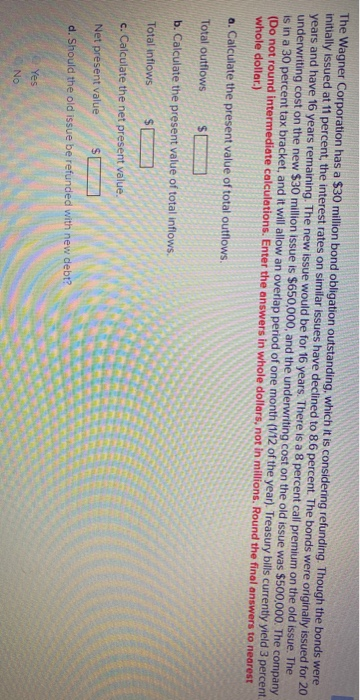

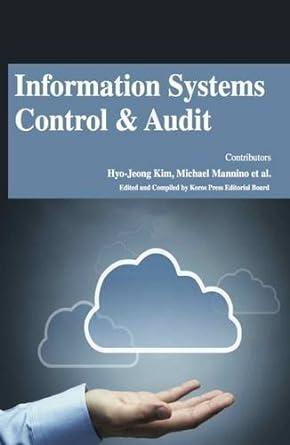

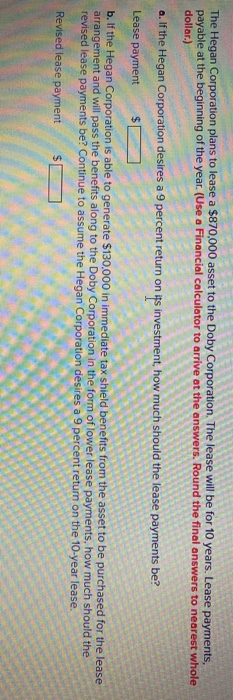

The Wagner Corporation has a $30 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 11 percent, the interest rates on similar issues have declined to 8.6 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 8 percent call premium on the old issue. The underwriting cost on the new $30 million issue is $650,000, and the underwriting cost on the old issue was $500,000. The company is in a 30 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 3 percent (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows. Total outflows $ b. Calculate the present value of total inflows. Total inflows $ c. Calculate the net present value. Net present value S d. Should the old issue be refunded with new debt? The Hegan Corporation plans to lease a $870,000 asset to the Doby Corporation. The lease will be for 10 years. Lease payments. payable at the beginning of the year. (Use a Financial calculator to arrive at the answers. Round the final answers to nearest whole dollar.) a. If the Hegan Corporation desires a 9 percent return on its investment, how much should the lease payments be? Lease payment $0 b. If the Hegan Corporation is able to generate $130,000 in immediate tax shield benefits from the asset to be purchased for the lease arrangement and will pass the benefits along to the Doby Corporation in the form of lower lease payments, how much should the revised lease payments be? Continue to assume the Hegan Corporation desires a 9 percent return on the 10-year lease. Revised lease payment SO 5 The Wagner Corporation has a $30 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 11 percent, the interest rates on similar issues have declined to 8.6 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 8 percent call premium on the old issue. The underwriting cost on the new $30 million issue is $650,000, and the underwriting cost on the old issue was $500,000. The company is in a 30 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 3 percent (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows. Total outflows $ b. Calculate the present value of total inflows. Total inflows $ c. Calculate the net present value. Net present value S d. Should the old issue be refunded with new debt? The Hegan Corporation plans to lease a $870,000 asset to the Doby Corporation. The lease will be for 10 years. Lease payments. payable at the beginning of the year. (Use a Financial calculator to arrive at the answers. Round the final answers to nearest whole dollar.) a. If the Hegan Corporation desires a 9 percent return on its investment, how much should the lease payments be? Lease payment $0 b. If the Hegan Corporation is able to generate $130,000 in immediate tax shield benefits from the asset to be purchased for the lease arrangement and will pass the benefits along to the Doby Corporation in the form of lower lease payments, how much should the revised lease payments be? Continue to assume the Hegan Corporation desires a 9 percent return on the 10-year lease. Revised lease payment SO 5