analyst. Based on an expected free cash flow of 54 lakhs for the following year and an expected growth rate of 9 percent, the analyst has estimated the value of Hansel Limited to be 1800 lakhs. However, he committed a mistake of using the book values of debt and equity. The book value weights employed by the analyst are not known, but you know that Hansel Limited has a cost of equity of 20 percent and post tax cost of debt of 10 percent. The value of equity is thrice its book value, whereas the market value of its debt is nine-tenths of its book value. What is the correct value of Hansel Ltd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started