Answered step by step

Verified Expert Solution

Question

1 Approved Answer

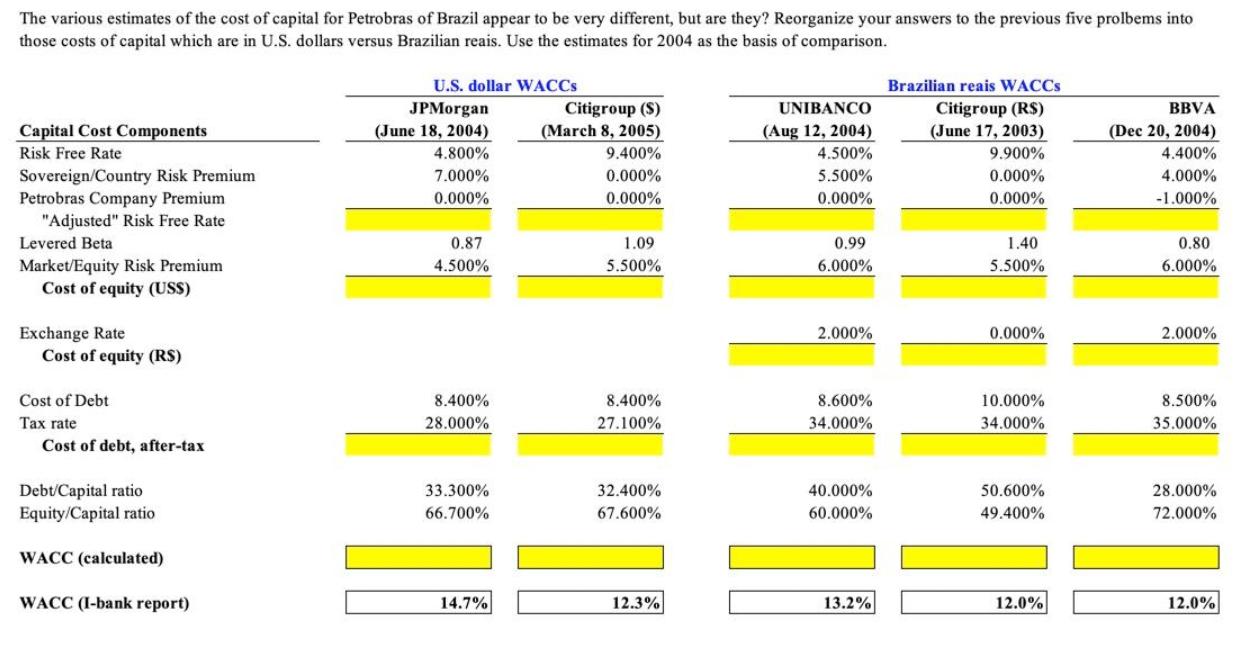

The various estimates of the cost of capital for Petrobras of Brazil appear to be very different, but are they? Reorganize your answers to

The various estimates of the cost of capital for Petrobras of Brazil appear to be very different, but are they? Reorganize your answers to the previous five prolbems into those costs of capital which are in U.S. dollars versus Brazilian reais. Use the estimates for 2004 as the basis of comparison. U.S. dollar WACCS Brazilian reais WACCS UNIBANCO JPMorgan (June 18, 2004) Citigroup ($) (March 8, 2005) Citigroup (RS) (June 17, 2003) BBVA Capital Cost Components (Aug 12, 2004) (Dec 20, 2004) Risk Free Rate 4.800% 9.400% 4.500% 9.900% 4.400% Sovereign/Country Risk Premium Petrobras Company Premium "Adjusted" Risk Free Rate 7.000% 0.000% 5.500% 0.000% 4.000% 0.000% 0.000% 0.000% 0.000% -1.000% Levered Beta 0.87 1.09 0.99 1.40 0.80 Market/Equity Risk Premium Cost of equity (USS) 4.500% 5.500% 6.000% 5.500% 6.000% Exchange Rate 2.000% 0.000% 2.000% Cost of equity (RS) Cost of Debt 8.400% 8.400% 8.600% 10.000% 8.500% Tax rate 28.000% 27.100% 34.000% 34.000% 35.000% Cost of debt, after-tax Debt/Capital ratio Equity/Capital ratio 33.300% 32.400% 40.000% 50.600% 28.000% 66.700% 67.600% 60.000% 49.400% 72.000% WACC (calculated) WACC (I-bank report) 14.7% 12.3% 13.2% 12.0% 12.0%

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Applying excel formulas To calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started