Question

The Visadrone Surveillance Technologies, Inc. management has been told by their investment banker that the firm could issue new bonds at par with a

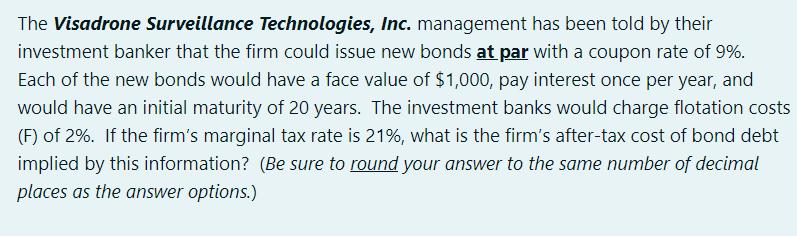

The Visadrone Surveillance Technologies, Inc. management has been told by their investment banker that the firm could issue new bonds at par with a coupon rate of 9%. Each of the new bonds would have a face value of $1,000, pay interest once per year, and would have an initial maturity of 20 years. The investment banks would charge flotation costs (F) of 2%. If the firm's marginal tax rate is 21%, what is the firm's after-tax cost of bond debt implied by this information? (Be sure to round your answer to the same number of decimal places as the answer options.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Management

Authors: Jeff Madura

14th Edition

0357130545, 978-0357130544

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App