Question

The vice-president of marketing and director of human resources have proposed that the company change its compensation of the sales force to a commission

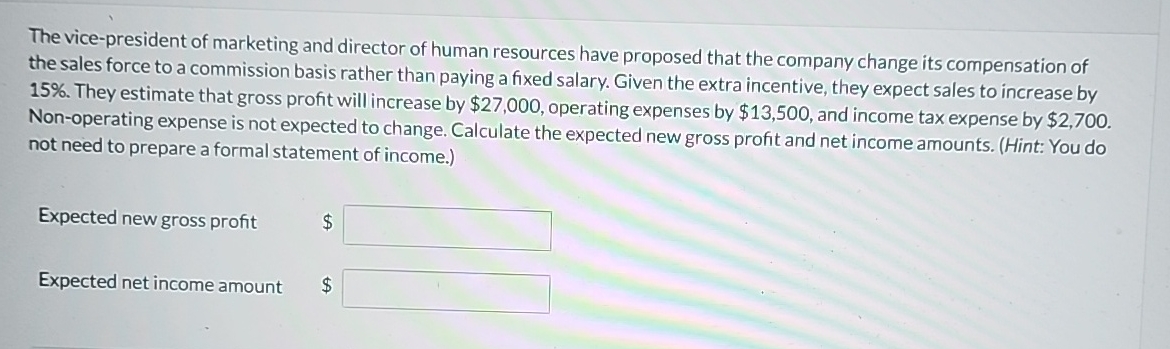

The vice-president of marketing and director of human resources have proposed that the company change its compensation of the sales force to a commission basis rather than paying a fixed salary. Given the extra incentive, they expect sales to increase by 15%. They estimate that gross profit will increase by $27,000, operating expenses by $13,500, and income tax expense by $2,700. Non-operating expense is not expected to change. Calculate the expected new gross profit and net income amounts. (Hint: You do not need to prepare a formal statement of income.) Expected new gross profit $ Expected net income amount $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the expected new gross profit and net income amounts we need to consider the cha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

6th Canadian edition

1118644948, 978-1118805084, 1118805089, 978-1118644942

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App